- Analytics

- News and Tools

- Market News

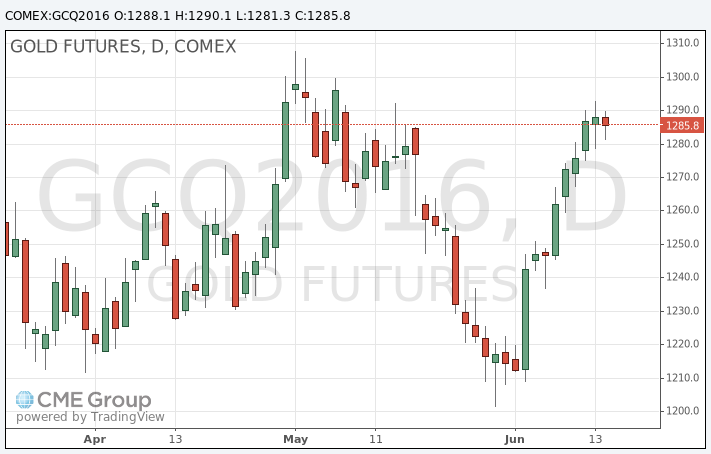

- Gold fell

Gold fell

Gold has been billed as a 'wonder investment' in portfolios: apparently it can help protect against inflation or deflation, political, financial or economic chaos and much more besides, so it's no wonder that we're seeing interest in this commodity soar at the moment as investors find themselves in a moment of political turbulence on both sides of the Atlantic.

However, some caution is warranted here. Odysseus famously plugged his crew's ears with beeswax and had himself strapped to the mast to resist the call of the sirens. I would simply suggest that gold should occupy no more than low single digits in percentage terms as a proportion of your total investible assets - calls to hold significantly more, no matter how honeyed the voices, should be strongly resisted.

Perhaps the most alluring part of gold's story right now seems to be its role as a safe port in the storm. In a world seemingly beset with more than usual levels of monetary, economic and political uncertainty, gold, with its thousands of years of practice as a store of value, seems to shine brightly as an investment prospect.

Most would agree that a safe asset should have a relatively stable value during times of market stress. If we assume that such times tend to see equity markets fall sharply, gold's historical record over the long run is far from perfect on this count.

Even without that blemished relative record, investors should be wary of havens where the price has jumped around so dramatically - even when just viewed over the past five years. Nonetheless, if enough investors believe gold to be a haven then it may well act as one.

Some argue that gold is not for protection against expected changes in inflation, but rather the unexpected. This is more difficult to weigh, as the tricky procedure of decomposing inflation into its expected and unexpected components is more art than science. However, based on some (admittedly crude) empirical work, the long-run relationship between gold and unexpected inflation looks entirely unremarkable.

One area where there is an undeniably strong relationship is between gold and real bond yields.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.