- Analytics

- News and Tools

- Market News

- Gold turned lower

Gold turned lower

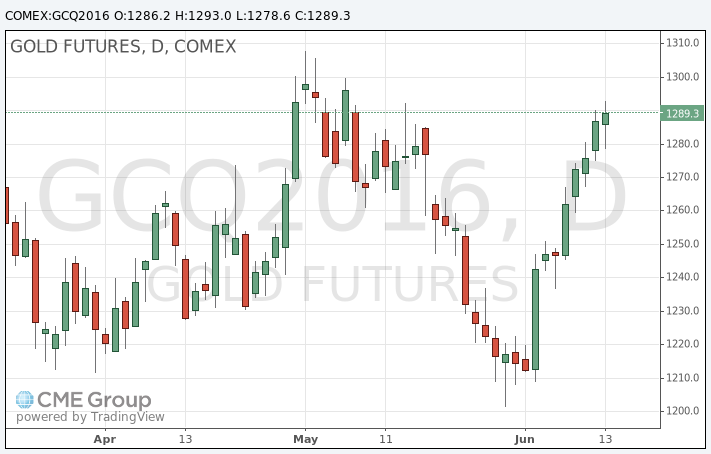

Gold futures turned lower on Tuesday, with prices struggling to hold ground near their highest level in five weeks.

Gold futures had been catching a strong bid as investors sought the relative safety of haven assets ahead of next week's "Brexit" referendum and a tandem of closely watched central-bank meetings.

Gold for August delivery shed $1.50, or 0.1%, to $1,285.40 an ounce.

Worries remained heightened that a U.K. referendum on European Union membership-set for June 23 and expected to be fully tallied on June 24-will result in a British exit from the bloc, and potentially stir uncertainty in the market. European stocks fell for a fifth straight day on Tuesday, while bonds were in demand, driving yields on the 10-year German bund into negative territory for the first time ever. U.S. stocks traded mostly lower.

"We have focused on the vote and its potential impact on markets, but we have not factored in potentially devastating set of 'ripple' effects," said Julian Phillips, founder of and contributor to GoldForecaster.com.

Those include the possibility of heavy outflows of capital from Britain and its effects on the euro and the impact on global growth, he said. "The scene is gold-positive and, consequently, silver-positive," said Phillips.

This week, the U.S.'s Federal Open Market Committee and Bank of Japan are holding interest-rate policy meetings that could impact precious-metals trading. The Federal Reserve isn't expected to announce any change in key policy in its statement Wednesday but it could lay some groundwork for future action. Higher interest rates tend to push up the dollar and cut the appeal of nonyielding assets including gold.

U.S. retail sales data may give the Fed more reason to lean toward a rate increase. Sales at U.S. retailers rose a solid 0.5% in May after an even larger gain in the prior month.

"The Fed frequently makes an impact on the gold market in the short term and is important for traders to focus on, but long-term [gold] owners are better served ignoring Fed noise and focusing on gold's important benefits as a diversification," said Mark O'Byrne, research director at GoldCore.

"The 'no hike' is likely being priced in but we could see gold hit the $1,300 level, prior to a correction on the way to the next level of resistance at $1,400," he said.

Over in Japan, central-bank officials could work to talk down yen when they meet Wednesday and Thursday, as a stronger home currency hurts exports.

"Japanese Finance Minister Taro Aso delivered another round of currency intervention warnings, signaling that quick and speculative movements in the FX market may warrant a response," Pissouros noted.

Pissouros said Aso will closely watch the Brexit referendum given its potential impact on global markets.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.