- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the positive economic data from Germany

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the positive economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Construction Work Done Quarter I -2.9% Revised From -3.6% -1.5% -2.6%

06:00 Germany Gfk Consumer Confidence Survey June 9.7 9.7 9.8

06:00 Switzerland UBS Consumption Indicator April 1.40 Revised From 1.51 1.47

08:00 Germany IFO - Business Climate May 106.7 Revised From 106.6 106.8 107.7

08:00 Germany IFO - Expectations May 100.5 Revised From 100.4 100.8 101.6

08:00 Germany IFO - Current Assessment May 113.2 113.2 114.2

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) May 11.5 17.5

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. preliminary services PMI data.

The euro traded mixed against the U.S. dollar after the release of the positive economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index rose to 107.7 in May from 106.7 in April, exceeding expectations for an increase to 106.8. April's reading was revised up from 106.6.

"Business confidence in German industry and trade has improved in all four main sectors. In construction a new record high has even been reached," Ifo President Clemens Fuest said.

"The German economy is growing at a robust pace," he added.

Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index climbed to 9.8 in June from 9.7 in May. Analysts had expected the index to remain unchanged at 9.7.

"Private consumption will remain an important pillar of the German economy over the next few months. GfK therefore still stands by the forecast it made at the start of the year that real private consumer spending will climb by around 2 percent in 2016. This figure stood at 1.9 percent in 2015," Gfk noted.

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Bank of Canada's interest rate decision. The central bank is expected to keep its interest rate unchanged.

The Swiss franc traded mixed against the U.S. dollar. ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 17.5 in May from 11.5 in April.

"Economic expectations have reached their highest assessment balance since October 2015," the ZEW said.

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.47 in April from 1.40 in March. March's figure was revised down from 1.51. The increase was driven by positive trends in tourism and new car registrations.

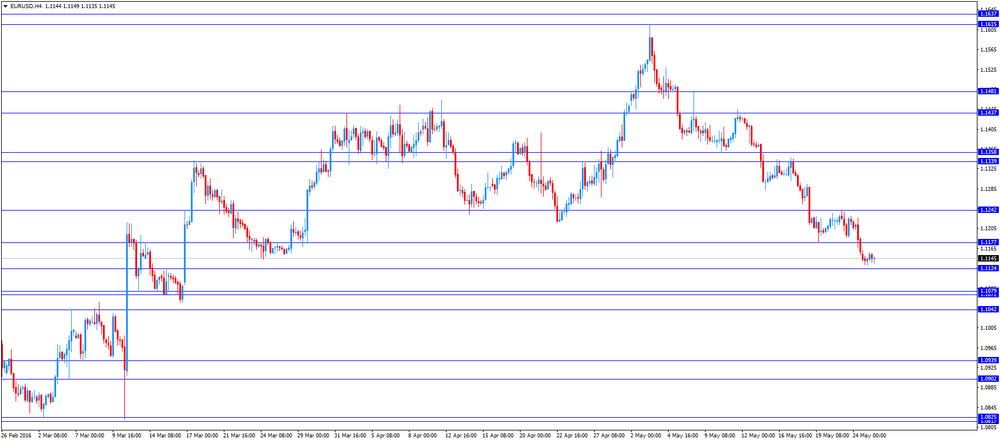

EUR/USD: the currency pair traded mixed

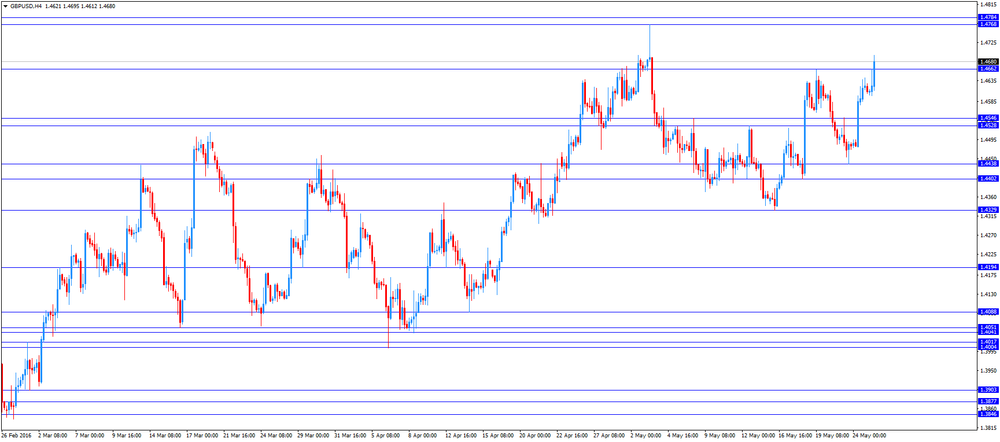

GBP/USD: the currency pair climbed to $1.4695

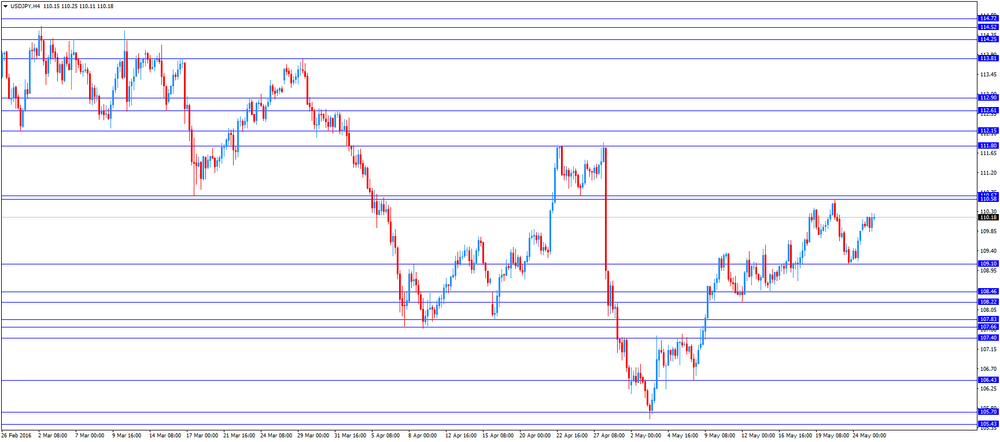

USD/JPY: the currency pair rose to Y110.27

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) May 52.8

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories May 1.31 -2.5

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.