- Analytics

- News and Tools

- Market News

- Before the bell: Stocks set to continue rebound

Before the bell: Stocks set to continue rebound

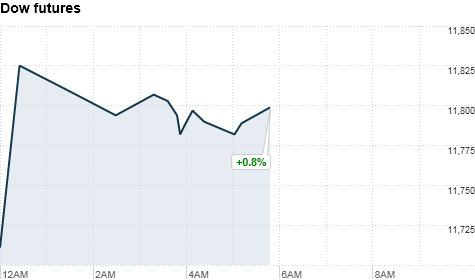

The U.S. stock futures solidly higher ahead of Friday's opening bell.

U.S. stocks closed broadly higher Thursday, rebounding after two days of sharp declines as investors reacted to heightened worries about a nuclear crisis in Japan.

The Japanese yen had been driven sharply higher in recent days due to global uncertainty and the prospect of more cash flowing into Japan.

But the yen eased after finance ministers from the Group of 7 major economic powers announced a coordinated intervention to prevent the Japanese currency from rising further. The announcement pushed the Nikkei up 2.7%.

With no U.S. economic data or corporate results on the agenda Friday, investors will likely remain focused on the ongoing disaster in Japan.

After a massive earthquake and tsunami devastated the northern part of Japan last Friday, workers at the Fukushima Daiichi nuclear power plant have been struggling to cool damaged reactors.

World markets: European stocks rose in afternoon trading. Britain's FT-100 added 0.5%, the DAX in Germany notched up 0.3% and France's CAC-40 gained 0.7%.

Asian markets ended the session higher. The Shanghai Composite rose 0.3%, the Hang Seng in Hong Kong added less than 0.1%.

Companies: Shares of General Electric (GE, Fortune 500) were up 1.2% in premarket trading after CEO John Dineen told reporters Thursday that the company expects its health care business revenue in India to grow 25% in 2011.

Freeport McMoran Copper and Gold (FCX, Fortune 500) gained 1.9% in premarket trade. Shares have risen 8.8% over the past five days as commodity prices soar.

Nike (NKE, Fortune 500) shares fell 7.7% in premarket trading after the company reported disappointing earnings late Thursday. Nike said higher commodity prices hurt profit margins and the company will raise prices on many of its products as a result.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.