- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the European Central Bank's March minutes

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the European Central Bank's March minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:45 France Trade Balance, bln February -3.91 Revised From -3.70 -3.8 -5.18

07:00 Switzerland Foreign Currency Reserves March 571 576

07:30 United Kingdom Halifax house price index March -1.5% Revised From -1.4% 0.7% 2.6%

07:30 United Kingdom Halifax house price index 3m Y/Y March 9.7% 9.5% 10.1%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. initial jobless claims data. The number of initial jobless claims in the U.S. is expected to decline by 6,000 to 270,000 last week.

The Fed Chairwoman Janet Yellen will speak at 21:30 GMT.

The euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) March minutes. The minutes showed that most members of the Governing Council supported the monetary policy easing. The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion).

ECB Vice President Vitor Constancio said before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday that the central bank was doing and would continue to do everything to fulfil its mandate.

ECB Executive Board member Peter Praet said in a speech on Thursday that the central bank's monetary policy adopted since June 2014 was effective.

He pointed out that the ECB could add further stimulus measures if the downside risks increase.

"If further adverse shocks were to materialise, our measures could be recalibrated once more commensurate with the strength of the headwind, also taking into account possible side-effects," Praet said.

He noted that the central bank did not discussed helicopter money.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. climbed 2.6% in March, after a 1.5% decline in February. February's figure was revised down from a 1.4% fall.

On a yearly basis, house prices jumped 10.1% in the three months to March, after a 9.7% increase in the three months to February.

"Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months," Halifax's housing economist Martin Ellis said.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian housing market data. The Canadian building permits are expected to rise 4.8% in February, after a 9.8% drop in January.

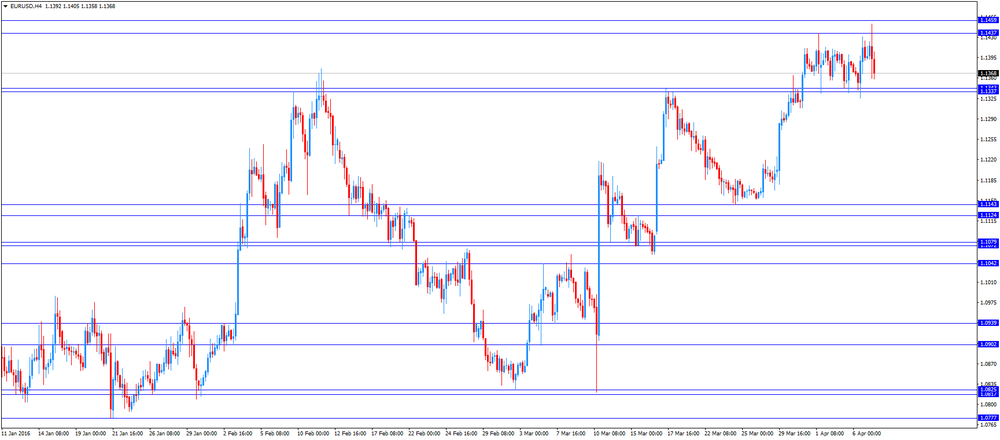

EUR/USD: the currency pair declined to $1.1358

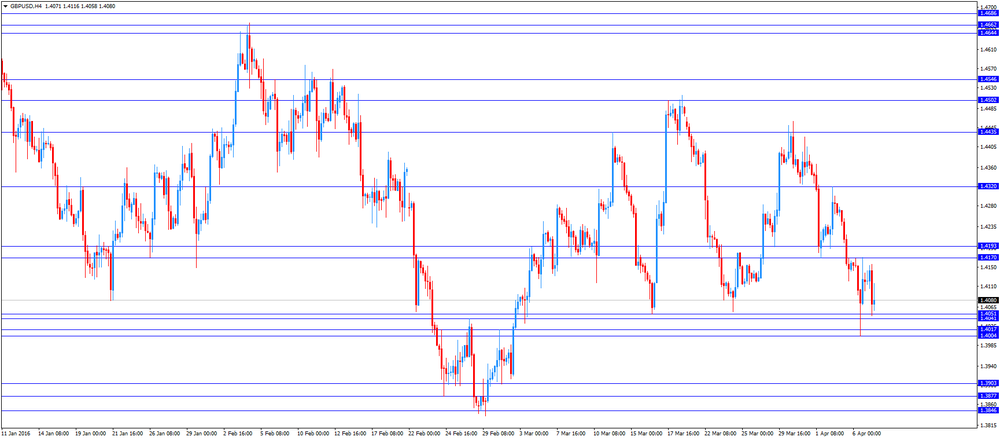

GBP/USD: the currency pair decreased to $1.4047

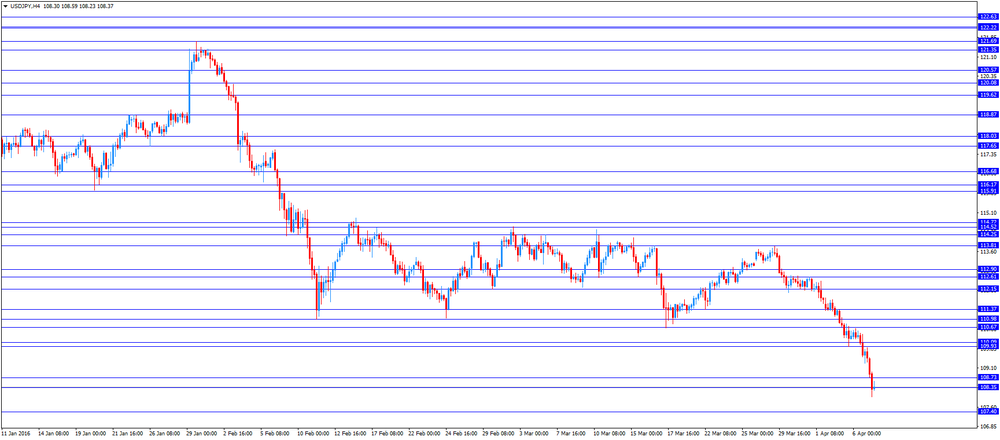

USD/JPY: the currency pair dropped to Y108.00

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) February -9.8% 4.8%

12:30 U.S. Continuing Jobless Claims March 2173 2173

12:30 U.S. Initial Jobless Claims April 276 270

14:00 Eurozone ECB President Mario Draghi Speaks

19:00 U.S. Consumer Credit February 10.54 14.74

21:30 U.S. Fed Chairman Janet Yellen Speaks

23:50 Japan Current Account, bln February 521 2006

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.