- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) February 0.9% Revised From 1.0% -1.2%

03:40 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Coincident Index (Preliminary) January 110.9 113.8

05:00 Japan Leading Economic Index (Preliminary) January 101.8 Revised From 102.1 101.4

07:00 Germany Factory Orders s.a. (MoM) January -0.2% Revised From -0.7% -0.3% -0.1%

09:10 United Kingdom MPC Member Andy Haldane Speaks

09:30 Eurozone Sentix Investor Confidence March 6.0 5.5

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

Market participants continued to eye Friday's U.S. labour market data. According to the U.S. Labor Department's data, the U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs. The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services. The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations. Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

The euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 5.5 in March from 6.0 in February. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone suffers from the loss of economic momentum of the global economy," managing director at Sentix, Patrick Hussy, said.

"A look abroad gives more reasons to cheer this time: values for Asia ex. Japan could recover the second month in a row. Moreover, the US economy exhibits resilience in March," he added.

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.1% in January, beating expectations for a 0.3% decrease, after a 0.2% fall in December. December's figure was revised up from a 0.7% drop.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 1.0% in January, while domestic orders dropped by 1.6%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.4132

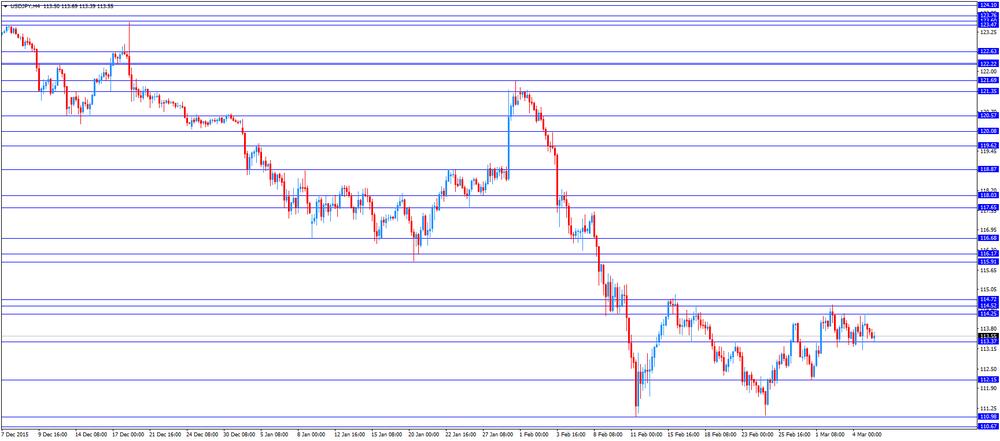

USD/JPY: the currency pair fell to Y113.39

The most important news that are expected (GMT0):

15:00 U.S. Labor Market Conditions Index February 0.4

17:00 U.S. FOMC Member Brainard Speaks

17:30 U.S. FED Vice Chairman Stanley Fischer Speaks

20:00 U.S. Consumer Credit January 21.27 16.75

23:20 Australia RBA Assist Gov Lowe Speaks

23:50 Japan Current Account, bln January 960.7 719

23:50 Japan GDP, q/q (Finally) Quarter IV 0.3% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter IV 1.3% -1.5%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.