- Analytics

- News and Tools

- Market News

- Gold rebounded

Gold rebounded

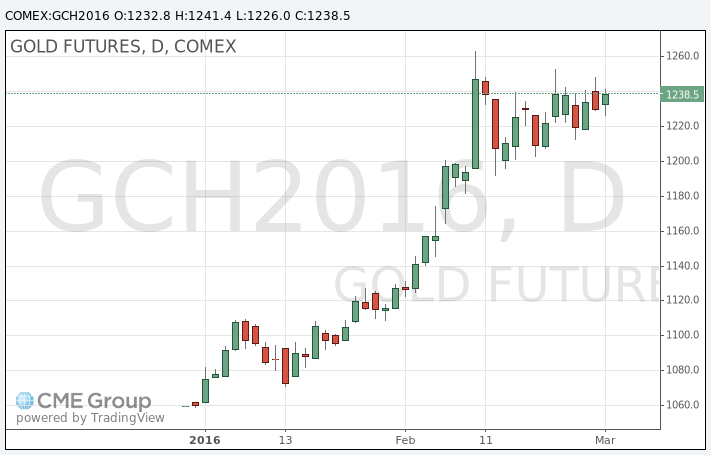

Gold rebounded on Wednesday as global shares turned lower after a fall in oil prices, shrugging off a steadier dollar following better-than-expected U.S. economic data.

Bullion, seen as a shelter for risk-averse investors, has rallied about 16 percent this year in the face of tumbling equities and fears of a global economic slowdown.

"We are still in the phase of investors filling their boots and that means the retracement we are seeing in gold is likely to be used as a buying opportunity," Saxo Bank senior manager Ole Hansen said.

On Wednesday, gold had started the day on the back foot along with other assets perceived as safer, including the Japanese yen, due to a rally in stock markets.

But a retreat in stocks after oil prices slipped generated renewed demand for the metal.

Gold rebounded even as the dollar gained 0.1 percent against a basket of currencies, after data showed the U.S. private employers added 214,000 jobs in February, above economists' expectations.

Investors will be watching more U.S. data to gauge the impact on stocks and the Federal Reserve's monetary policy, with the most important release being non-farm payrolls on Friday.

Gold futures for March delivery rose to $1241,40 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.