- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the pound little changed

Foreign exchange market. Asian session: the pound little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 U.S. FOMC Member Rosengren Speaks

The pound traded range-bound ahead of data on employment in the U.K. Economists expect the unemployment rate calculated by the International Labor Organization method to have declined to 5% in December from 5.1%. Market participants also expect average earnings growth to have declined to 1.9% in the three months to December from +2%.

Market participants paid attention to comments by Boston Federal Reserve Bank President Eric Rosengren. He said that the Fed would have to delay further rate hikes if economic conditions don't become clearer. "Should these conditions persist, and slow progress on attaining the Fed's dual mandate, I believe the normalization of monetary policy should be unhurried, and wait for economic data to improve," Rosengren said.

Japanese Economic and Social Research Institute released data on core machinery orders. The corresponding index rose by 4.2% m/m in December marking first rise in two months. Economists expected a reading of +4.7%. The index is expected to post a stronger gain of 8.6% in the January-March period suggesting strong investment. A higher reading for the machinery orders index points to growing confidence among producers, however it is uncertain how producers will react to the recent stock selloff and a stronger yen.

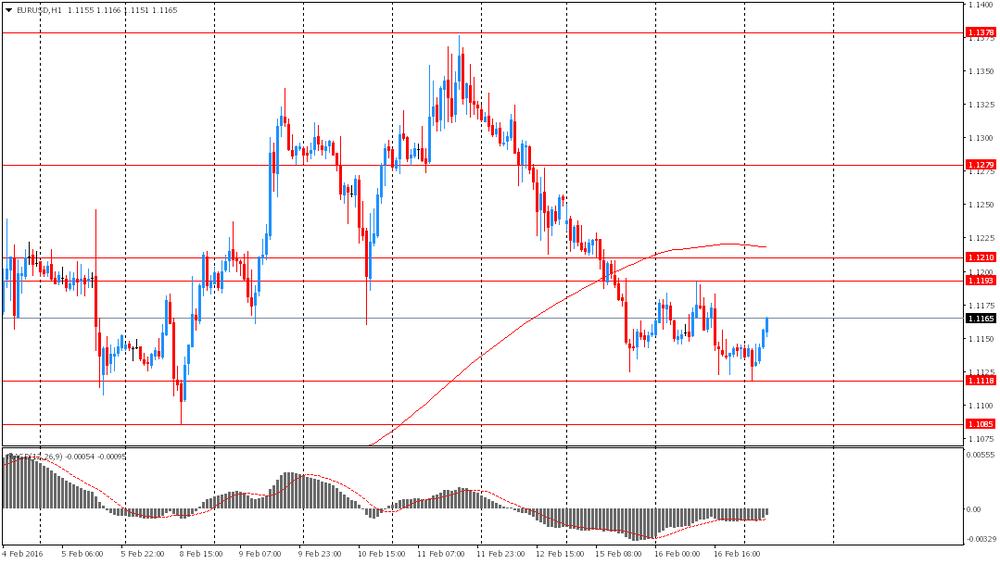

EUR/USD: the pair rose to $1.1170 in Asian trade

USD/JPY: the pair traded around Y114.00

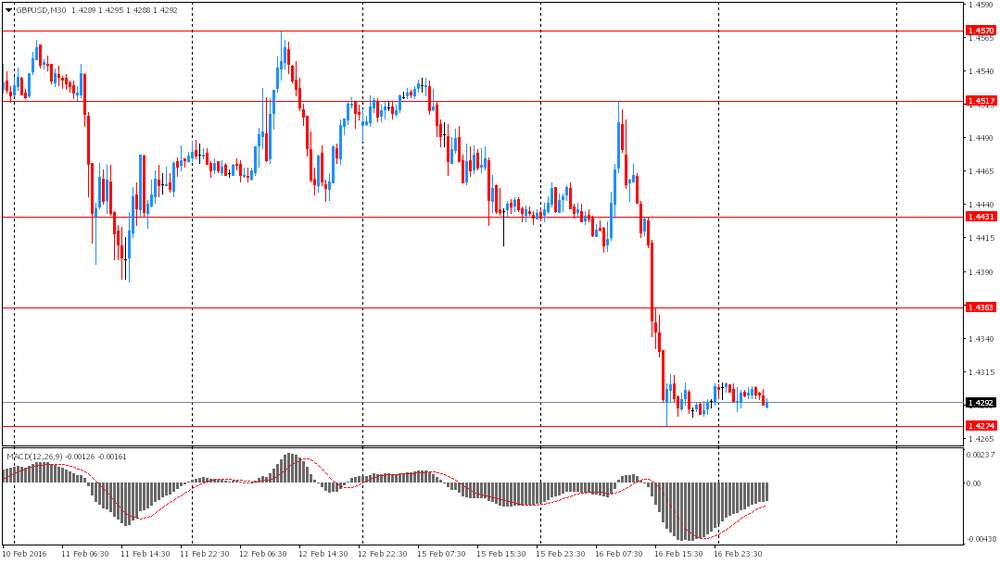

GBP/USD: the pair traded within $1.4285-05

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average Earnings, 3m/y December 2% 1.9%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December 1.9% 1.8%

09:30 United Kingdom Claimant count January -4.3 -3

09:30 United Kingdom ILO Unemployment Rate December 5.1% 5%

10:00 Eurozone Construction Output, y/y December 2.1%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -3

12:00 U.S. MBA Mortgage Applications February 9.3%

13:30 Canada Foreign Securities Purchases December 2.58

13:30 U.S. PPI, m/m January -0.2% -0.2%

13:30 U.S. PPI, y/y January -1% -0.6%

13:30 U.S. PPI excluding food and energy, m/m January 0.1% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y January 0.3% 0.4%

13:30 U.S. Building Permits January 1204 1200

13:30 U.S. Housing Starts January 1149 1170

13:30 U.S. NY Fed Empire State manufacturing index February -19.37

14:15 U.S. Capacity Utilization January 76.5% 76.7%

14:15 U.S. Industrial Production YoY January -1.8%

14:15 U.S. Industrial Production (MoM) January -0.4% 0.4%

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter IV 1.6%

21:45 New Zealand PPI Output (QoQ) Quarter IV 1.3%

23:50 Japan Trade Balance Total, bln January 140 -680.2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.