- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the New Zealand dollar dropped

Foreign exchange market. Asian session: the New Zealand dollar dropped

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Meeting's Minutes

02:00 China New Loans January 597.8 1800 2510

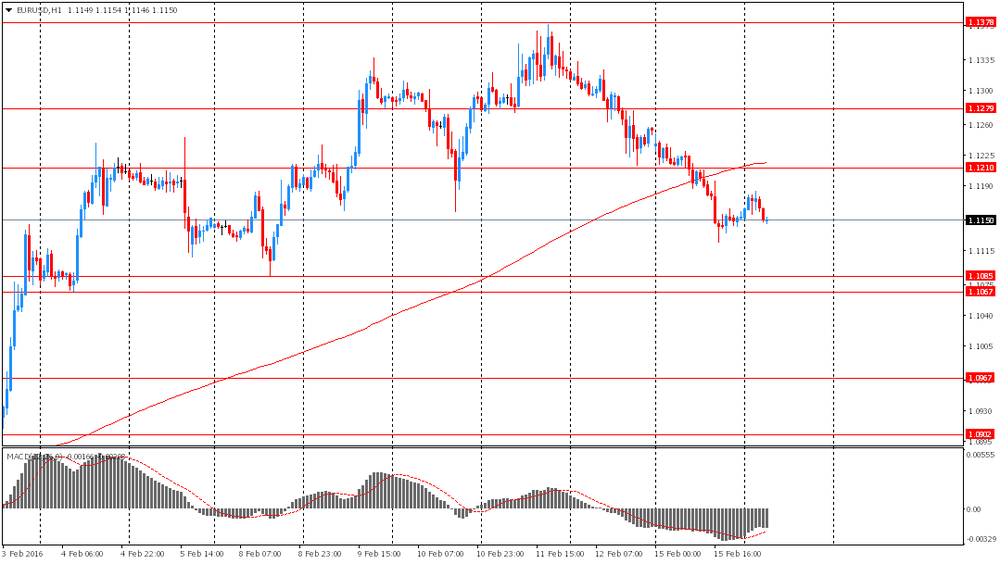

The euro declined slightly ahead of euro zone consumer confidence data. Economists expect to see a decline amid market turbulence in February. Market participants are also waiting for minutes of January ECB meeting. The central bank is expected to add stimulus in March, that's why the minutes will be studied carefully.

The New Zealand dollar dropped after the Reserve Bank of New Zealand published its inflation expectations. The index came in at 1.6% in the first quarter of 2016 compared to its previous reading of 1.9%. This index reflects business managers' expectations regarding the annualized CPI over a two-year period of time. Higher expectations may provoke rate increases. Lower expectations are a negative factor for the NZD. The country's retail sales data were released today. Retail sales rose by 1.2% in the fourth quarter of 2015 missing expectations for a 1.4% rise.

Global Dairy Trade auction will take place at 12:00 GMT today. Milk powder is New Zealand's key export product. Analysts expect prices to fall by about 8%. This would weigh on the New Zealand dollar.

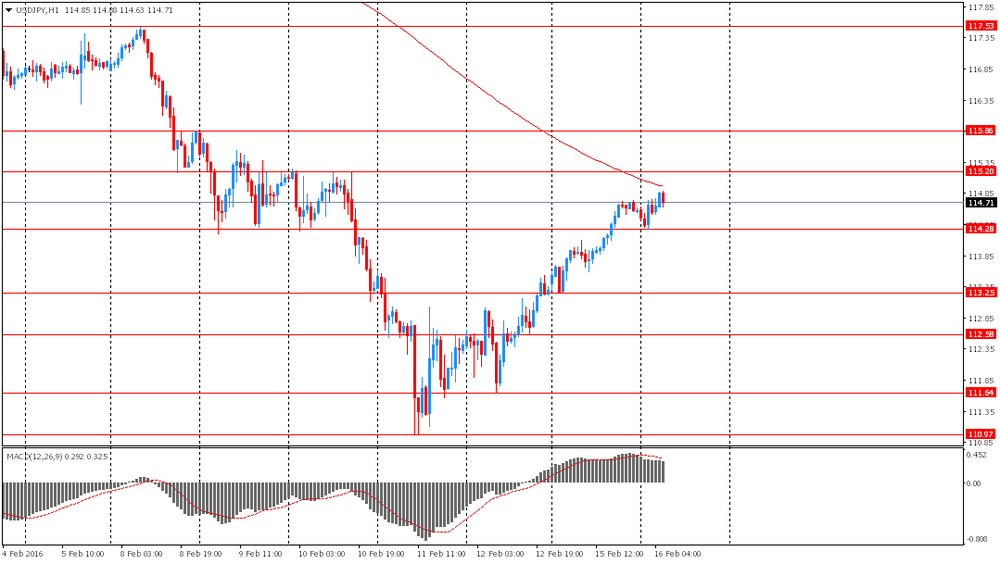

The yen declined after Japanese Prime Minister Shinzo Abe said that excessive currency volatility was undesirable noting the yen's rally last week. He added that Tokyo would take steps if needed.

EUR/USD: the pair fluctuated within $1.1145-80 in Asian trade

USD/JPY: the pair traded within Y111.30-85

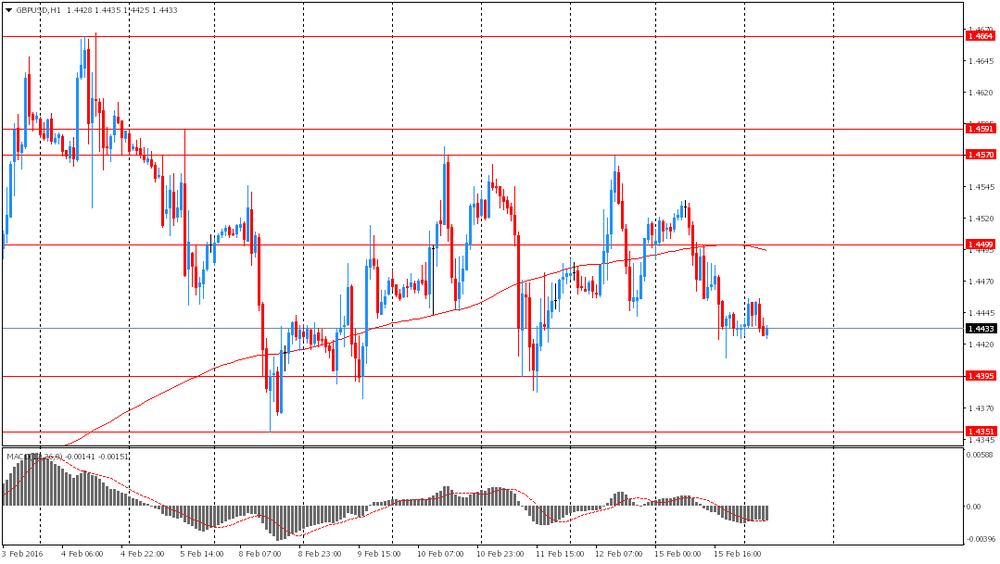

GBP/USD: the pair traded within $1.4415-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Producer Price Index - Input (MoM) January -0.8% -1.4%

09:30 United Kingdom Retail prices, Y/Y January 1.2% 1.4%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.2% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) January -10.8% -8.8%

09:30 United Kingdom Producer Price Index - Output (YoY) January -1.2% -0.9%

09:30 United Kingdom Retail Price Index, m/m January 0.3% -0.6%

09:30 United Kingdom HICP, m/m January 0.1% -0.7%

09:30 United Kingdom HICP, Y/Y January 0.2% 0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January 1.4% 1.3%

10:00 Eurozone ZEW Economic Sentiment February 22.7 10.3

10:00 Germany ZEW Survey - Economic Sentiment February 10.2 0

13:30 Canada Manufacturing Shipments (MoM) December 1% 0.7%

13:30 U.S. NY Fed Empire State manufacturing index February -19.37 -10

15:00 U.S. NAHB Housing Market Index February 60 60

21:00 U.S. Total Net TIC Flows December -3.2

21:00 U.S. Net Long-term TIC Flows December 31.4

23:30 Australia Leading Index January -0.3%

23:50 Japan Core Machinery Orders December -14.4% 4.7%

23:50 Japan Core Machinery Orders, y/y December 1.2% -3.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.