- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the better-than-expected economic data from the Eurozone

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter IV 0.5% 0.3% 0.4%

00:30 Australia CPI, y/y Quarter IV 1.5% 1.6% 1.7%

00:30 Australia Trimmed Mean CPI q/q Quarter IV 0.3% 0.5% 0.6%

00:30 Australia Trimmed Mean CPI y/y Quarter IV 2.1% 2.1% 2.1%

07:00 United Kingdom Nationwide house price index January 0.8% 0.6% 0.3%

07:00 United Kingdom Nationwide house price index, y/y January 4.5% 4.7% 4.4%

07:00 Germany Gfk Consumer Confidence Survey February 9.4 9.3 9.4

07:00 Switzerland UBS Consumption Indicator December 1.55 Revised From 1.66 1.62

07:45 France Consumer confidence January 96 96 97

09:30 United Kingdom BBA Mortgage Approvals December 44.53 Revised From 45 45.5 43.98

12:00 U.S. MBA Mortgage Applications January 9% 8.8%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the Fed's monetary policy meeting results later in the day. Analysts expect the Fed to keep its monetary policy unchanged.

New home sales in the U.S. are expected to rise to 500,000 units in December from 490,000 units in November.

The euro traded higher against the U.S. dollar after the release of the better-than-expected economic data from the Eurozone. Market research group GfK released its consumer confidence index for Germany on Wednesday. German Gfk consumer confidence index remained unchanged at 9.4 in February, beating expectations for a drop to 9.3.

"The consumer climate has therefore been able to withstand the recent growth in risks it is facing. However, in the next few months the escalating terror threat and the rising fears among certain groups of the population that Germany could eventually become overstretched by the persistently high influx of refugees and asylum seekers may cause consumer confidence to wane in the long term. In turn, this would have a lasting impact on the consumer climate," Gfk noted.

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index rose to 97 in January from 96 in December. Analysts had expected the index to remain unchanged at 96.

The British pound traded mixed against the U.S. dollar after the release of the U.K. economic data. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals decreased to 43,975 in December from 44,533 in November, missing expectations for a rise to 45,500. November's figure was revised up from 45,437.

"Last year was a strong year for household borrowing. There was a 6% rise in mortgage borrowing compared to 2014 and consumer credit expanded at more than 5% annually within an overall unsecured market which is growing at nearly 10% annually," the chief economist at the BBA, Richard Woolhouse, said.

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.3% in January, missing expectations for a 0.6% rise, after a 0.8% increase in December.

On a yearly basis, house prices fell to 4.4% in January from 4.5% in December. Analysts had expected house prices to rise by 4.7%.

"As we look ahead, the risks are skewed towards a modest acceleration in house price growth, at least at the national level, Robert Gardner, said.

The Swiss franc traded lower against the U.S. dollar. UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.62 in December from 1.55 in November. November's figure was revised down from 1.66.

The bank expect the consumption to rise.

"Consumer sentiment will likely start the year strong despite a seasonal increase in the unemployment rate in December. As low interest rates provide little incentive to save, people tend to consume more," the bank said.

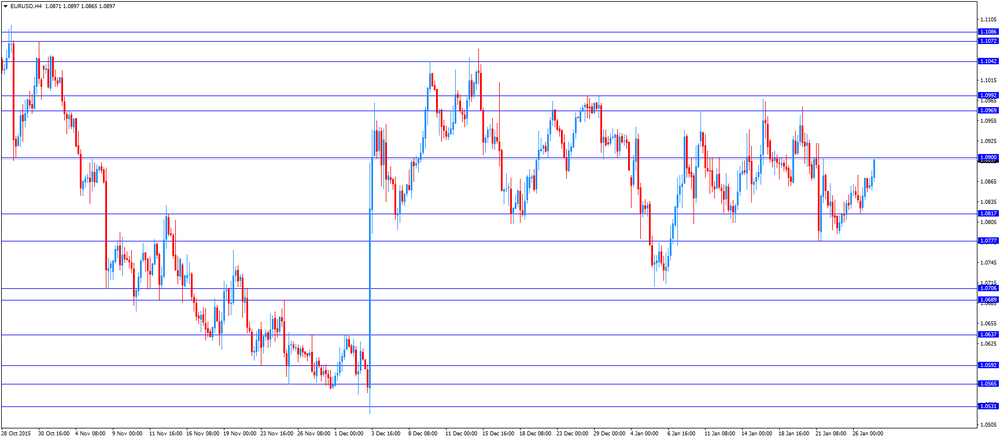

EUR/USD: the currency pair rose to $1.0897

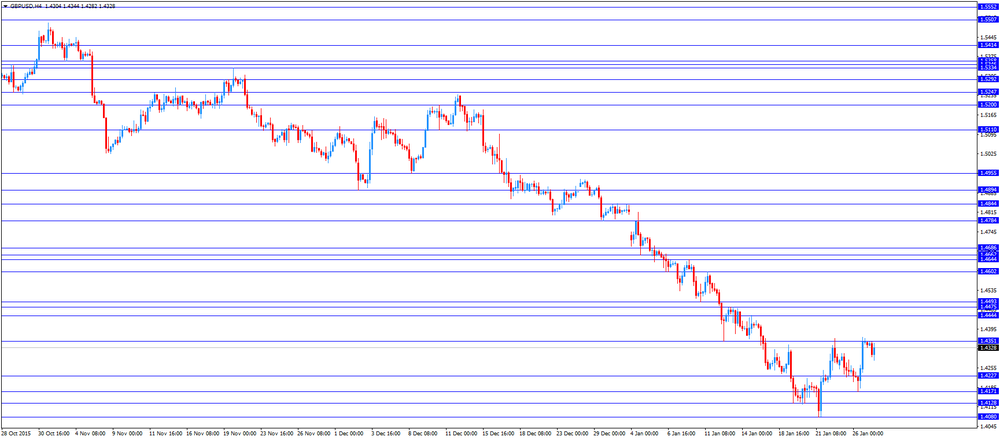

GBP/USD: the currency pair traded mixed

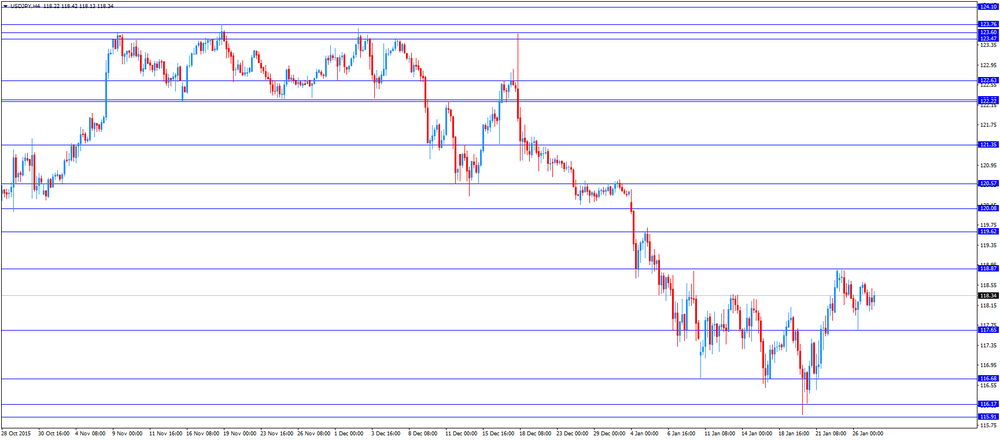

USD/JPY: the currency pair increased to Y118.42

The most important news that are expected (GMT0):

15:00 U.S. New Home Sales December 490 500

15:30 U.S. Crude Oil Inventories January 3.979 3.3

19:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

19:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.5% 2.5%

20:00 New Zealand RBNZ Rate Statement

21:45 New Zealand Trade Balance, mln December -779 -131

23:50 Japan Retail sales, y/y December -1.0% -0.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.