- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the yen rose

Foreign exchange market. Asian session: the yen rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Current Account, bln Quarter III -20.5 Revised From -19.0 -16.5 -18.1

00:30 Australia Building Permits, m/m October 2.3% Revised From 2.2% -2.3% 3.9%

01:00 China Non-Manufacturing PMI November 53.1 53.6

01:00 China Manufacturing PMI November 49.8 49.8 49.6

01:35 Japan Manufacturing PMI (Finally) November 52.4 52.8 52.6

01:45 China Markit/Caixin Manufacturing PMI November 48.3 48.3 48.6

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

06:45 Switzerland Gross Domestic Product (YoY) Quarter III 1.2% 0.9% 0.8%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.2% 0.2% 0.0%

The euro climbed against the U.S. dollar ahead of an ECB meeting scheduled for Thursday. Many investors expect the bank to decide to expand its quantitative easing program. Speaking earlier at a European Banking Congress in Frankfurt ECB President Maria Draghi said that at the next meeting the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target was at risk the central bank would use all tools available to support it.

The yen rose sharply against the U.S. dollar after sources reported that Japan's public pension fund had started to hedge a small amount of its investments against currency fluctuations, particularly against fluctuations in the euro in the "short term". This step was taken because of a negative outlook for the euro amid expectations for further easing by the European Central Bank.

The Australian dollar rose after the Reserve Bank of Australia left its benchmark interest rate at 2% as expected. The bank said the economy continued expanding at a moderate pace amid declines in mining investment. Inflation is expected to remain low and its outlook gives room for further policy easing.

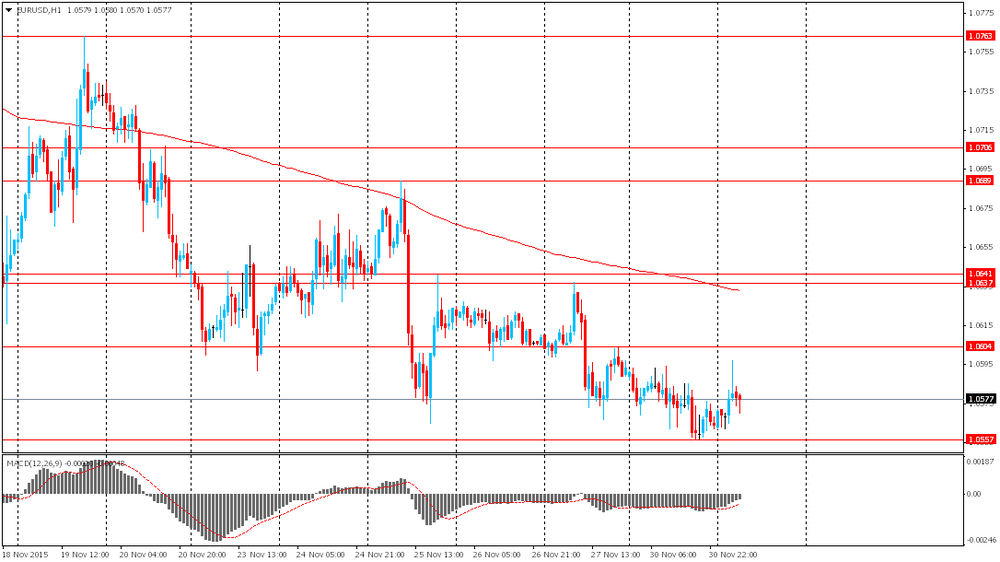

EUR/USD: the pair rose to $1.0595 in Asian trade

USD/JPY: the pair fell to Y122.65

GBP/USD: the pair rose to $1.5095

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales (MoM) October 0.1%

08:15 Switzerland Retail Sales Y/Y October 0.2% 0.4%

08:30 Switzerland Manufacturing PMI November 50.7 51

08:50 France Manufacturing PMI (Finally) November 50.6 50.8

08:55 Germany Manufacturing PMI (Finally) November 52.1 52.6

08:55 Germany Unemployment Change November -5 -5

08:55 Germany Unemployment Rate s.a. November 6.4% 6.4%

09:00 Eurozone Manufacturing PMI (Finally) November 52.3 52.8

09:00 United Kingdom BOE Financial Stability Report

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Purchasing Manager Index Manufacturing November 55.5 53.6

10:00 Eurozone Unemployment Rate October 10.8% 10.8%

13:30 Canada GDP QoQ Quarter III -0.1%

13:30 Canada GDP (YoY) Quarter III -0.5% 2.3%

13:30 Canada GDP (m/m) September 0.1% 0%

14:45 U.S. Manufacturing PMI (Finally) November 54.1 52.6

15:00 U.S. Construction Spending, m/m October 0.6% 0.5%

15:00 U.S. ISM Manufacturing November 50.1 50.4

17:45 U.S. FOMC Member Charles Evans Speaks

20:00 U.S. Total Vehicle Sales, mln November 18.24 18.1

23:30 Australia RBA's Governor Glenn Stevens Speech

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.