- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the better-than-expected economic data from the Eurozone

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

08:00 France Services PMI (Preliminary) November 52.7 52.6 51.3

08:00 France Manufacturing PMI (Preliminary) November 50.6 50.8 50.8

08:30 Germany Manufacturing PMI (Preliminary) November 52.1 52 52.6

08:30 Germany Services PMI (Preliminary) November 54.5 54.3 55.6

09:00 Eurozone Manufacturing PMI (Preliminary) November 52.3 52.3 52.8

09:00 Eurozone Services PMI (Preliminary) November 54.1 54.1 54.6

The U.S. dollar traded mixed against the most major currencies ahead of the release of the economic data from the U.S. The U.S. preliminary manufacturing PMI is expected to decline to 53.9 in November from 54.1 in October.

The existing home sales in the U.S. are expected to decrease to 5.40 million units in October from 5.55 million units in September.

Market participants are awaiting an unscheduled Fed meeting later in the day. According to the Fed's website, the Fed will review the advance and discount rates to be charged by the Federal Reserve Banks. The meeting is scheduled to begin at 16:30 GMT.

The euro traded mixed against the U.S. dollar on the better-than-expected economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI rose to 52.8 in November from 52.3 in October. Analysts had expected the index to remain unchanged at 52.3.

Eurozone's preliminary services PMI climbed to 54.6 in November from 54.1 in October. Analysts had expected the index to remain unchanged at 54.1.

Business activity and employment were main contributors for the rise.

Markit's Chief Economist Chris Williamson said that Eurozone's economic growth accelerated, "putting the region on course for one of its best quarterly performances over the past four-and-a-half year".

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter.

"November's slightly improved PMI reading will no doubt do little to dissuade policymakers that more needs to be done at their December meeting to ensure stronger and more sustainable growth," Williamson added.

Germany's preliminary manufacturing PMI climbed to 52.6 in November from 52.1 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary services PMI was up to 55.6 in November from 54.5 in October. Analysts had expected index to decline to 54.3.

France's preliminary manufacturing PMI rose to 50.8 in November from 50.6 in October, in line with forecasts.

France's preliminary services PMI decreased to 51.3 in November from 52.7 in October. Analysts had expected the index to fall to 52.6.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from U.K.

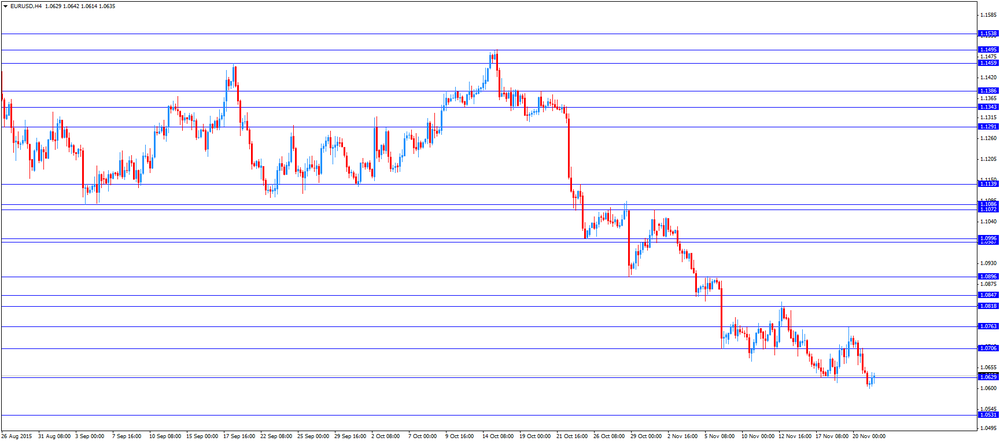

EUR/USD: the currency pair traded mixed

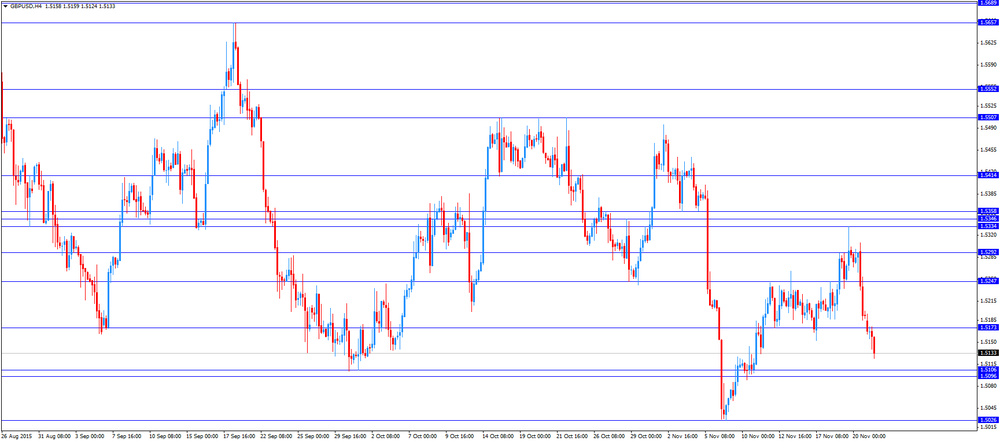

GBP/USD: the currency pair fell to $1.5124

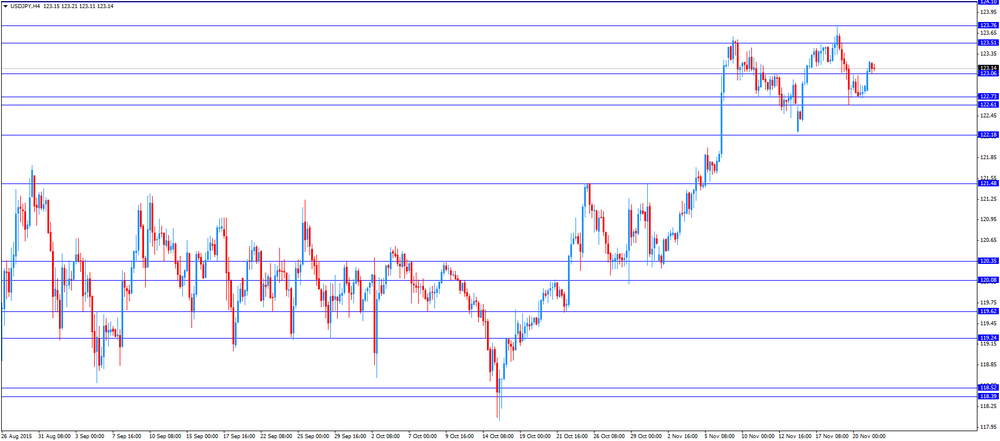

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Preliminary) November 54.1 53.9

15:00 U.S. Existing Home Sales October 5.55 5.4

16:30 U.S. Fed Announcement

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.