- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the labour market data from the U.K.

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:30 China Retail Sales y/y October 10.9% 10.9% 11.0%

05:30 China Industrial Production y/y October 5.7% 5.8% 5.6%

05:30 China Fixed Asset Investment October 10.3% 10.2% 10.2%

06:00 Japan Prelim Machine Tool Orders, y/y October -19.1% -23.1%

09:30 United Kingdom Average Earnings, 3m/y September 3.0% 3.2% 3%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September 2.8% 2.7% 2.5%

09:30 United Kingdom Claimant count October 0.5 Revised From 4.6 1.5 3.3

09:30 United Kingdom ILO Unemployment Rate September 5.4% 5.4% 5.3%

12:00 U.S. MBA Mortgage Applications November -0.8% -1.3%

The U.S. dollar traded higher against the most major currencies in the absence of any major U.S. economic reports.

The greenback remains supported by speculation that the Fed will start raising its interest rate next month.

The euro traded lower against the U.S. dollar ahead a speech by the European Central Bank President Mario Draghi. Market participants will closely monitor his comments for signals what the central bank plans to decide on its December monetary policy meeting. The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the volume of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

European Central Bank (ECB) Governing Council member Ignazio Visco said on Wednesday that the central bank will consider the deposit rate cut and the expansion of its asset-buying programme at its December monetary policy meeting to boost inflation in the Eurozone.

The German Council of Economic Experts (GCEE) released its Annual Economic Report on Wednesday. The experts said that the economy in Germany and the Eurozone continued to recover, but there are the downside risks from the slowdown in emerging economies.

The British pound traded higher against the U.S. dollar on the labour market data from the U.K. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.3% in the July to September quarter from 5.4% in the June to August quarter. It was the lowest reading since the second quarter of 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.4%.

"These figures continue the recent strengthening trend in the labour market, with a new record high in the employment rate and the unemployment rate still at its lowest since spring 2008. Earnings continue to grow, albeit the rate for regular pay has fallen back a little from recent months," ONS labour market statistician, Nick Palmer said.

Average weekly earnings, excluding bonuses, climbed by 2.5% in the July to September quarter, missing expectations for a 2.7% rise, after a 2.8% gain in the June to August quarter.

Average weekly earnings, including bonuses, rose by 3.0% in the July to September quarter, missing expectations for a gain of 3.2%, after a 3.0% increase in the June to August quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

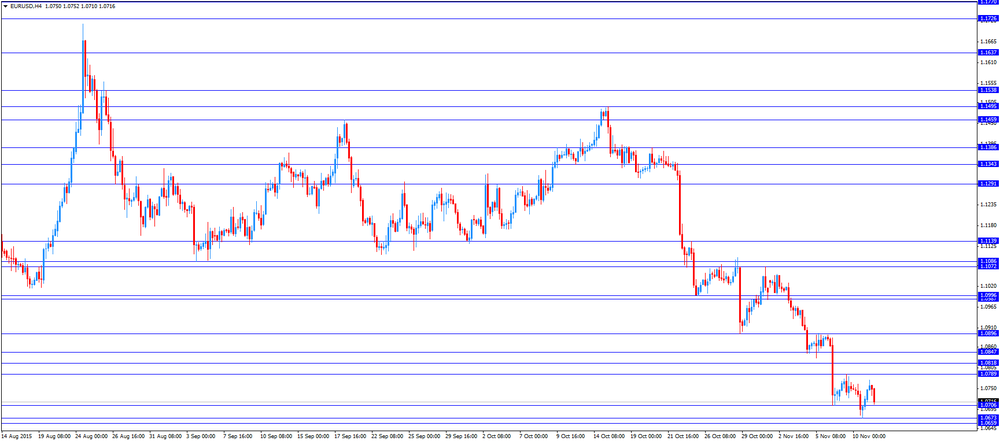

EUR/USD: the currency pair declined to $1.0710

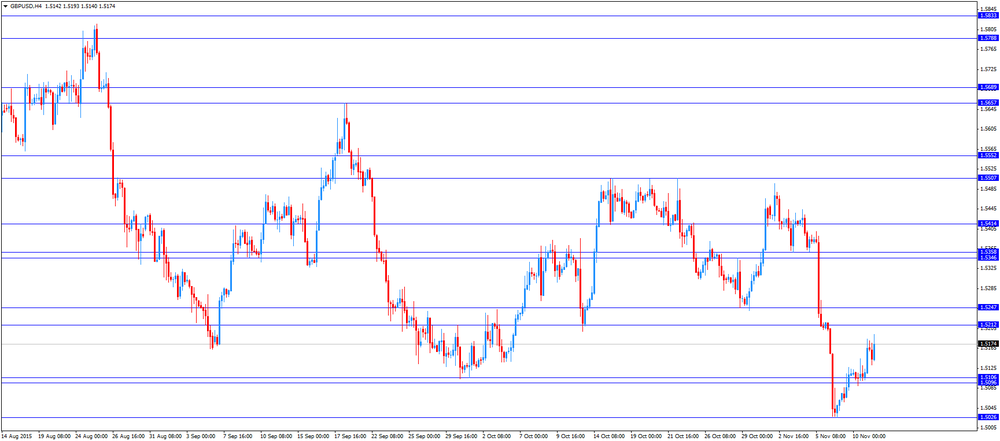

GBP/USD: the currency pair was up to $1.5193

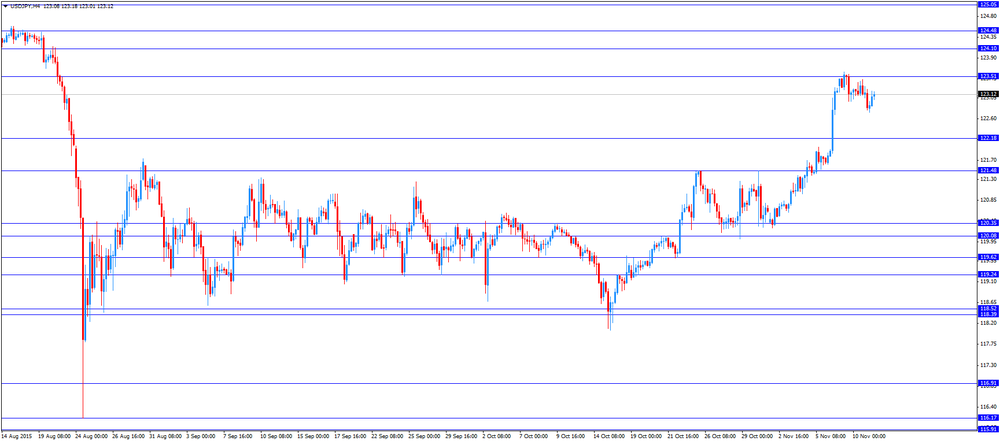

USD/JPY: the currency pair increased to Y123.20

The most important news that are expected (GMT0):

13:15 Eurozone ECB President Mario Draghi Speaks

21:30 New Zealand Business NZ PMI October 55.4

23:50 Japan Tertiary Industry Index September 0.1%

23:50 Japan Core Machinery Orders, y/y September -3.5% -4%

23:50 Japan Core Machinery Orders September -5.7% 3.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.