- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the yen advanced against the U.S. dollar

Foreign exchange market. Asian session: the yen advanced against the U.S. dollar

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Import Price Index, q/q Quarter III 1.4% 1.6% 1.4%

00:30 Australia Export Price Index, q/q Quarter III -4.4% 0.5% 0.0%

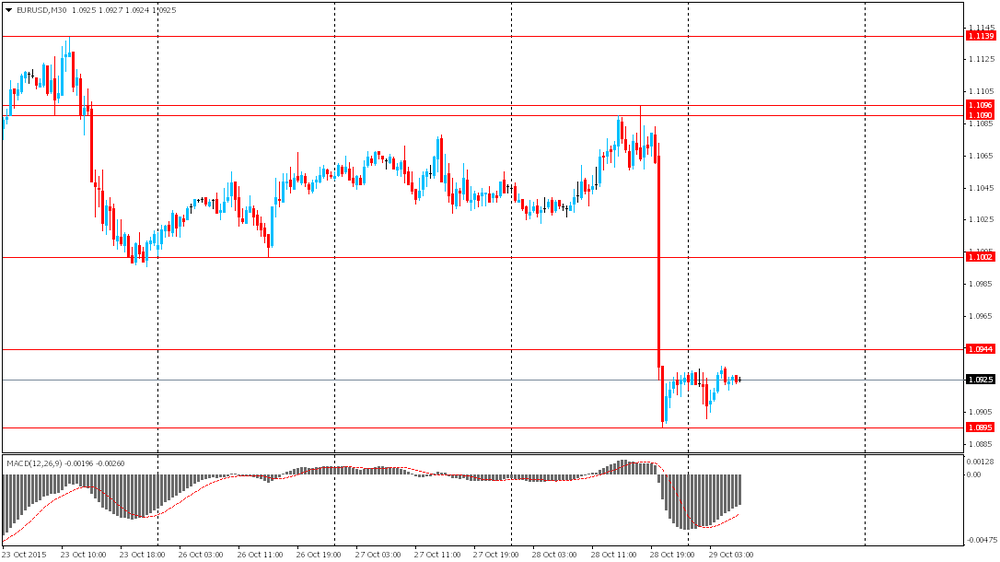

The U.S. dollar rose against the euro after the Federal Reserve left its key interest rate unchanged, but gave a hint that a rate hike in December would still be possible. Fed's statement did not mention a concern seen in September that market turbulence and worldwide events might hold back economic activity in the U.S. This does not guarantee a rate hike in the current year, but it signals that obstacles mentioned in September decreased.

The yen advanced against the U.S. dollar amid Japanese industrial production data. The Ministry of Economy, Trade and Industry reported that the country's industrial production rose by 1.0% in September compared to a 1.3% decline reported previously and a 0.5% fall expected by economists. On a y/y basis the index came in at -0.9%. The unexpected rise in September gives hope for a stronger growth of the country's economy despite China's economic slowdown.

Tomorrow the Bank of Japan will hold a meeting and revise inflation and economic growth forecasts. Inflation forecasts are likely to be revised down.

The New Zealand dollar declined after the Reserve Bank of New Zealand left it benchmark rate at 2.75%, but signaled that it might be lowered later on. A rate cut would depend on economic data. The RBNZ's inflation target is 1%-3%, while the CPI is currently at 0.4%.

EUR/USD: the pair fluctuated within $1.0900-35 in Asian trade

USD/JPY: the pair fell to Y120.60

GBP/USD: the pair fell to $1.5250

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index, y/y October 3.8% 3.8%

07:00 United Kingdom Nationwide house price index October 0.5% 0.5%

08:55 Germany Unemployment Change October 3 -4

08:55 Germany Unemployment Rate s.a. October 6.4% 6.4%

09:30 United Kingdom Consumer credit, mln September 860 1100

09:30 United Kingdom Mortgage Approvals September 71.03 72.45

09:30 United Kingdom Net Lending to Individuals, bln September 4.3

10:00 Eurozone Economic sentiment index October 105.6 105.2

10:00 Eurozone Consumer Confidence (Finally) October -7.1 -7.7

10:00 Eurozone Business climate indicator October 0.34 0.32

10:00 Eurozone Industrial confidence October -2.2 -2.7

11:00 United Kingdom CBI retail sales volume balance October 49

12:30 Canada Industrial Product Price Index, m/m September -0.3% -0.1%

12:30 Canada Industrial Product Price Index, y/y September -0.4%

12:30 U.S. Continuing Jobless Claims October 2170 2160

12:30 U.S. Initial Jobless Claims October 259 263

12:30 U.S. PCE price index, q/q (Preliminary) Quarter III 2.2% 3.2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter III 1.9% 1.4%

12:30 U.S. GDP, q/q (Preliminary) Quarter III 3.9% 1.6%

13:00 Germany CPI, m/m (Preliminary) October -0.2% -0.1%

13:00 Germany CPI, y/y (Preliminary) October 0% 0.2%

14:00 U.S. Pending Home Sales (MoM) September -1.4% 1%

14:10 U.S. FOMC Member Dennis Lockhart Speaks

21:45 New Zealand Building Permits, m/m September -4.9% 0.2%

23:30 Japan Unemployment Rate September 3.4% 3.4%

23:30 Japan Tokyo Consumer Price Index, y/y October -0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October -0.2% -0.1%

23:30 Japan National Consumer Price Index, y/y September 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y September -0.1% -0.2%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.