- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the U.S. dollar little changed ahead of Fed interest rate decision

Foreign exchange market. Asian session: the U.S. dollar little changed ahead of Fed interest rate decision

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia CPI, q/q Quarter III 0.7% 0.6% 0.5%

00:30 Australia CPI, y/y Quarter III 1.5% 1.7% 1.5%

00:30 Australia Trimmed Mean CPI q/q Quarter III 0.6% 0.5% 0.3%

00:30 Australia Trimmed Mean CPI y/y Quarter III 2.2% 2.4% 2.1%

The U.S. dollar little changed ahead of Fed monetary policy decision, which will be announced later today. Most market participants expect the Federal Reserve to hold onto soft policy and postpone a rate increase till 2016. Tomorrow the central bank will only publish its monetary policy statement, there will be no conference. However investors will eye the statement to find clues on the timing of the first rate hike in nearly a decade.

The Australian dollar fell against the greenback amid sharp declines in commodity prices. Worse-than-expected inflation data also weighed on the AUD. The consumer price index rose by 0.5% in the third quarter compared to 0.6% expected and 0.7% previous. Consumer prices rose by 1.5% on an annualized basis, while economists had expected a 1.7% growth. Now market participants expect the Reserve Bank of Australia to lower its benchmark interest rate.

The Reserve Bank of New Zealand will hold a meeting today. The bank is expected to leave its key interest rate at 2.75% waiting for new economic data and moves of other central banks.

EUR/USD: the pair fell to $1.1020 in Asian trade

USD/JPY: the pair traded within Y120.25-55

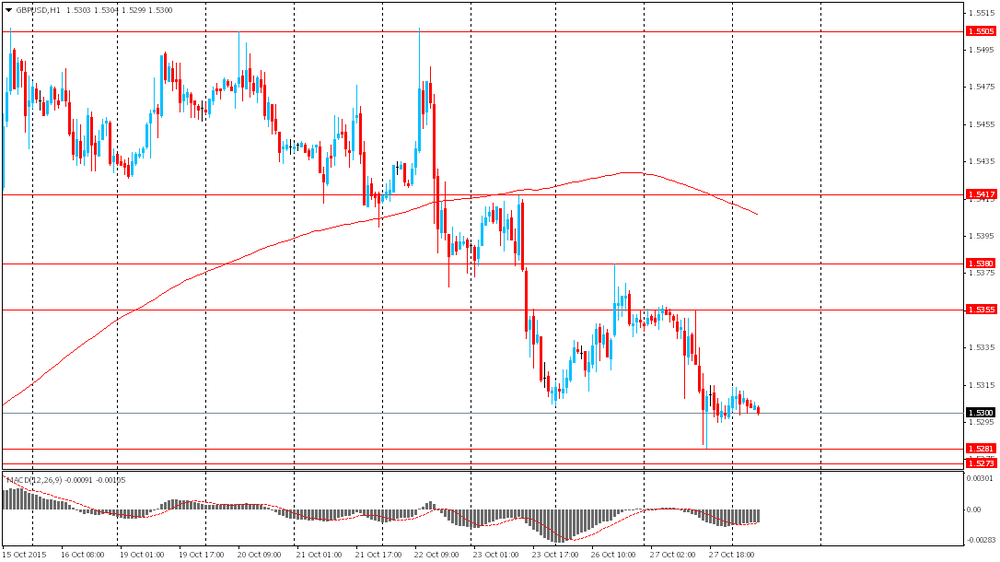

GBP/USD: the pair traded within $1.5295-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Gfk Consumer Confidence Survey November 9.6 9.4

07:45 France Consumer confidence October 97 97

11:00 U.S. MBA Mortgage Applications October 11.8%

14:30 U.S. Crude Oil Inventories October 8.028 3.5

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.75%

20:00 New Zealand RBNZ Rate Statement

23:50 Japan Industrial Production (MoM) (Preliminary) September -1.2% -0.5%

23:50 Japan Industrial Production (YoY) (Preliminary) September -0.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.