- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the euro is steady ahead of ECB's decision

Foreign exchange market. Asian session: the euro is steady ahead of ECB's decision

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia NAB Quarterly Business Confidence Quarter III 4 0

The euro little changed ahead of results of the European Central Bank meeting. Analysts say that despite recent talks of expansion of the QE program ECB Governor Draghi is unlikely to change the program's "settings" and is likely to wait at least till December. Meanwhile Draghi may try to lower the euro verbally. The single currency's strength is unfavorable for domestic exporters. Analysts say that the ECB intends to maintain euro's low exchange rate in order to support competitiveness of exports. That's why the central bank may signal that it inclines towards softer policy.

The Australian dollar slightly rose at the beginning of the session after yesterday's decline, which was caused by declines in commodity prices. Meanwhile later the AUD fell amid news that one of Australia's major banks Commonwealth Bank decided to raise its standard interest rate by 15 basis points like Westpac.

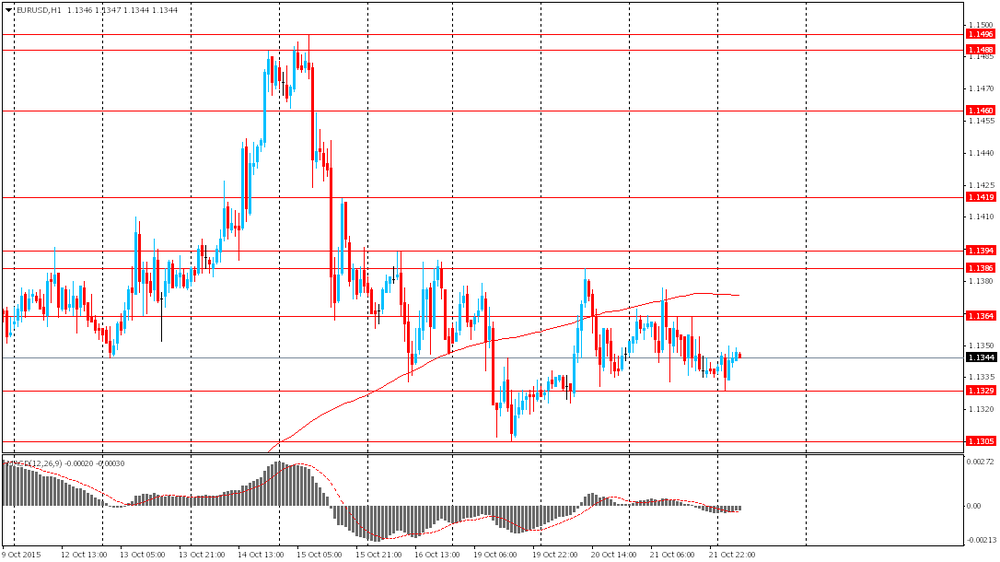

EUR/USD: the pair fluctuated within $1.1330-50 in Asian trade

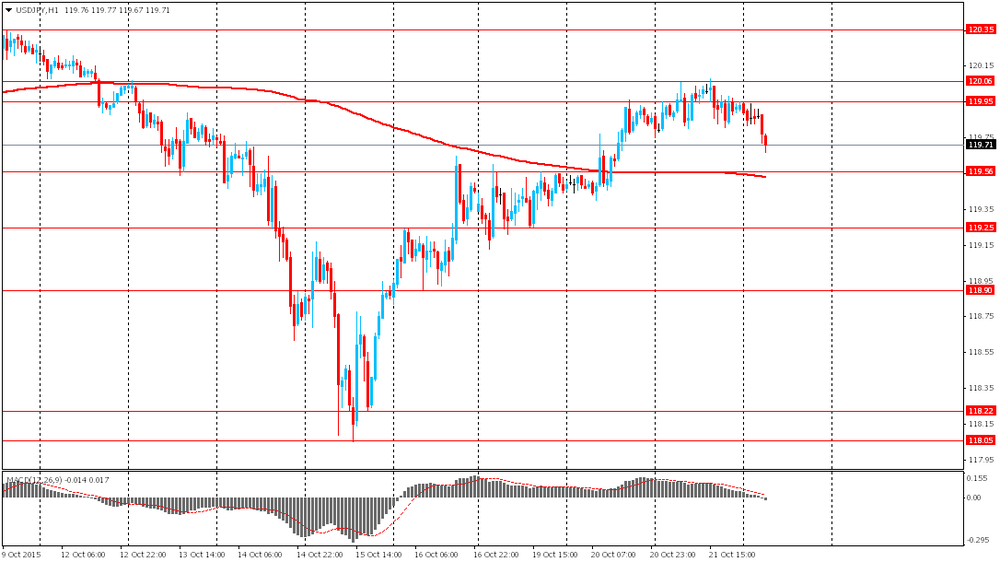

USD/JPY: the pair fell to Y119.60

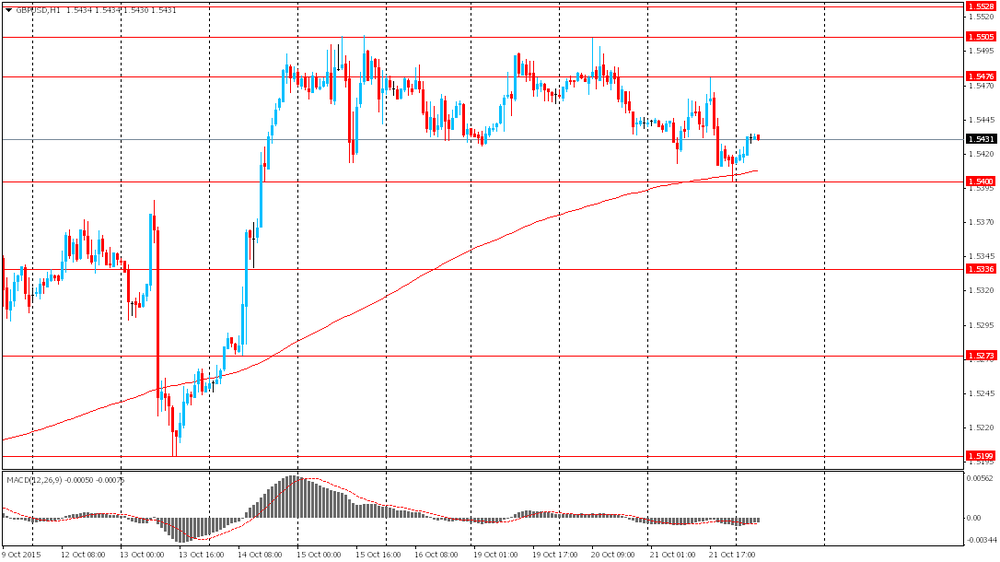

GBP/USD: the pair rose to $1.5435

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Retail Sales (MoM) September 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) September 3.7% 4.8%

11:45 Eurozone ECB Interest Rate Decision 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Retail Sales, m/m August 0.5% 0.1%

12:30 Canada Retail Sales YoY August 1.8%

12:30 Canada Retail Sales ex Autos, m/m August 0% 0.1%

12:30 U.S. Chicago Federal National Activity Index September -0.41

12:30 U.S. Continuing Jobless Claims October 2158 2188

12:30 U.S. Initial Jobless Claims October 255 265

13:00 U.S. Housing Price Index, m/m August 0.6%

14:00 Eurozone Consumer Confidence (Preliminary) October -7.1 -7.35

14:00 U.S. Leading Indicators September 0.1% 0.0%

14:00 U.S. Existing Home Sales September 5.31 5.38

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.