- Analytics

- News and Tools

- Market News

- WTI crude oil declines for a third day

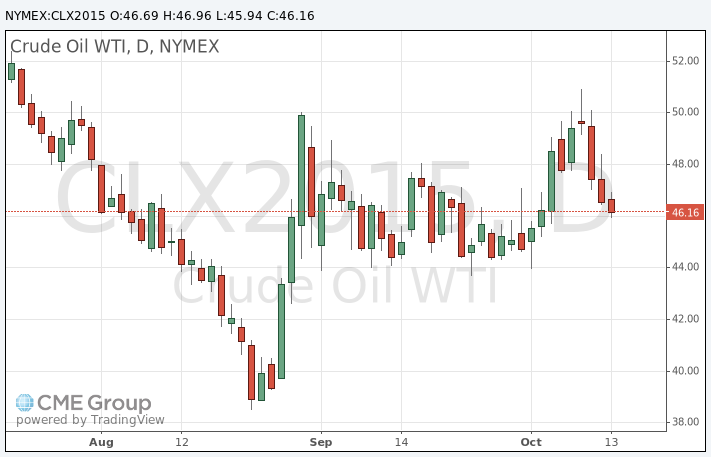

WTI crude oil declines for a third day

WTI crude oil fell on concerns over the global oil oversupply. The International Energy Agency's (IEA) agency said in its monthly report on Tuesday that global oil oversupply will remain next year as global demand is expected to slow. Global oil demand growth is expected to decline to 1.2 million barrels per day (mb/d) in 2016 from 1.8 mb/d in 2015, down 150,000 barrels per day from its September estimate.

Kuwait's oil minister Ali al-Omair said on Tuesday that OPEC will discuss Venezuela's proposal an oil price floor of $70-$100 per barrel at its next meeting this month.

Venezuelan Oil Minister Eulogio del Pino said on Tuesday that eight non-OPEC countries (Azerbaijan, Brazil, Colombia, Kazakhstan, Norway, Mexico, Oman and Russia) have been invited to ameeting on October 21.

Earlier, the weak inflation data from China weighed on oil prices. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in September, missing expectations for a 1.8% increase, after a 2.0% gain in August.

The Chinese producer price index (PPI) dropped 5.9% in September, in line with expectations, after a 5.9% decline in August. It was the biggest decline since 2009.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Thursday.

WTI crude oil for November delivery declined to $45.94 a barrel on the New York Mercantile Exchange.

Brent crude oil for November increased to $49.25 a barrel on ICE Futures Europe.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.