- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weak U.K. inflation data

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weak U.K. inflation data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence September 1 5

01:00 China New Loans September 809.6 900 376.2

02:00 China Trade Balance, bln September 60.24 46.79 59.43

05:00 Japan Consumer Confidence September 41.7 40.6

06:00 Germany CPI, m/m (Finally) September 0.0% -0.2% -0.2%

06:00 Germany CPI, y/y (Finally) September 0.2% 0% 0%

06:00 Japan Prelim Machine Tool Orders, y/y September -16.5% -19.1%

07:15 Switzerland Producer & Import Prices, y/y September -6.8% -6.8%

07:15 Switzerland Producer & Import Prices, m/m September -0.7% -0.1%

08:30 United Kingdom BOE Credit Conditions Survey

08:30 United Kingdom Retail Price Index, m/m September 0.5% 0.1% -0.1%

08:30 United Kingdom Retail prices, Y/Y September 1.1% 1% 0.8%

08:30 United Kingdom Producer Price Index - Input (MoM) September -3% Revised From -2.4% 0.4% 0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) September -14.6% Revised From -13.8% -12.9% -13.3%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.5% Revised From -0.4% -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -1.9% Revised From -1.8% -1.8% -1.8%

08:30 United Kingdom HICP, m/m September 0.2% 0% -0.1%

08:30 United Kingdom HICP, Y/Y September 0.0% 0% -0.1%

08:30 United Kingdom HICP ex EFAT, Y/Y September 1.0% 1.1% 1.0%

09:00 Eurozone ZEW Economic Sentiment October 33.3 30.1

09:00 Germany ZEW Survey - Economic Sentiment October 12.1 6 1.9

The U.S. dollar traded mixed to lower against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index dropped to 1.9 in October from 12.1 in September, missing expectations for a fall to 6.0.

"The exhaust gas scandal of Volkswagen and the weak growth of emerging markets has dampened economic outlook for Germany. However, the performance of the domestic economy is still good and the Euro area economy continues to recover. This makes it rather unlikely that the German economy will slide into recession," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 30.1 in October from 33.3 in September.

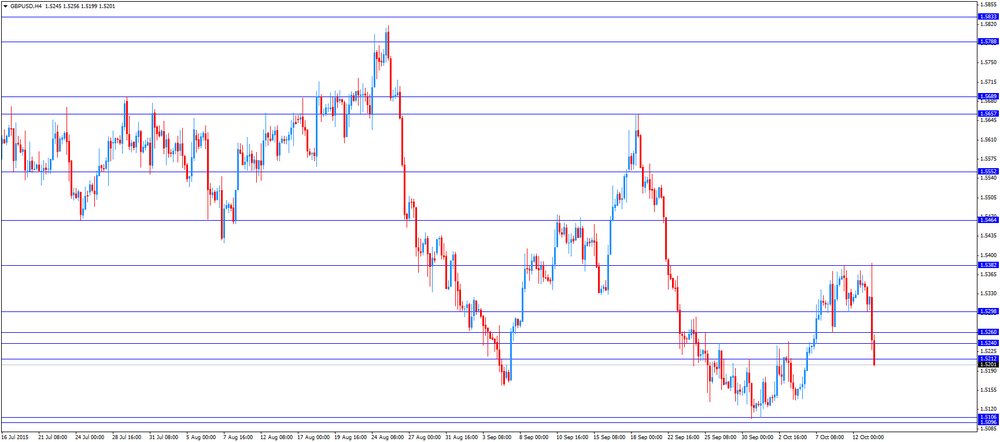

The British pound traded lower against the U.S. dollar after the release of the weak U.K. inflation data. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in September from 0.0% in August, missing expectations for a flat reading.

The decline was driven by low petrol and clothing prices.

"The largest downward contribution came from petrol, with prices falling by 3.7 pence per litre between August and September this year compared with a fall of 0.8 pence per litre between the same 2 months a year ago. Diesel prices are now at their lowest level since December 2009, standing at 110.2 pence per litre," the ONS said.

On a monthly basis, U.K. consumer prices fell 0.1% in September, missing expectations for a flat reading, after a 0.2% rise in August.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.0% in September, missing forecasts of a rise to 1.1%.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.7% in August, faster than a 0.8% in July.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 5.2% in July, same as in July. It was the lowest rise since September 2013.

The lower house price inflation was mainly driven by a decline in prices in the East and the South East.

The Swiss franc traded mixed against the U.S. dollar after the weak producer and import prices data from Switzerland. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices fell 0.1% in September, after a 0.7% drop in August.

The decline was mainly driven by lower prices for crude petroleum and fuel products.

The Import Price Index decreased by 0.2% in September, while producer prices were flat.

On a yearly basis, producer and import prices plunged 6.8% in September, after a 6.8% drop in August. It was the biggest drop since April 1950.

The Import Price Index fell by 11.2% year-on year in September, while producer prices dropped 4.8%.

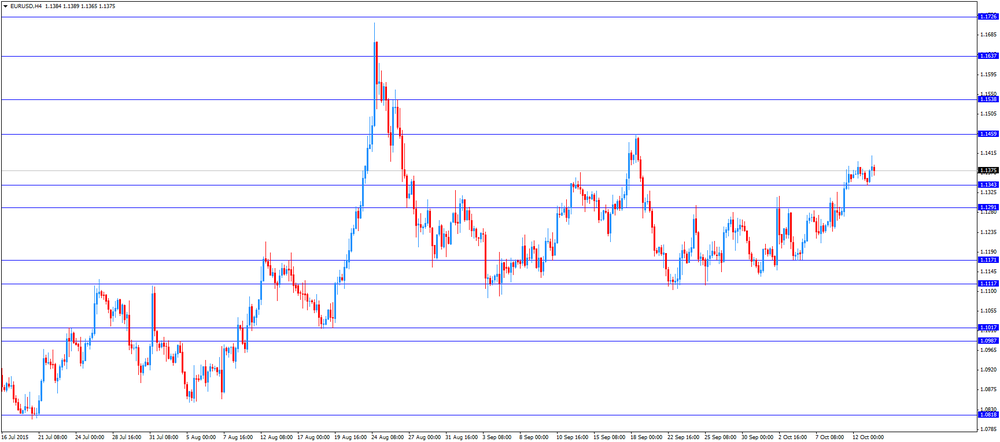

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5199

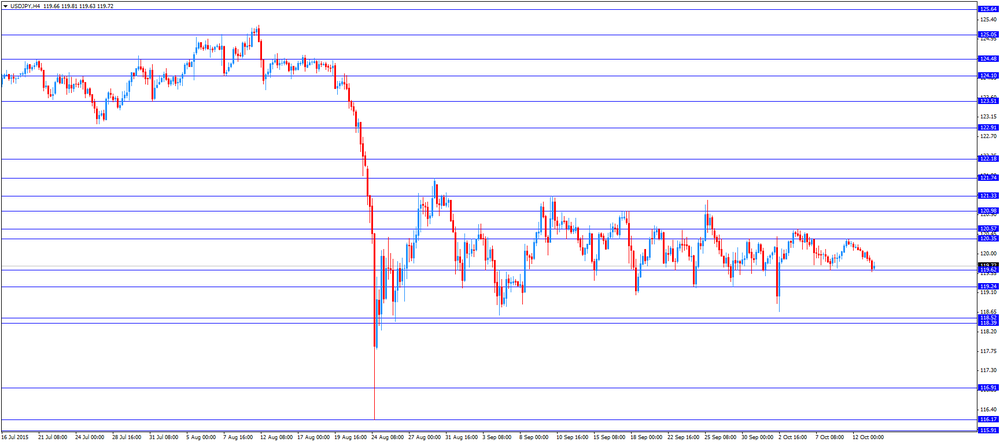

USD/JPY: the currency pair declined to Y119.59

The most important news that are expected (GMT0):

18:00 U.S. Federal budget September -64.4 95

23:30 Australia Westpac Consumer Confidence October -5.6% 3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.