- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the yen climbed

Foreign exchange market. Asian session: the yen climbed

The U.S. dollar declined against the euro amid mixed domestic data and speeches of several Fed officials. US Bureau of Economic analysis reported that personal spending rose by 0.4% in August compared to the previous month. Meanwhile personal income rose by 0.3% in August. Economists expected a 0.3% rise in spending and a 0.4% rise in income.

Meanwhile FOMC Member Dudley said on Monday that the central bank is likely to raise rates later this year.

The Australian dollar fell amid concerns over China's economy and declines in Chinese stocks. Investors' pessimism is related to signs of weaker activity in the country's manufacturing sector. Data have also shown that in the first eight month of the current year total revenues of large Chinese manufacturers fell by 1.9% to $592 billion compared to the same period last year. China is Australia's biggest trading partner and news on China affects the Australian dollar.

The yen rose against the U.S. dollar due to higher demand for safe-haven assets amid declines in stocks worldwide. Stocks in Tokyo have fallen below 17,000 for the first time since January 19.

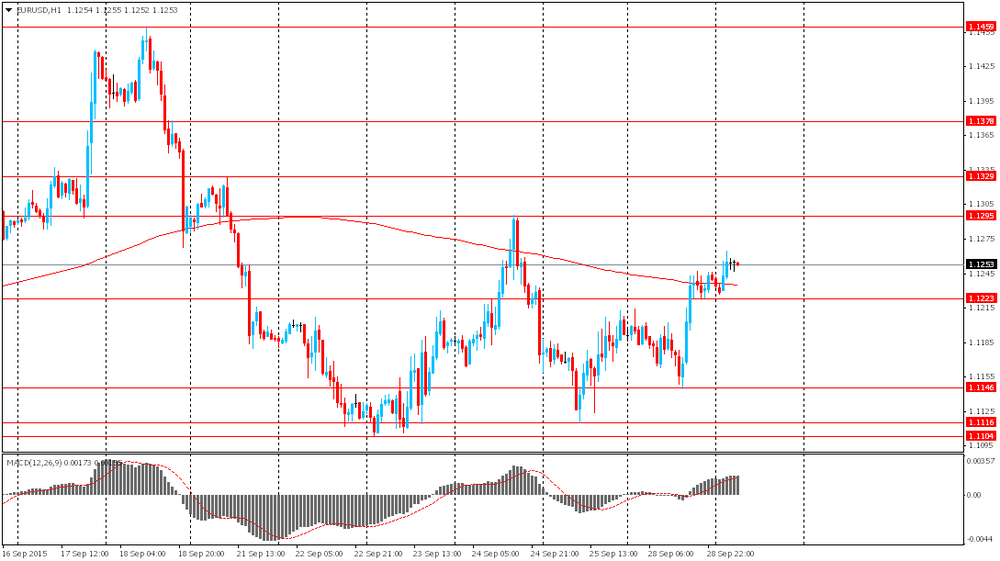

EUR/USD: the pair rose to $1.1265 in Asian trade

USD/JPY: the pair fell to Y119.45

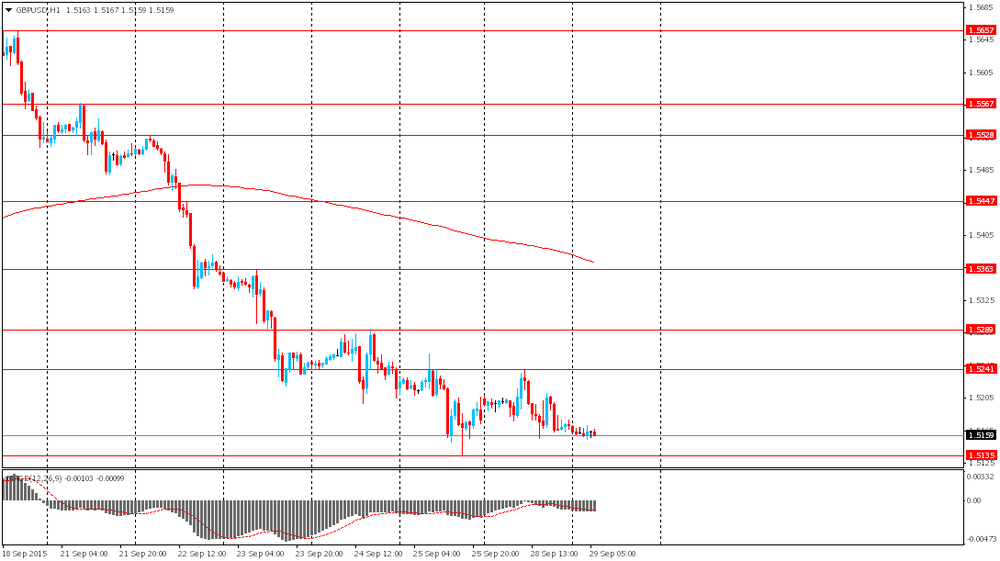

GBP/USD: the pair traded within $1.5155-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Consumer credit, mln August 1173 1200

08:30 United Kingdom Mortgage Approvals August 68.76 70

08:30 United Kingdom Net Lending to Individuals, bln August 3.9 4.1

09:00 Eurozone Economic sentiment index September 104.2 104.1

09:00 Eurozone Consumer Confidence (Finally) September -6.9 -7.1

09:00 Eurozone Business climate indicator September 0.21 0.20

09:00 Eurozone Industrial confidence September -3.7 -3.8

12:00 Germany CPI, m/m (Preliminary) September 0.0% -0.1%

12:00 Germany CPI, y/y (Preliminary) September 0.2% 0.1%

12:30 Canada Industrial Product Price Index, m/m August 0.7% -0.4%

12:30 Canada Industrial Product Price Index, y/y August 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y July 5.0% 5.2%

14:00 U.S. Consumer confidence September 101.5 96.1

19:40 United Kingdom BOE Gov Mark Carney Speaks

20:30 U.S. API Crude Oil Inventories September -3.7

21:45 New Zealand Building Permits, m/m August 20.4%

23:50 Japan Industrial Production (MoM) (Preliminary) August -0.8% 1%

23:50 Japan Industrial Production (YoY) (Preliminary) August 0.0%

23:50 Japan Retail sales, y/y August 1.6% 1.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.