- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the euro remained under pressure

Foreign exchange market. Asian session: the euro remained under pressure

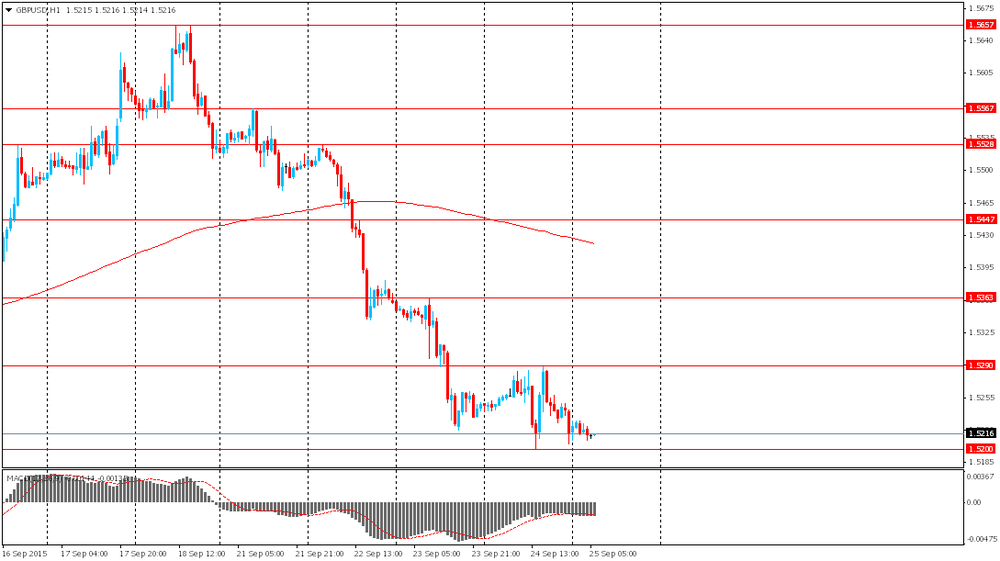

The euro remained under pressure after Fed Chair Yellen's speech boosted the U.S. dollar. Janet Yellen said yesterday that the central bank would raise rates by the end of the year and noted that inflationary pressures are likely to grow in the coming years. Nevertheless she said that the decision had not been made yet and it depends on the labor market and price stability.

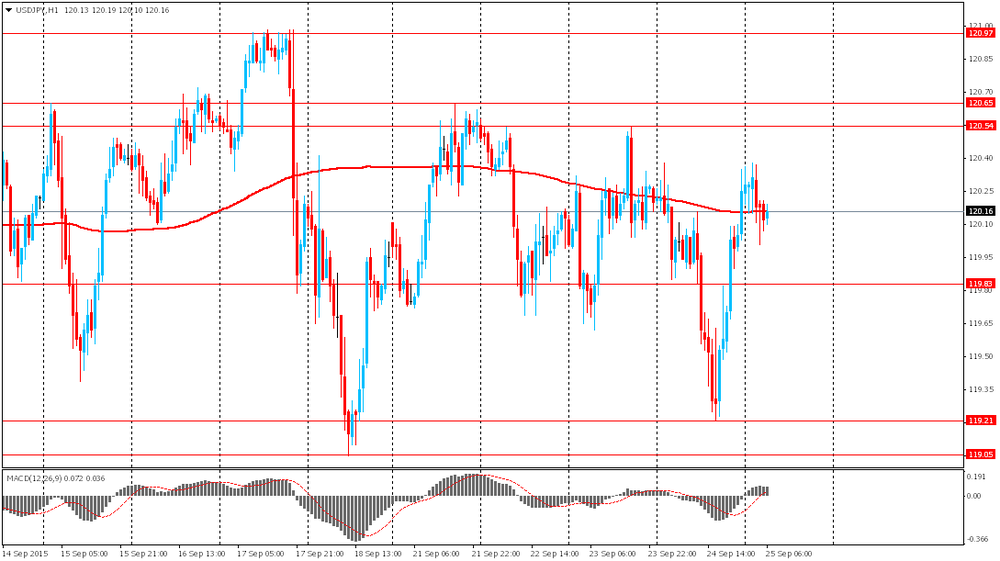

The yen had a mixed session. On one hand it was weighed by inflation data. The core consumer price index fell by 0.1% in August compared to the same period last year. The index has fallen for the first time since 2013. On the other hand the yen was supported by speeches of Japan economy minister and Bank of Japan Governor. Both officials said that GDP growth trend was intact and that the core CPI fell because of low energy costs. Excluding energy the index rose by 1.1%.

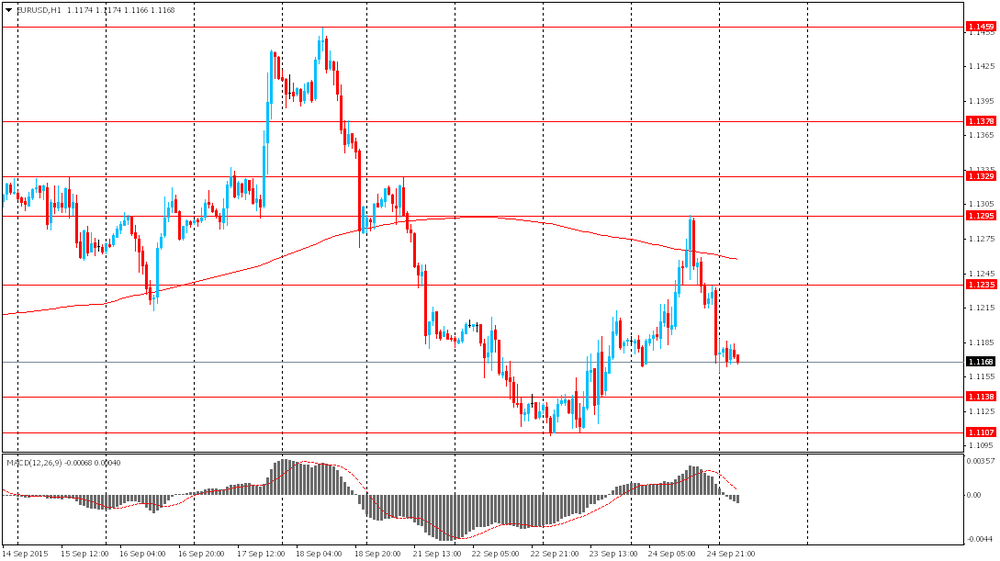

EUR/USD: the pair slid to $1.1165 in Asian trade

USD/JPY: the pair is currently at Y120.34

GBP/USD: the pair is currently at $1.5225

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence September 93 94

07:00 Eurozone ECB's Jens Weidmann Speaks

08:00 Eurozone Private Loans, Y/Y August 0.9% 1.1%

08:00 Eurozone M3 money supply, adjusted y/y August 5.3% 5.3%

12:30 U.S. GDP, q/q (Finally) Quarter II 0.6% 3.7%

13:45 U.S. Services PMI (Preliminary) September 56.1 55.6

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 91.9 86.7

16:30 Eurozone ECB's Jens Weidmann Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.