- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive economic data from Germany

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) September 51.7 50.9

04:30 Japan All Industry Activity Index, m/m July 0.5% Revised From 0.3% 0.2%

06:00 Germany Gfk Consumer Confidence Survey October 9.9 9.8 9.6

08:00 Germany IFO - Current Assessment September 114.8 114.7 114

08:00 Germany IFO - Expectations September 102.2 101.5 103.3

08:00 Germany IFO - Business Climate September 108.4 Revised From 108.3 108 108.5

08:30 United Kingdom BBA Mortgage Approvals August 46.3 Revised From 46.0 46.74

09:15 Eurozone Targeted LTRO 73.8 15.5

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The U.S. durable goods orders are expected to decrease 2.0% in August, after a 2.2% gain in July.

The U.S. durable goods orders excluding transportation are expected to rise 0.1% in August, after a 0.6% gain in July.

The number of initial jobless claims in the U.S. is expected to rise by 7,000 271,000 last week.

New home sales in the U.S. are expected to rise to 515,000 units in August from 507,000 units in July.

The Fed Chairwoman Janet Yellen will speak at 21:00 GMT.

The euro traded higher against the U.S. dollar after the release of the positive economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index rose to 108.4 in September from 108.3 in August, beating expectations for a decline to 108.0.

"The German economy is proving robust. In manufacturing the business climate continued to deteriorate slightly. Manufacturers scaled back their very good assessments of the current business situation, but were nevertheless more optimistic about short-term business developments. More companies plan to ramp up production in the months ahead," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index declined to 114.0 from 114.8. Analysts had expected the index to fell to 114.7.

The Ifo expectations index rose to 103.3 from 102.2. Analysts had expected the index to decrease to 101.5.

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 104 in September from 103 in August. It was the highest level since August 2011.

The British pound traded lower against the U.S. dollar despite the positive mortgage approvals data from the U.K. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals increased to 46,743 in August from 46,315 in July. It was the highest reading since February 2014.

"Mortgage borrowing continues to pick up. The August increase is the largest in five years, although borrowing is still some way below pre-crisis levels," the chief economist at the BBA, Richard Woolhouse, said.

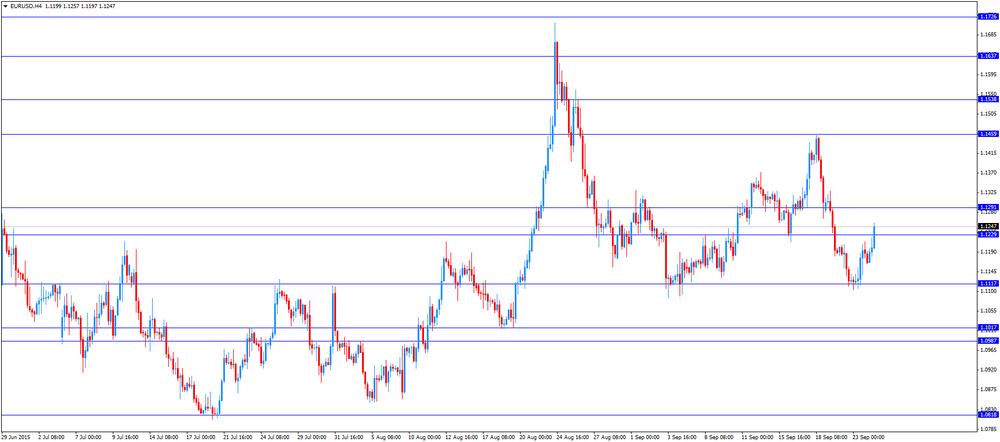

EUR/USD: the currency pair increased to $1.1257

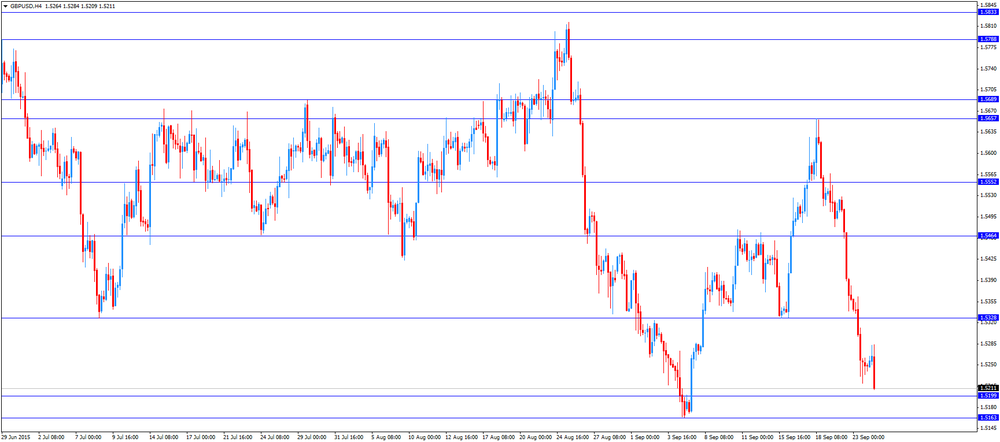

GBP/USD: the currency pair fell to $1.5209

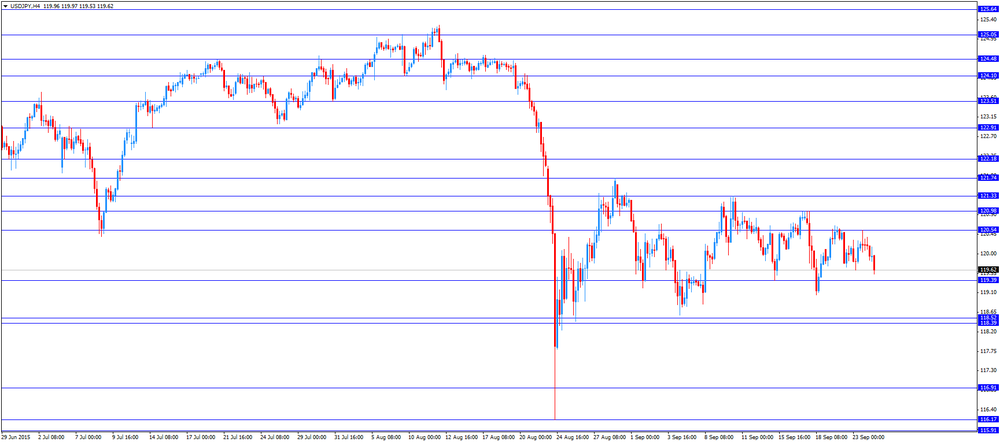

USD/JPY: the currency pair declined to Y119.53

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims September 264 271

12:30 U.S. Durable Goods Orders August 2.2% -2%

12:30 U.S. Durable Goods Orders ex Transportation August 0.6% 0.1%

12:30 U.S. Durable goods orders ex defense 1.0% -1.2%

14:00 U.S. New Home Sales August 507 515

21:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Japan Tokyo Consumer Price Index, y/y September 0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y August 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y August 0.0% -0.1%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.