- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the yen gained after BOJ meeting

Foreign exchange market. Asian session: the yen gained after BOJ meeting

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.6%

01:30 Australia New Motor Vehicle Sales (YoY) August 3.7% 2.1%

01:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0% 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

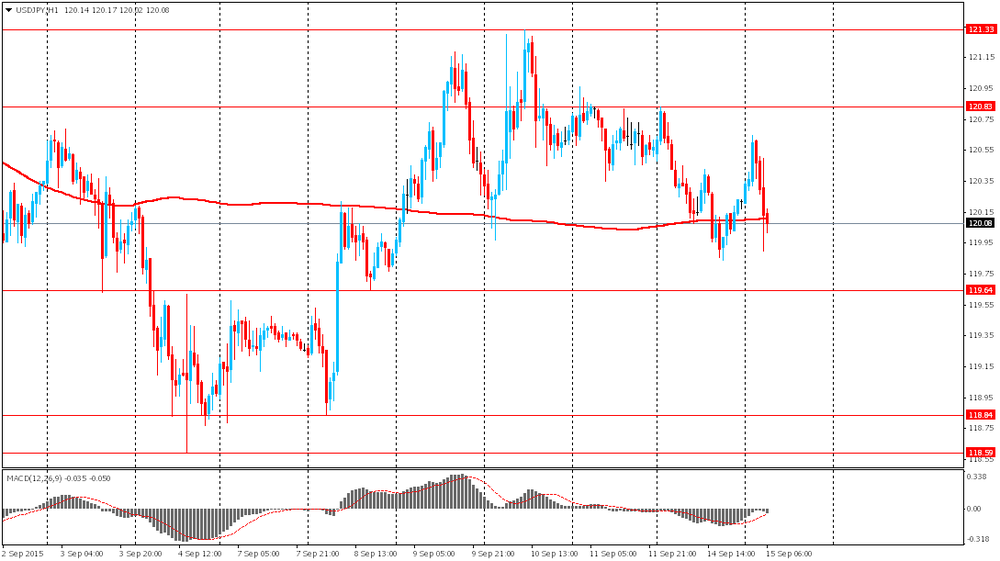

The yen advanced against the U.S. dollar after the Bank of Japan voted 8-1 to keep monetary base growth at annual pace of 80 trillion yen. Traditionally BOJ Board member Kiuchi was against the majority's decision. The central bank cut assessment of overseas economies saying that Japan economy continued to grow moderately. Investors are waiting for BOJ Governor Kuroda conference at 6:30 GMT. If the policymaker does not signal further easing of monetary policy, the yen might continue strengthening.

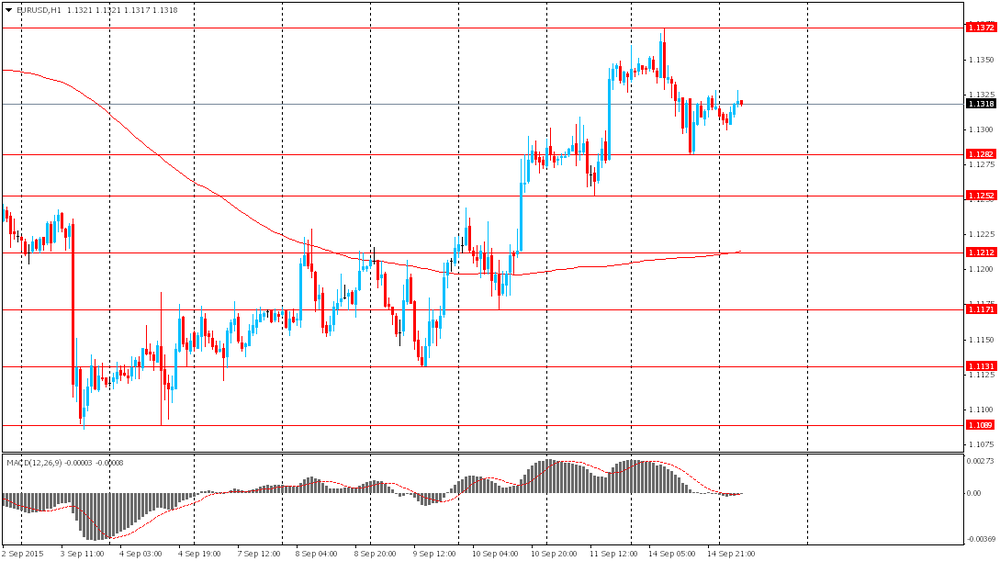

The euro climbed slightly ahead of today's trade balance data and a report on business confidence from the ZEW. The data are expected to be favorable.

Meanwhile the pound was flat ahead of inflation data. A median forecast suggests that the consumer price index rose by 0.2% in August compared to -0.2% in July.

Federal Open Market Committee meeting will be this week's key event. A survey by the Wall Street Journal showed that approximately 46% of the economists surveyed last week expect the Fed to raise rates in September. 35% of economists said the Fed would raise rates in December and 9.5% said they expect a liftoff in 2016.

EUR/USD: the pair fluctuated within $1.1300-25 in Asian trade

USD/JPY: the pair fell to Y119.90

GBP/USD: the pair traded within $1.5415-30

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:30 Japan BOJ Press Conference

06:45 France CPI, m/m August -0.4%

06:45 France CPI, y/y August 0.2%

08:30 United Kingdom Producer Price Index - Input (MoM) August -0.9% -2.4%

08:30 United Kingdom Producer Price Index - Input (YoY) August -12.4% -13.7%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) August -1.6% -1.7%

08:30 United Kingdom Retail Price Index, m/m August -0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y August 1% 0.9%

08:30 United Kingdom HICP, m/m August -0.2% 0.2%

08:30 United Kingdom HICP, Y/Y August 0.1% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y August 1.2%

09:00 Eurozone Employment Change Quarter II 0.1%

09:00 Eurozone Trade balance unadjusted July 26.4

09:00 Eurozone ZEW Economic Sentiment September 47.6

09:00 Germany ZEW Survey - Economic Sentiment September 25 18.4

12:30 U.S. NY Fed Empire State manufacturing index September -14.92 -0.75

12:30 U.S. Retail sales August 0.6% 0.3%

12:30 U.S. Retail sales excluding auto September 0.4% 0.2%

13:15 U.S. Capacity Utilization August 78% 77.8%

13:15 U.S. Industrial Production (MoM) August 0.6% -0.2%

13:15 U.S. Industrial Production YoY August 1.3%

14:00 U.S. Business inventories July 0.8% 0.1%

20:30 U.S. API Crude Oil Inventories September 2.1

22:45 New Zealand Current Account Quarter II 660 -1500

23:30 Australia RBA Assist Gov Debelle Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.