- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the euro edged up

Foreign exchange market. Asian session: the euro edged up

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Japan Labor Cash Earnings, YoY July -2.5% Revised From -2.4% 0.6%

06:00 Germany Factory Orders s.a. (MoM) July 2.0% -0.6% -1.4%

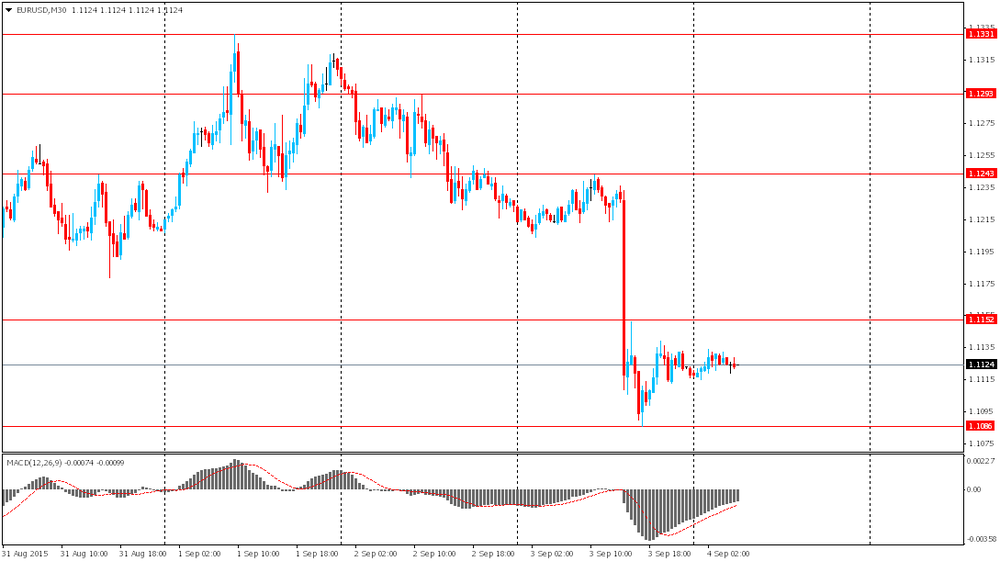

The euro advanced slightly against the U.S. dollar after yesterday's decline amid revised forecasts from the European Central Bank. The ECB cut its economic growth and inflation forecasts and signaled that its quantitative easing program might be extended. However market focus shifted back to U.S. jobs data.

A key event today is a closely watched U.S. employment report. Strong data would raise probability of a rate hike by the Federal Reserve this month. If this happens the greenback can rise sharply at first and retreat later amid considerations that the next rates increase would not happen soon. According to a median forecast, the U.S. economy generated 220,000 jobs in August compared to +215,000 in July.

The yen gained. Labor cash earnings data have been published today. Japanese wages rose by 0.6% in July missing expectations for a 2.1% rise. Higher earnings suggest consumption growth, that's why an uptrend in wages is an inflationary factor for Japan.

EUR/USD: the pair fluctuated within $1.1115-35 in Asian trade

USD/JPY: the pair fell to Y119.10

GBP/USD: the pair fell to $1.5225

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence August 93 94

07:15 Switzerland Consumer Price Index (MoM) August -0.6% -0.2%

07:15 Switzerland Consumer Price Index (YoY) August -1.3% -1.4%

09:00 G20 G20 Meetings

09:00 Eurozone GDP (QoQ) (Revised) Quarter II 0.4% 0.3%

09:00 Eurozone GDP (YoY) (Revised) Quarter II 1.0% 1.2%

12:10 U.S. FOMC Member Laсker Speaks

12:30 Canada Unemployment rate August 6.8% 6.8%

12:30 Canada Employment August 6.6 -4.5

12:30 U.S. Average workweek August 34.6 34.5

12:30 U.S. Average hourly earnings August 0.2% 0.2%

12:30 U.S. Unemployment Rate August 5.3% 5.2%

12:30 U.S. Nonfarm Payrolls 215 220

14:00 Canada Ivey Purchasing Managers Index August 52.9 52

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.