- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mostly positive economic data from the Eurozone

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mostly positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) August 47.8 47.7 47.1

06:00 Germany Gfk Consumer Confidence Survey September 10.1 10.1 9.9

07:00 France Services PMI (Preliminary) August 52 52 51.8

07:00 France Manufacturing PMI (Preliminary) August 49.6 49.7 48.6

07:30 Germany Services PMI (Preliminary) August 53.8 53.9 53.6

07:30 Germany Manufacturing PMI (Preliminary) August 51.8 51.7 53.2

08:00 Eurozone Manufacturing PMI (Preliminary) August 52.4 52.2 52.4

08:00 Eurozone Services PMI (Preliminary) August 54 54 54.3

08:30 United Kingdom PSNB, bln July 8.64 Revised From 8.58 -2.4 -2.07

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to rise to 54.0 in August from 53.8 in July.

Concerns over a slowdown in the Chinese economy weighed on the greenback. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

The euro traded mixed against the U.S. dollar after the mostly positive economic data from the Eurozone. Eurozone's preliminary manufacturing PMI remained unchanged at 52.4 in August. Analysts had expected index to decline to 52.2.

Eurozone's preliminary services PMI rose to 54.3 in August from 54.0 in July. Analysts had expected the index to remain unchanged at 54.0.

Markit's Senior Economist Rob Dobson said that Eurozone's economy "is still experiencing one of its best periods of economic growth and job creation during the past four years".

"GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout," he added.

Germany's preliminary manufacturing PMI climbed to 53.2 in August from 51.8 in July, exceeding forecasts of a decline to 51.7.

Germany's preliminary services PMI was down to 53.6 in August from 53.8 in July. Analysts had expected index to climb to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by higher output and new orders.

"Based on PMI data available for the third quarter so far, we should expect German GDP to increase at a similar rate to the 0.4% seen in the three months to June," he noted.

France's preliminary manufacturing PMI dropped to 48.6 in August from 49.6 in July, missing forecasts of a rise to 49.7.

France's preliminary services PMI fell to 51.8 in August from 52.0 in July. Analysts had expected the index to remain unchanged at 52.0.

"Output growth in France's private sector economy cooled to a four-month low in August, suggesting that third-quarter GDP may disappoint again following stagnation in Q2. An improvement in service providers' business expectations to a near three-and-a-half year high provided some rare positive news, but manufacturing continued to struggle amid a sharper drop in new orders," the Senior Economist at Markit Jack Kennedy said.

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections. He is seeking a mandate to implement reforms.

The election is expected to be held on September 20.

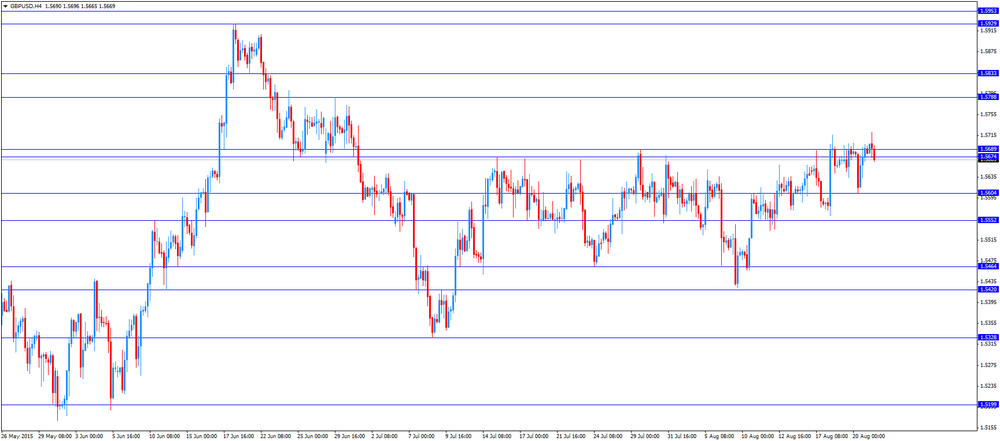

The British pound traded lower against the U.S. dollar. The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. declined to -£2.07 billion in July from £8.64 billion in June, beating expectations for a drop to -£2.4 billion. June's figure was revised up from £8.58 billion.

Public sector net borrowing excluding public sector banks fell by £1.4 billion to a surplus of £1.29 billion.

The increase was driven by the tax receipts.

The Canadian dollar traded mixed against the U.S. dollar ahead the release of the Canadian economic data. The consumer price index in Canada is expected to rise to 1.4% in July from 1.0% in June.

The core consumer price index in Canada is expected to climb to 2.4% in July from 2.3% in June.

Canadian retail sales are expected to increase 0.2% in June, after a 1.0% rise in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5665

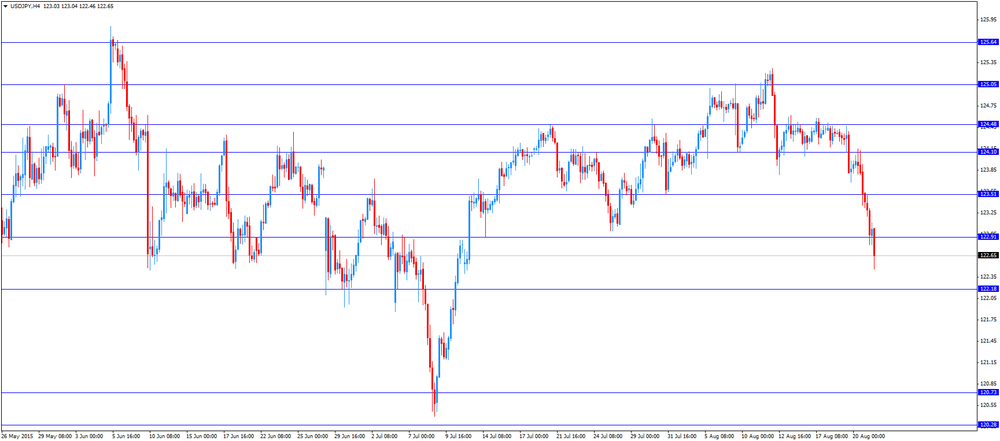

USD/JPY: the currency pair fell to Y122.46

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m June 1.0% 0.2%

12:30 Canada Retail Sales YoY June 2.7%

12:30 Canada Retail Sales ex Autos, m/m June 0.9% 0.5%

12:30 Canada Consumer Price Index m / m July 0.2% 0.1%

12:30 Canada Consumer price index, y/y July 1% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July 2.3% 2.4%

13:45 U.S. Manufacturing PMI (Preliminary) August 53.8 54

14:00 Eurozone Consumer Confidence (Preliminary) August -7.1 -6.9

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.