- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the U.S. dollar strengthened

Foreign exchange market. Asian session: the U.S. dollar strengthened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Westpac Consumer Confidence August -3.2% 7.8%

01:30 Australia Wage Price Index, y/y Quarter II 2.3% 2.3% 2.3%

01:30 Australia Wage Price Index, q/q Quarter II 0.5% 0.6% 0.6%

04:30 Japan Industrial Production (YoY) (Finally) June -3.9% 2.0%

04:30 Japan Industrial Production (MoM) (Finally) June -2.1% 0.8% 0.8%

05:30 China Industrial Production y/y July 6.8% 6.6% 6.0%

05:30 China Retail Sales y/y July 10.6% 10.6% 10.5%

05:30 China Fixed Asset Investment June 11.4% 11.5% 11.2%

The U.S. dollar advanced against major currencies after the People's Bank of China unexpectedly conducted 1.9% yuan devaluation.

Investors intensified purchases of the dollar as they seem to be convinced that the U.S. economy is strong enough for the Federal Reserve to raise interest rates for the first time in nearly a decade. Higher rates would make the U.S. dollar more attractive for investors seeking higher yields.

Yuan devaluation weighed on the Australian and New Zealand dollars. The Kiwi fell to a six-year low against the greenback. The unexpected move by the PBOC outweighed favorable data on the Australian economy. Westpac reported that the index of confidence of Australian consumers rose by 7.8% to 99.5 in August, although it remained below the 100 threshold, which separates pessimism from optimism.

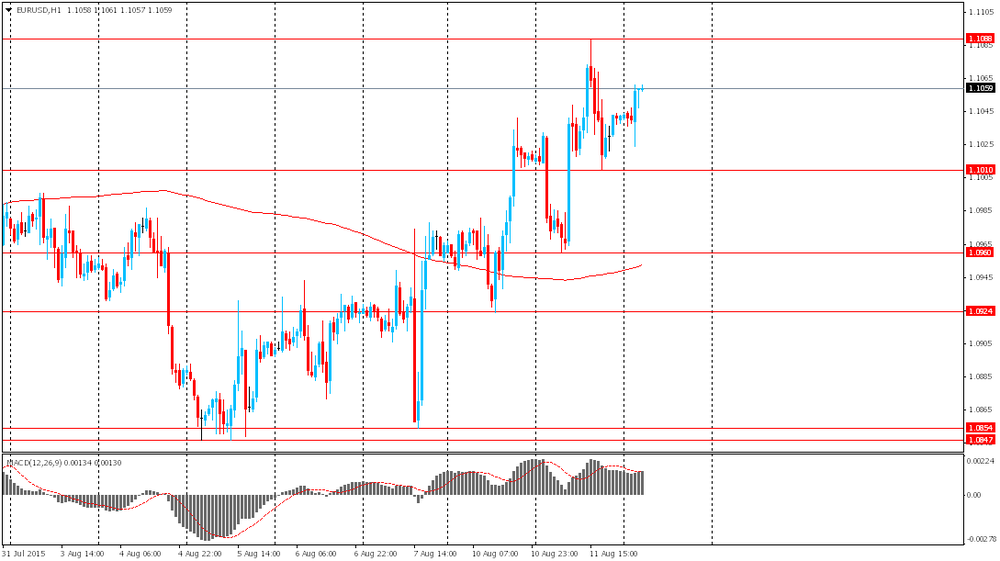

EUR/USD: the pair fluctuated within $1.1025-60 in Asian trade

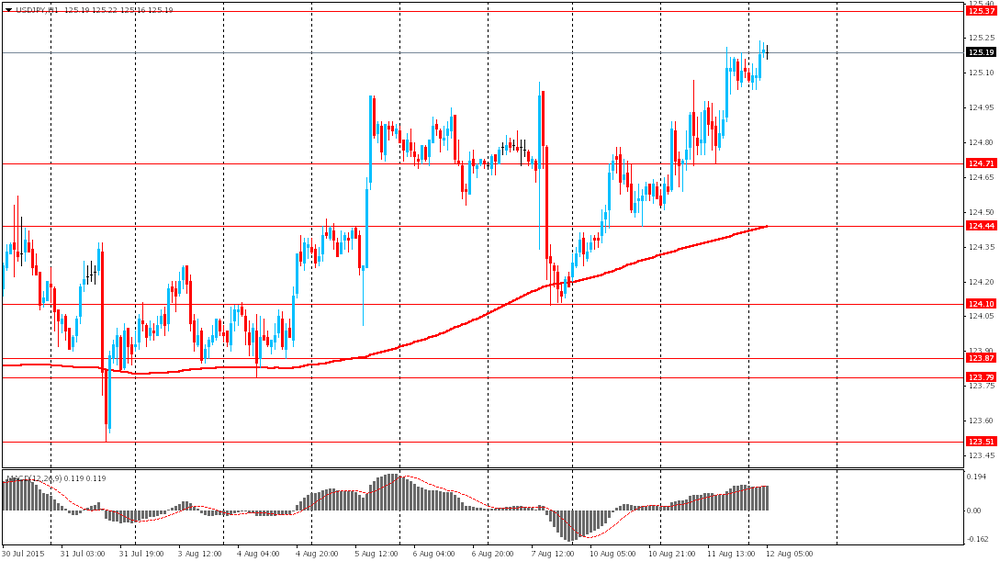

USD/JPY: the pair rose to Y125.25

GBP/USD: the pair declined to $1.5535

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.8% 2.8%

08:30 United Kingdom Average Earnings, 3m/y June 3.2% 2.8%

08:30 United Kingdom ILO Unemployment Rate June 5.6% 5.6%

08:30 United Kingdom Claimant count July 7 1.5

09:00 Eurozone Industrial production, (MoM) June -0.4% -0.2%

09:00 Eurozone Industrial Production (YoY) June 1.6% 1.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August -5.4

10:00 Australia RBA Assist Gov Lowe Speaks

11:00 U.S. MBA Mortgage Applications August 4.7%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. JOLTs Job Openings June 5.363 5.3

14:30 U.S. Crude Oil Inventories August -4.407 -2.0

18:00 U.S. Federal budget July 51.8 -132

22:30 New Zealand Business NZ PMI July 55.2

23:50 Japan Core Machinery Orders June 0.6% -5.6%

23:50 Japan Core Machinery Orders, y/y June 19.3% 16.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.