- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the euro steady ahead of payrolls data

Foreign exchange market. Asian session: the euro steady ahead of payrolls data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Home Loans June -7.3% Revised From -6.1% 5% 4.4%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Monetary Policy Statement

05:45 Switzerland Unemployment Rate (non s.a.) July 3.1% 3.1%

06:00 Germany Current Account June 11.8 Revised From 11.1 24.4

06:00 Germany Trade Balance June 19.6 24.0

The euro traded in a narrow range ahead of today's U.S. payrolls data. Investors expect a strong report, which could move expectations for a rate increase to an earlier date. Median forecast suggests 223,000 new jobs. Earlier ADP data missed expectations, but correlation between these two reports is low. That's why today's report still may raise probability of a rate hike in September.

The yen showed little reaction to the Bank of Japan decision to keep its monetary policy unchanged. The BOJ has also reiterated that the economy continued recovering at a moderate pace.

The Australian dollar advanced amid Reserve Bank of Australia statements and housing market data. The RBA cut its unemployment and GDP forecasts. GDP growth is likely to decline to 2.5%-3.5% by the end of the current year from 2.75%-3.75%. The RBA also said that accommodative monetary policy remained appropriate and signs that a weaker AUD supported the economy intensified. Meanwhile the Australian Bureau of Statistics reported that home loans rose by 4.4% in June from -7.3% (revised from -6.1%) reported previously.

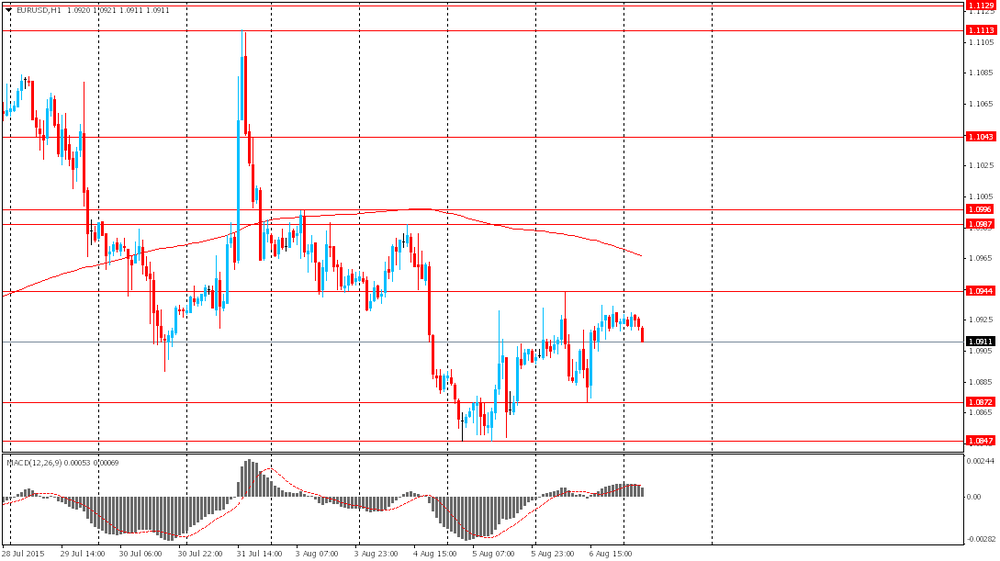

EUR/USD: the pair declined to $1.0910 in Asian trade

USD/JPY: the pair traded Y124.65-85

GBP/USD: the pair traded within $1.5495-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:00 Germany Industrial Production s.a. (MoM) June 0.0% 0.3%

06:00 Germany Industrial Production (YoY) June 2.1%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln June -4.0

06:45 France Industrial Production, m/m June 0.4% 0.2%

06:45 France Industrial Production, y/y June 1.6%

07:00 United Kingdom Halifax house price index July 1.7%

07:00 United Kingdom Halifax house price index 3m Y/Y July 9.6%

08:30 United Kingdom Total Trade Balance June -0.393

12:30 Canada Building Permits (MoM) June -14.5% 5%

12:30 Canada Unemployment rate July 6.8% 6.8%

12:30 Canada Employment July -6.4 5

12:30 U.S. Average workweek July 34.5 34.5

12:30 U.S. Average hourly earnings July 0.0% 0.2%

12:30 U.S. Nonfarm Payrolls 223 223

12:30 U.S. Unemployment Rate July 5.3% 5.3%

14:00 Canada Ivey Purchasing Managers Index July 55.9 52

19:00 U.S. Consumer Credit June 16.09 17

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.