- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weak producer price index from the Eurozone

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weak producer price index from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M June 0.4% Revised From 0.3% 0.5% 0.7%

01:30 Australia Trade Balance June -2.68 Revised From -2.75 -3.1 -2.93

01:30 Japan Labor Cash Earnings, YoY June 0.7% Revised From 0.6% -2.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index July -0.2% 0.4% 0.4%

06:00 United Kingdom Nationwide house price index, y/y July 3.3% 3.5% 3.5%

08:30 United Kingdom PMI Construction July 58.1 58.4 57.1

09:00 Eurozone Producer Price Index, MoM June 0% 0% -0.1%

09:00 Eurozone Producer Price Index (YoY) June -2% -2.2% -2.2%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. factory orders data. The U.S. factory orders are expected to increase 1.8% in June, after a 1.0 drop in May.

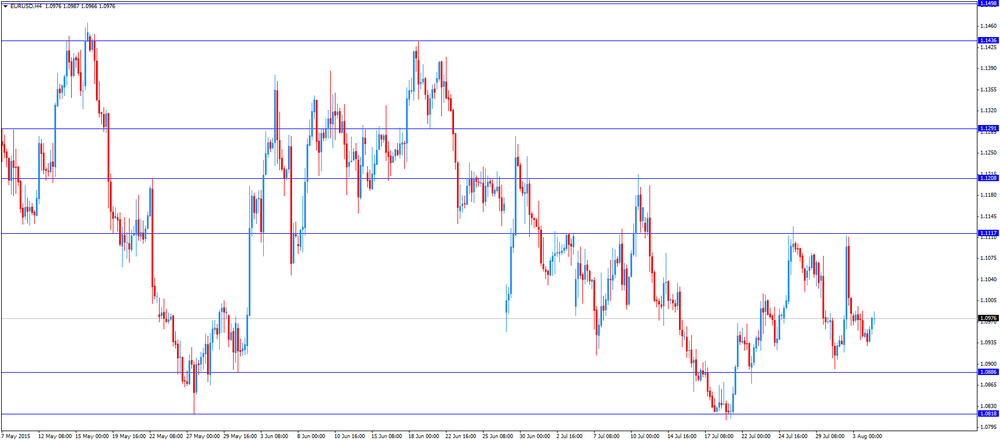

The euro traded higher against the U.S. dollar despite the weak producer price index from the Eurozone. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

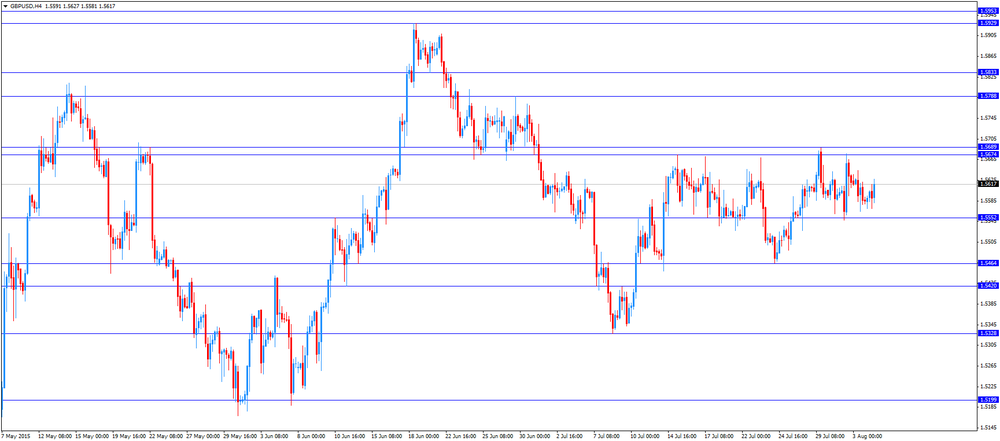

The British pound traded higher against the U.S. dollar despite the weaker-than-expected the construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

The Nationwide Building Society released its house prices data for the U.K. on Tuesday. UK house prices rose 0.4% in July, in line with expectations, after a 0.2% decline in June.

On a yearly basis, house prices increased to 3.5% in July from 3.3% in June, in line with expectations.

"The outlook on the demand side remains encouraging. Employment growth has remained relatively robust in recent quarters, and, after a prolonged period of subdued growth, wage growth is also edging up. With consumer confidence buoyant and mortgage rates still close to all-time lows, demand for housing is likely to firm up in the quarters ahead," Nationwide's chief economist, Robert Gardner, said.

EUR/USD: the currency pair increased to $1.0987

GBP/USD: the currency pair rose to $1.5627

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Factory Orders June -1% 1.8%

22:45 New Zealand Unemployment Rate Quarter II 5.8% 5.9%

22:45 New Zealand Employment Change, q/q Quarter II 0.7% 0.5%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.