- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: Australian and New Zealand dollars are under pressure

Foreign exchange market. Asian session: Australian and New Zealand dollars are under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia MI Inflation Gauge, m/m July 0.1% 0.2%

01:00 Australia HIA New Home Sales, m/m June -2.3% 0.5%

01:30 Australia ANZ Job Advertisements (MoM) July 1.3% -0.4%

01:35 Japan Manufacturing PMI (Finally) July 50.1 51.4 51.2

01:45 China Markit/Caixin Manufacturing PMI (Finally) July 49.4 48.2 47.8

Volatility of the U.S. dollar was low after its short-term fall on Friday, which was caused by weak wages data (only +0.2% in the second quarter vs +0.6% expected). This report made investors think that the anticipated rate increase might be postponed. The Federal Reserve monitors wage data. An acceleration of wage growth would signal that the labor market improved. However the latest slowdown points to the market's weakness.

On Friday data from the euro area showed that inflation rose by 0.2% in July confirming that it left the negative territory. However the unemployment level remained at 11.1% for the third straight month. For some economists these data signal that the European Central Bank will have to continue quantitative easing to help inflation reach the target level of just under 2%.

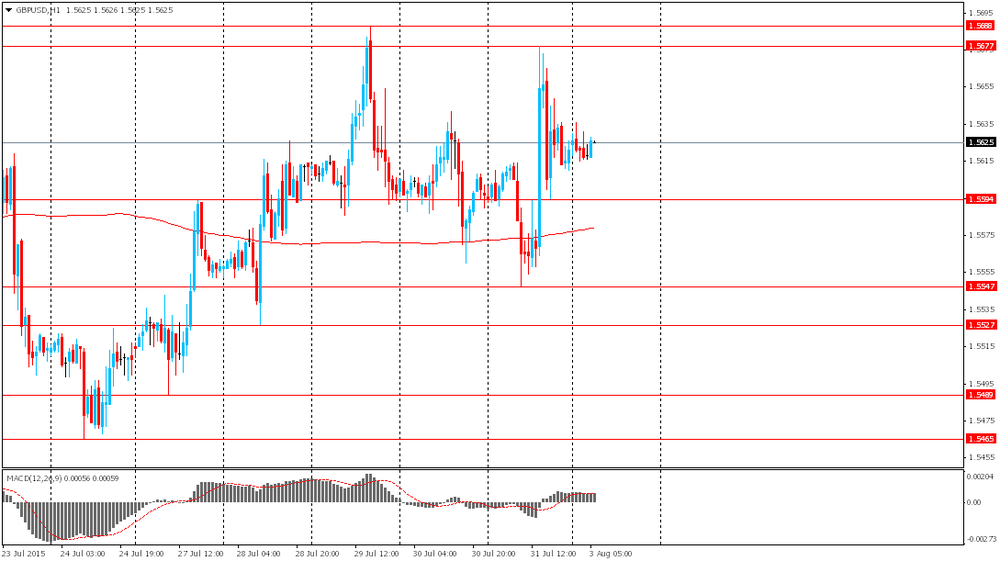

The sterling little changed. Investors are waiting for Bank of England meeting, which will be held this Thursday. This will be the first time the BOE announces its interest rate decision, publishes minutes of its meeting and updated forecasts on the UK economy on the same day.

AUD and NZD declined after official data showed that China Manufacturing PMI posted 50.0 in July, while analysts expected a 50.2 reading. Only a reading above 50 suggests expansion, while the 50 threshold itself still points to contraction.

EUR/USD: the pair fluctuated around $1.0965-90 in Asian trade

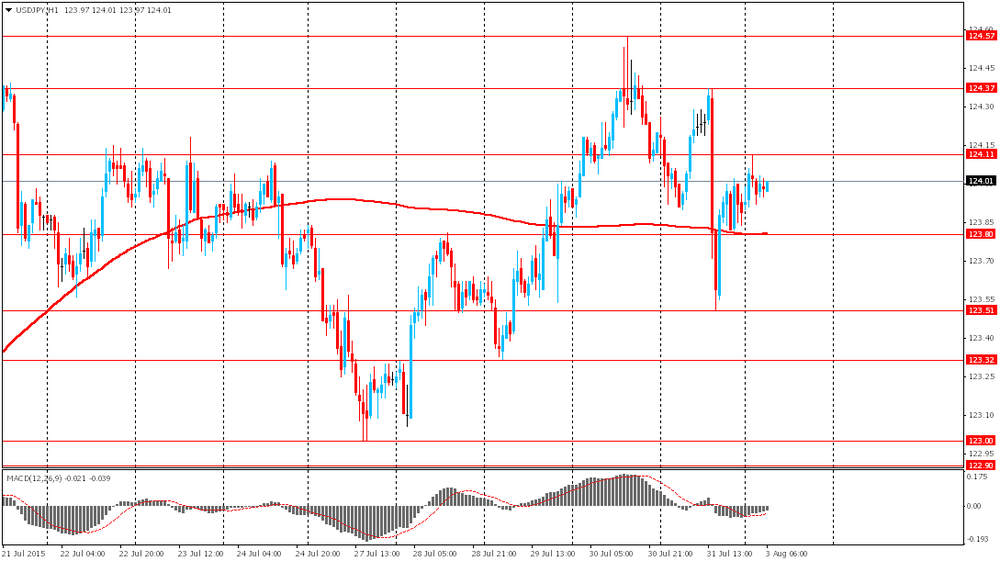

USD/JPY: the pair traded around Y123.90-10

GBP/USD: the pair traded around $1.5615-35-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:30 Switzerland Manufacturing PMI July 50 50.7

07:50 France Manufacturing PMI (Finally) July 50.7 49.6

07:55 Germany Manufacturing PMI (Finally) July 51.9 51.5

08:00 Eurozone Manufacturing PMI (Finally) July 52.5 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing July 51.4 51.6

12:30 U.S. Personal spending June 0.9% 0.2%

12:30 U.S. Personal Income, m/m June 0.5% 0.4%

12:30 U.S. PCE price index ex food, energy, m/m June 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y June 1.2%

13:45 U.S. Manufacturing PMI (Finally) July 53.6 53.8

14:00 U.S. Construction Spending, m/m June 0.8% 0.6%

14:00 U.S. ISM Manufacturing July 53.5 53.6

20:00 U.S. Total Vehicle Sales, mln July 17.2 17.2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.