- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the euro remains under pressure

Foreign exchange market. Asian session: the euro remains under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 Australia Conference Board Australia Leading Index May -0.3% 0.2%

The euro remained under pressure despite positive news from Athens. Yesterday EU finance ministers agreed to provide Greece with financial aid in the coming three years. The final decision will be made today. Improvements in political and financial situations boost demand for European stocks and undermine the single currency.

The Australian dollar little changed although the Conference Board released some favorable data. Australia leading index rose by 0.2% in May compared to -0.3% reported previously. Five out seven components of the index contributed in a positive way (sales to inventories ratio, rural goods exports, yield spread, building approvals, and gross operating surplus). Money supply and share prices declined in May.

EUR/USD: the pair climbed to $1.0900 in Asian trade

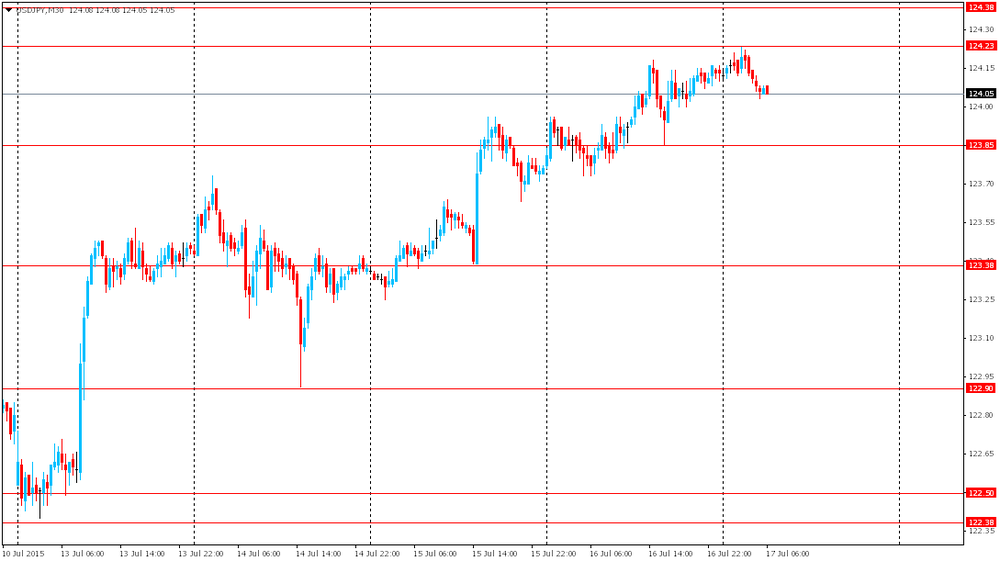

USD/JPY: the pair traded around Y124.10

GBP/USD: the pair advanced to $1.5635

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

14:30 Canada Consumer Price Index m / m June 0.6% 0.2%

14:30 Canada Consumer price index, y/y June 0.9% 1.0%

14:30 Canada Bank of Canada Consumer Price Index Core, y/y June 2.2% 2.2%

14:30 Canada Bank of Canada Consumer Price Index Core, m/m June 0.4%

14:30 U.S. Housing Starts June 1036 1110

14:30 U.S. Building Permits June 1275 1150

14:30 U.S. CPI excluding food and energy, m/m June 0.1% 0.2%

14:30 U.S. CPI, m/m June 0.4% 0.3%

14:30 U.S. CPI, Y/Y June 0.0% 0.1%

14:30 U.S. CPI excluding food and energy, Y/Y June 1.7% 1.8%

16:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 96.1 96.4

16:00 U.S. FED Vice Chairman Stanley Fischer Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.