- Analytics

- News and Tools

- Market News

- Gold declined amid prospects of a rate hike in the U.S.

Gold declined amid prospects of a rate hike in the U.S.

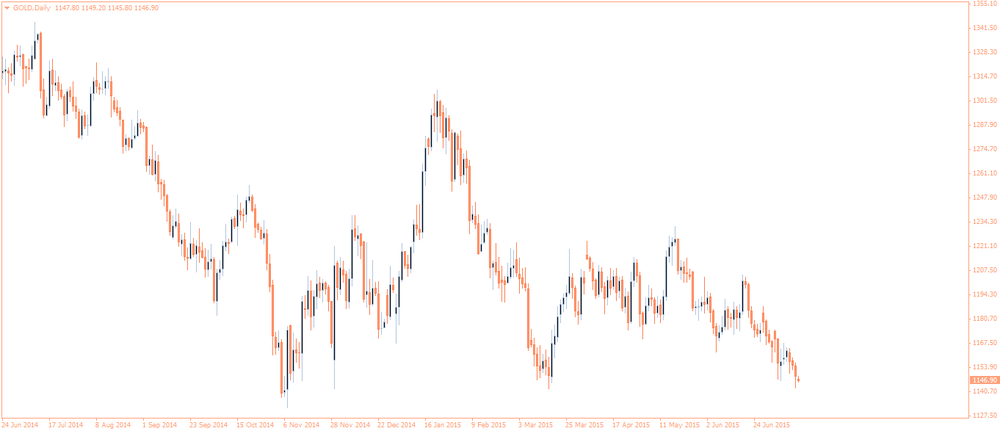

Gold is currently near a four-month low at $1,146.30 (-0.10%) an ounce as the Federal Reserve is preparing to raise its key interest rate from the current level of 0.25% within this year. Yesterday Fed Chair Yellen said that labor markets were expected to steadily improve and turmoil abroad unlikely to harm the U.S. economy.

HSBC analyst James Steel marked that a potential U.S. rate hike had been discussed by market participants as early as 2013, and gold has already fallen on this speculation. "This leads us to conclude that most of gold's declines based on a rate rise have already occurred, and that gold's reaction to the rate hike - whenever it comes - and subsequent hikes, may be muted or short-lived," Steel said.

Physical demand remains sluggish. India's trade ministry reported that imports to this country (second-biggest consumer of gold after China) fell 37% in June compared to a year earlier.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.