- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar ahead of the Greek referendum on Sunday

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar ahead of the Greek referendum on Sunday

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M May -0.1% Revised From 0.0% 0.5% 0.3%

01:45 China HSBC Services PMI June 53.5 51.8

07:50 France Services PMI (Finally) June 52.8 54.1 54.1

07:55 Germany Services PMI (Finally) June 53.0 54.2 53.8

08:00 Eurozone Services PMI (Finally) June 53.8 54.4 54.4

08:30 United Kingdom Purchasing Manager Index Services June 56.5 57.4 58.5

09:00 Eurozone Retail Sales (YoY) May 2.7% Revised From 2.2% 2.3% 2.4%

09:00 Eurozone Retail Sales (MoM) May 0.7% 0.1% 0.2%

12:00 U.S. Bank holiday

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for a public holiday.

The euro traded mixed against the U.S. dollar ahead of the Greek referendum on Sunday. Greek Finance Minister Yanis Varoufakis said on Friday that a deal between Greece and its creditors will be reached regardless of the outcome of Sunday's referendum. He noted that a deal was "more or less done".

The head of the Eurogroup Jeroen Dijsselbloem said on Thursday that if Greeks vote "No" on Sunday, it could mean that Greece have to leave the Eurozone. He added that Greeks should not expect better conditions if they vote "No".

The International Monetary Fund (IMF) said in its report on Thursday that Greece requires €50 billion and easier terms on existing debt from October 2015 to end 2018 to maintain its finances sustainable, including at least €36 billion from Eurozone.

The IMF expects that Athens needs about €29 billion over the next 12 months from October 2015.

The lender downgraded Greece's economic growth forecast for this year to zero from April's estimate of 2.5%

Meanwhile, the economic data from the Eurozone was solid. Retail sales in the Eurozone rose 0.2% in May, exceeding expectations for a 0.1% gain, after a 0.7% increase in April.

The increase was driven by higher food, drinks and tobacco and non-food sales.

On a yearly basis, retail sales in the Eurozone rose 2.4% in May, beating forecasts of a 2.3% gain, after a 2.7% increase in April. April's figure was revised up from a 2.2% rise.

Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in June from 53.8 in May, in line with the preliminary reading.

The increase was driven by rises in new business and employment.

Eurozone's final composite output index increased to 54.2 in June from 53.6 in May, up from the preliminary reading of 54.1. It was the highest level since May 2011.

"Despite the escalation of the Greek crisis in the second half of the month, the final PMI for June came in slightly above the 'flash' estimate, suggesting the turmoil has so far had little discernible impact on the real economy," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 53.8 in June from 53.0 in May, missing the preliminary reading of 54.2.

The increase was driven by rises in new orders and employment.

"June's PMI results signalled a re-acceleration of service sector activity growth in Germany, after May data pointed to the weakest rise in output for five months. Encouragingly, a further increase in staff recruitment highlighted confidence about upcoming workloads despite new business rising at the slowest pace in 2015 so far," an economist at Markit, Oliver Kolodseike,said.

France's final services purchasing managers' index (PMI) climbed to 54.1 in June from 52.8 in May, in line with the preliminary reading. It was the highest reading since August 2011.

The increase was driven by a rise in new business.

"Activity growth picked up pace further in June, rounding off a solid quarter of expansion in French private sector output. The PMI figures suggest that second quarter GDP will show a further robust expansion following the 0.6% rise seen in Q1," Senior Economist at Markit Jack Kennedy said.

The British pound traded higher against the U.S. dollar after the release of the services PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. jumped to 58.5 in June from 56.5 in May, exceeding expectations for a rise to 57.4.

The increase was driven by robust expansion in new work inflows.

"While uncertainty caused by the Greek debt crisis rules out any imminent hike in interest rates, the post-election rebound in service sector business activity adds to the likelihood of the Bank of England starting to nudge rates higher later this year. The survey data are indicating an acceleration of economic growth to 0.5% in the second quarter, up from 0.4% in the first three months of the year," the Chief Economist at Markit Chris Williamson said.

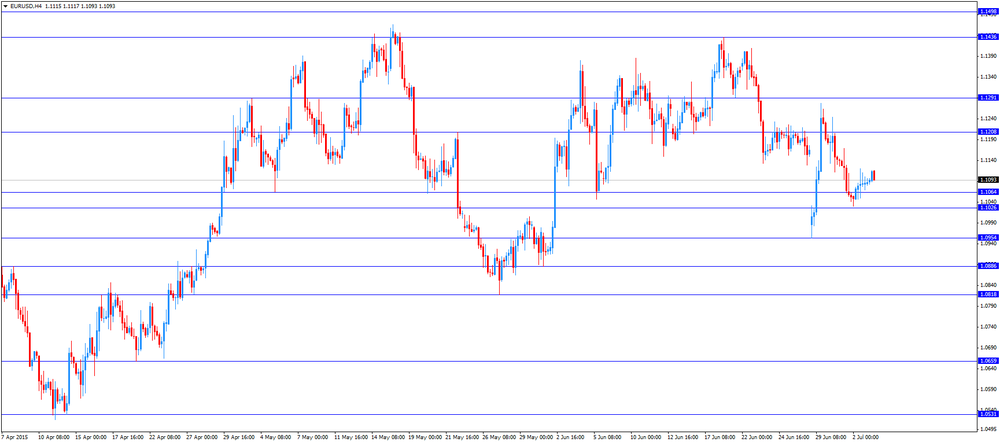

EUR/USD: the currency pair traded mixed

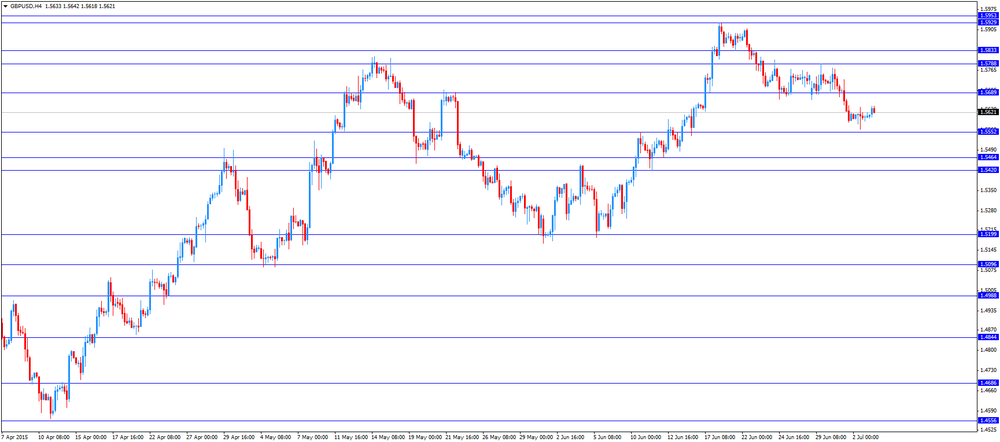

GBP/USD: the currency pair increased to $1.5642

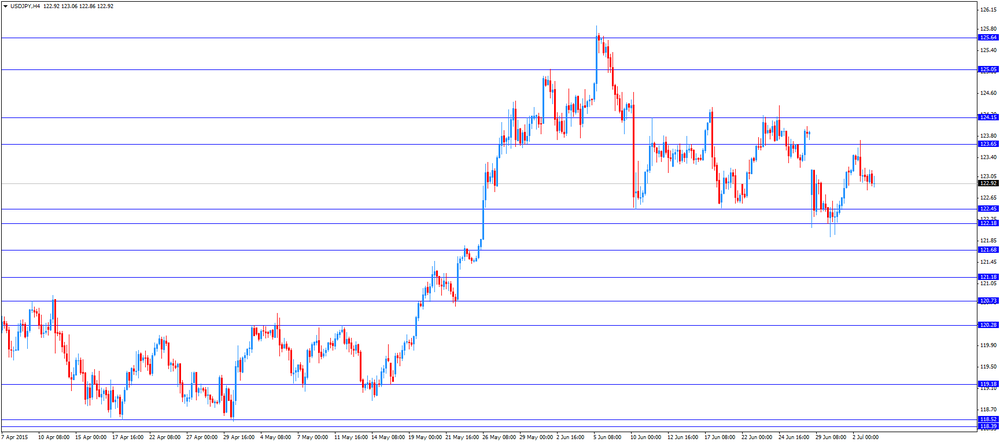

USD/JPY: the currency pair fell to Y122.86

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.