- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the uncertainty over Greece's debt crisis

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the uncertainty over Greece's debt crisis

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trade Balance May -4.13 Revised From -3.89 -2.2 -2.75

06:00 United Kingdom Nationwide house price index, y/y June 4.6% 4.3% 3.3%

06:00 United Kingdom Nationwide house price index June 0.2% Revised From 0.3% 0.5% -0.2%

08:30 United Kingdom PMI Construction June 55.9 56.5 58.1

09:00 Eurozone Producer Price Index, MoM May -0.1% 0.1% 0%

09:00 Eurozone Producer Price Index (YoY) May -2.2% -2.0% -2%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

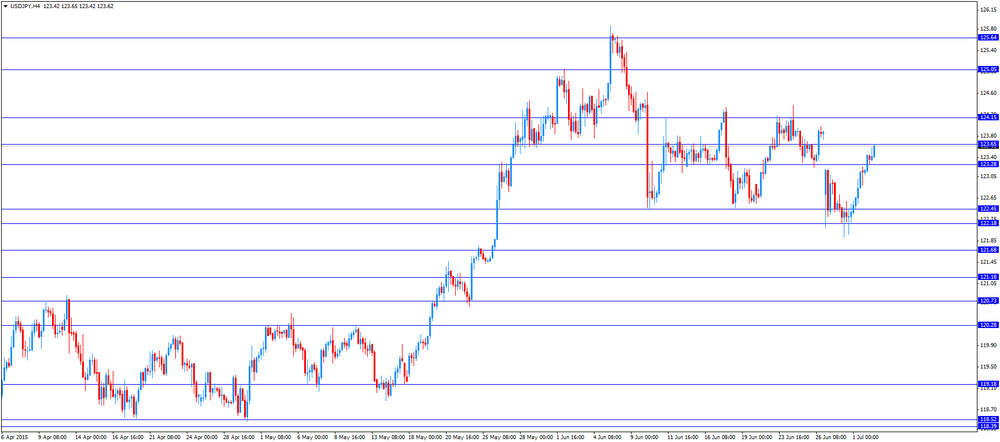

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to decline to 5.4% in June from 5.5% in May.

The U.S. economy is expected to add 232,000 jobs in June, after adding 280,000 jobs in May.

The number of initial jobless claims in the U.S. is expected to decrease by 1,000 to 270,000 last week.

Factory orders in the U.S. are expected to fall 0.5% in May after a 0.4% decline in April.

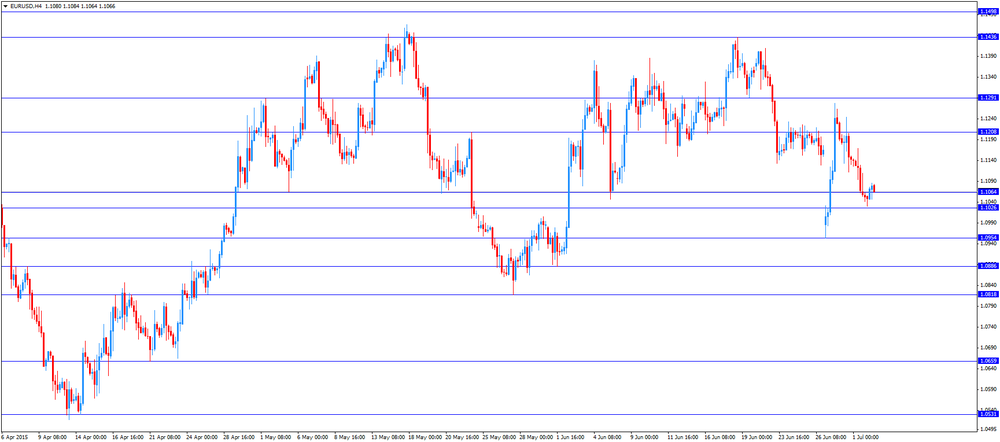

The euro traded mixed against the U.S. dollar on the uncertainty over Greece's debt crisis. Greek Prime Minister Alexis Tsipras said in a speech on Wednesday that Greeks should vote "no" in Sunday's referendum. He added that "no" would not mean that Greece have to leave the Eurozone.

The head of the Eurogroup Jeroen Dijsselboem said after the telephone conference on Wednesday that there is no reason to continue the debt talks before the referendum on Sunday.

Greek Finance Minister Yannis Varoufakis signalled on Thursday that he will resign if Greeks vote "Yes" in the referendum on Sunday.

Earlier, he said that a deal with Greece's creditors on Monday.

Meanwhile, the producer price inflation in the Eurozone improved slightly in May. Eurozone's producer price index was flat in May, missing expectations for a 0.1% increase, after a 0.1% decline in April.

On a yearly basis, Eurozone's producer price index dropped 2.0% in May, in line with expectations, after a 2.2% fall in April.

Eurozone's producer prices excluding energy fell 0.3% year-on-year in May. Energy prices dropped 6.4%.

The European Central Bank's (ECB) its minutes of March meeting on Thursday. According to the minutes, the ECB said in its minutes that there is no need to increase its bond-buying programme. The central bank added that it could adjust its bond-buying programme if needed.

The ECB President Mario Draghi is scheduled to speak at 15:10 GMT.

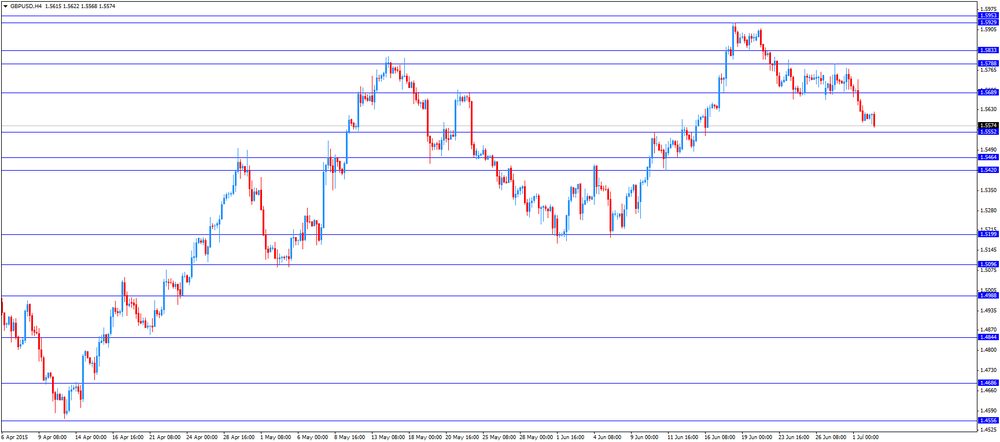

The British pound traded lower against the U.S. dollar after the release of the construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 58.1 in June from 55.9 in May, exceeding expectations for a rise to 56.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in the house-building sector, but both commercial and civil engineering activity also increased.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5568

USD/JPY: the currency pair rose to Y123.65

The most important news that are expected (GMT0):

12:30 U.S. Average hourly earnings June 0.3% 0.2%

12:30 U.S. Initial Jobless Claims June 271 270

12:30 U.S. Nonfarm Payrolls June 280 230

12:30 U.S. Unemployment Rate June 5.5% 5.4%

14:00 U.S. Factory Orders May -0.4% -0.5%

15:10 Eurozone ECB President Mario Draghi Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.