- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite hopes for a deal between Athens and its creditors

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite hopes for a deal between Athens and its creditors

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI June 50.2 50.3 50.2

01:00 China Non-Manufacturing PMI June 53.2 53.8

01:30 Australia Building Permits, m/m May -5.2% Revised From -4.4% 1% 2.4%

01:35 Japan Manufacturing PMI (Finally) June 50.9 49.9 50.1

01:45 China HSBC Manufacturing PMI (Finally) June 49.2 49.4

07:30 Switzerland Manufacturing PMI June 49.4 50.1 50

07:50 France Manufacturing PMI (Finally) June 49.4 50.5 50.7

07:55 Germany Manufacturing PMI (Finally) June 51.1 51.9 51.9

08:00 Eurozone Manufacturing PMI (Finally) June 52.2 52.5 52.5

08:30 United Kingdom Purchasing Manager Index Manufacturing June 51.9 Revised From 52.0 52.5 51.4

09:00 Eurozone Eurogroup Meetings

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

11:00 U.S. MBA Mortgage Applications June 1.6% -4.7%

12:00 Canada Bank holiday

12:15 U.S. ADP Employment Report June 203 Revised From 201 217 237

The U.S. dollar traded higher against the most major currencies after the release of the U.S. ADP jobs data. Private sector in the U.S. added 237,000 jobs in June, according the ADP report on Wednesday. May's figure was revised up to 203,000 jobs from a previous reading of 201,000 jobs. Analysts expected the private sector to add 217,000 jobs.

The euro traded lower against the U.S. dollar despite hopes for a deal between Athens and its creditors. Greek Prime Minister Alexis Tsipras signalled that he was ready to accept the most spending cuts demanded by the country's creditors.

But German Finance Minister Wolfgang Schaeuble said on Wednesday that there was no basis to have further negotiations with Greece.

The International Monetary Fund (IMF) confirmed that Greece has not repaid €1.538 billion IMF loans. A Greek default would be the first by an advanced economy in the IMF's seven-decade history, putting the country on a par with countries such as Afghanistan, Haiti and Zimbabwe, which also not paid IMF loans on time.

Another Eurogroup meeting has been called for today to discuss the latest proposal from Greece. The Head of the Eurogroup Jeroen Dijsselbloem said that the Eurogroup will discuss the request for a third bailout programme only after the referendum on Sunday. He also warns that new aid programme for Greece may have tougher conditions.

Meanwhile, the economic data from the Eurozone was solid. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.5 in June from 52.2 in May, in line with a preliminary reading. It was the highest level since April 2014.

The Netherlands was the strongest performer.

Markit's Chief Economist Chris Williamson said that June's PMI was "representing a major improvement compared to the malaise seen at the end of last year".

Germany's final manufacturing purchasing managers' index (PMI) rose to 51.9 in June from 51.1 in May, in line with a preliminary reading.

The increase was driven by a rise in output at consumer goods producers and in output in new orders.

"The overall expansions in output and new business were, however, well below levels seen at the start of last year," Markit economist Oliver Kolodseike said.

France's final manufacturing purchasing managers' index (PMI) rose to 50.7 in June from 49.4 in May, up from the preliminary reading of 50.5. It was the first reading above 50 since April 2014.

"The French manufacturing sector edged further in the right direction during June, with output and new orders broadly stabilizing. This was reflected in firms' hiring decisions, with the rate of job shedding easing to a marginal pace," Markit economist Jack Kennedy said.

The British pound traded mixed against the U.S. dollar after the release of the manufacturing PMI from the U.K. Markit Economics also released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 51.4 in June from 51.9 in May, missing expectations for a rise to 52.5. It was the lowest level since April 2013.

The decline was driven by declines in output and new orders.

"The UK manufacturing sector had a disappointing second quarter overall. Growth trends in output and new orders were the weakest since the opening quarter of 2013, as a strong sterling exchange rate and subdued demand from mainland Europe offset the continued solidity of the domestic market," Markit's Senior Economist Rob Dobson said.

The Bank of England Governor Mark Carney said on Wednesday that UK banks' direct exposure to Greece is very small. He noted that the economic growth in the U.K. has been solid and the burden of household debt has continued to decline.

The Swiss franc traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from Switzerland. The manufacturing purchasing managers' index in Switzerland rose to 50.0 in June from 49.4 in May, missing expectations for an increase to 50.1.

The increase was driven by a rise in production.

EUR/USD: the currency pair increased to $1.1081

GBP/USD: the currency pair declined to $1.5634

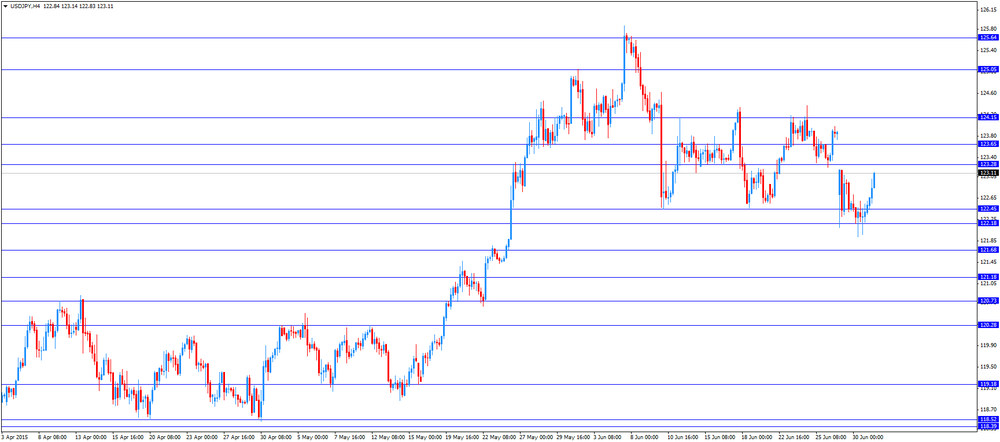

USD/JPY: the currency pair rose to Y123.14

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Finally) June 54.0 53.4

14:00 U.S. ISM Manufacturing June 52.8 53.1

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.