- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the euro declined

Foreign exchange market. Asian session: the euro declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 Australia HIA New Home Sales, m/m May 0.6% -2.3%

01:00 New Zealand ANZ Business Confidence June 15.7 -2.3

01:30 Australia Private Sector Credit, y/y May 6.1% 6.2%

01:30 Australia Private Sector Credit, m/m May 0.3% 0.5% 0.5%

01:30 Japan Labor Cash Earnings, YoY May 0.7% 0.6%

05:00 Japan Housing Starts, y/y May 0.4% 5.8% 5.8%

06:00 Germany Retail sales, real unadjusted, y/y May 1.1% 2.5% -0.4%

06:00 Germany Retail sales, real adjusted May 1.7% 0.0% 0.5%

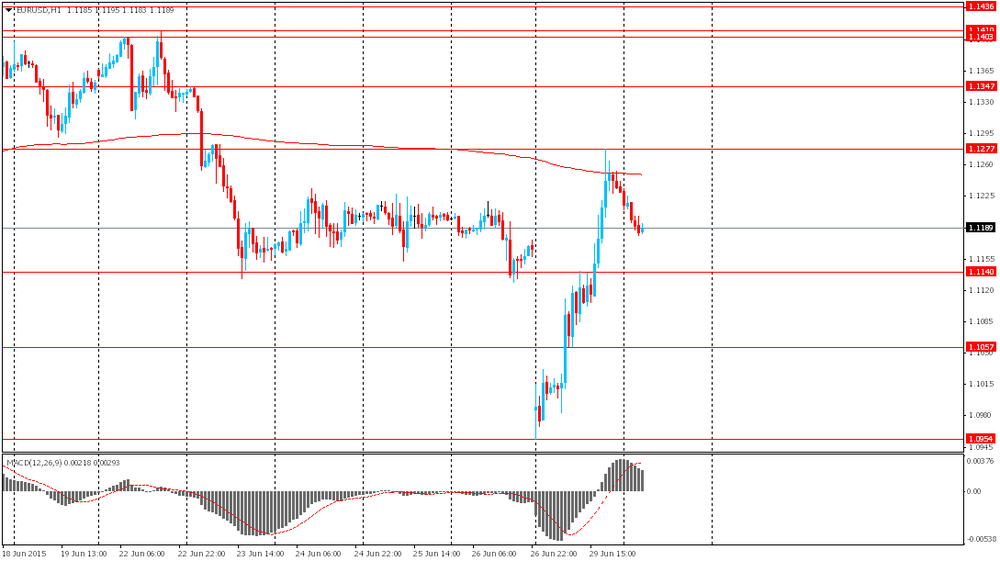

The euro slid as today Greece is supposed to make a €1.6 billion debt payment to the International Monetary Fund and it is not able to do it. Yesterday the single currency rose up to $1.1278 during the American session, because investors close their short positions after the euro had fallen down to $1.0954 amid Greece default prospects. Standard and Poor's cut Greece's sovereign debt rating to CCC- and noted that there is a 50% probability it would leave the single currency area.

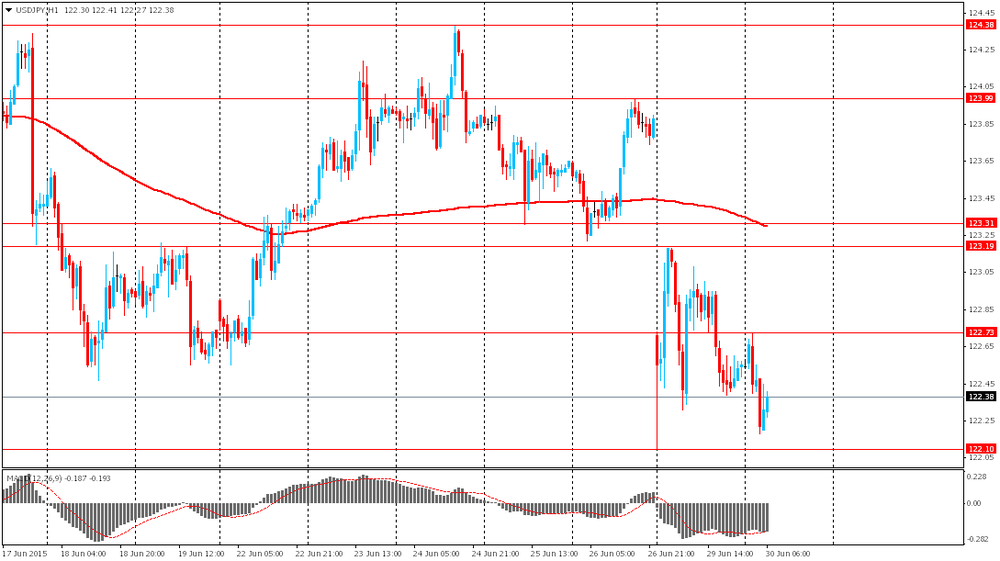

The yen continued gaining amid demand for this safe-haven currency. Greece is likely to default on its €1.6 billion payment to the IMF and leave the euro zone. Investors are waiting for a Greek referendum scheduled for July the 5th. Many market participants expect Greeks to say 'yes' to austerity measures. If they vote 'no', the yen will strengthen more.

The New Zealand Dollar declined after ANZ business confidence data showed that the corresponding index fell to -2.3 in May (the weakest result in four years) from 15.7 reported previously. This sharp decline means lack of business investment.

EUR/USD: the pair fell to $1.1180 this morning

USD/JPY: the pair fell to Y122.20

GBP/USD: the pair traded around $1.5715-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator June 93.1 93.6

07:55 Germany Unemployment Change June -5 -5

07:55 Germany Unemployment Rate s.a. June 6.4% 6.4%

08:30 United Kingdom Current account, bln Quarter I -25.3 -23.25

08:30 United Kingdom GDP, q/q(Finally) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y(Finally) Quarter I 3.0% 2.5%

08:40 Australia RBA's Governor Glenn Stevens Speech

09:00 Eurozone Harmonized CPI, Y/Y(Preliminary) June 0.3% 0.2%

09:00 Eurozone Unemployment Rate May 11.1% 11.1%

12:30 Canada GDP (m/m) April -0.2% 0.1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.0% 5.5%

13:45 U.S. Chicago Purchasing Managers' Index June 46.2 50.1

14:00 U.S. Consumer confidence June 95.4 97.2

20:30 U.S. API Crude Oil Inventories June -3.2

23:30 Australia AIG Manufacturing Index June 52.3

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 12 12

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 19 22

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.