- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the Swiss franc dropped against the U.S. dollar after comments by the Swiss National Bank President Thomas Jordan

Foreign exchange market. European session: the Swiss franc dropped against the U.S. dollar after comments by the Swiss National Bank President Thomas Jordan

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany Gfk Consumer Confidence Survey July 10.2 10.2 10.1

08:00 Switzerland SNB Chairman Jordan Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the final U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in May, after a 0.1 rise in April.

Personal income in the U.S. is expected to rise 0.5% in May, after a 0.4% gain in April.

Personal spending in the U.S. is expected to gain 0.7% in May, after a flat reading in April.

The preliminary services purchasing managers' index is expected to climb to 56.7 in June from 56.2 in April.

The number of initial jobless claims in the U.S. is expected to increase by 5,000 to 272,000.

The euro traded mixed against the U.S. dollar on the uncertainty over the debt talks between Greece and its creditors. Yesterday's debt talks between Greece and its creditors ended without any results. Greece rejected on Wednesday a "counter proposal" from its international creditors, according a government source. There are still differences.

"Unfortunately we have not reached an agreement yet, but we are determined to continue work," the head of the Eurogroup Jeroen Dijsselbloem said.

Athens and its lenders failed to reach a deal on tax, pension reform and VAT.

Athens have to repay €1.6 billion IMF loans by June 30.

Meanwhile, the economic data from the Eurozone was soft. German Gfk consumer confidence index fell to 10.1 in July from 10.2 in June. Analysts had expected the index to remain unchanged at 10.2.

The decrease was driven by declines in economic expectations and the willingness to buy. The previously unsuccessful attempts to find a solution to the debt crisis in Greece and a possible Greek default also weighed on the index.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc dropped against the U.S. dollar after comments by the Swiss National Bank President Thomas Jordan. He said that the Swiss franc is overvalued.

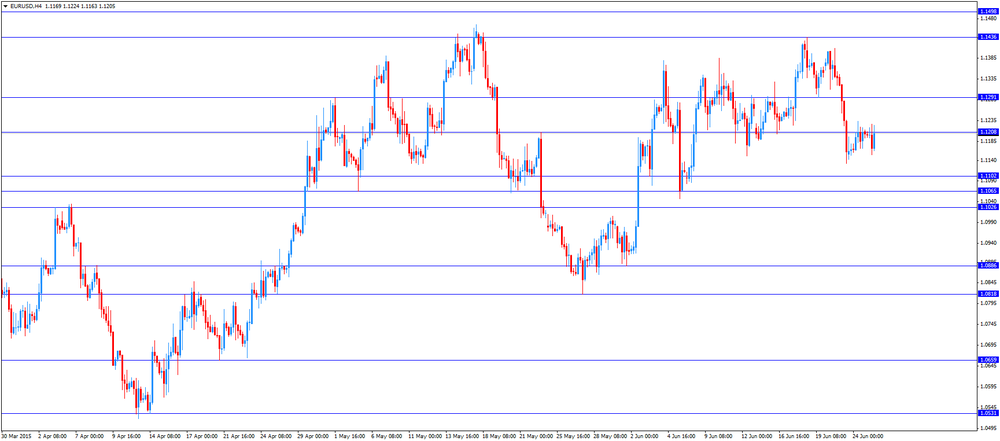

EUR/USD: the currency pair traded mixed

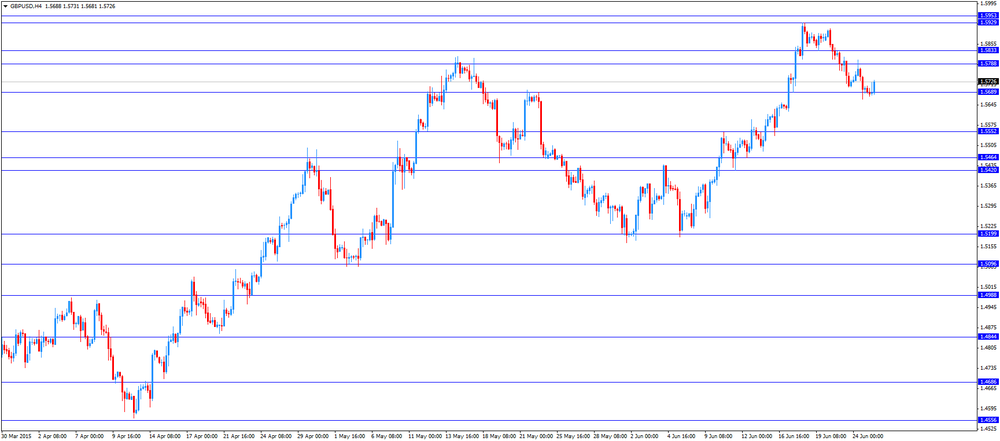

GBP/USD: the currency pair increased to $1.5731

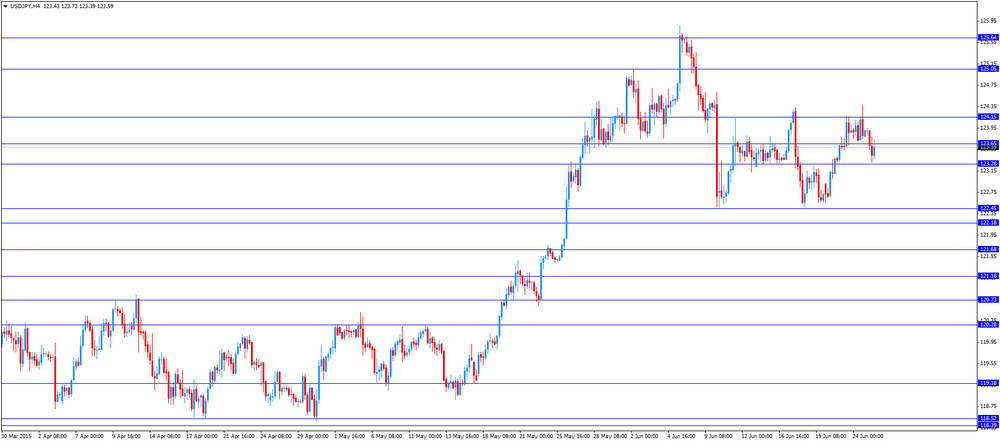

USD/JPY: the currency pair fell to Y123.31

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims June 267 272

12:30 U.S. Personal Income, m/m May 0.4% 0.5%

12:30 U.S. Personal spending May 0.0% 0.7%

12:30 U.S. PCE price index ex food, energy, m/m May 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y May 1.2% 0.8%

13:45 U.S. Services PMI (Preliminary) June 56.2 56.7

13:45 U.S. FOMC Member Jerome Powell Speaks

16:10 Canada BOC Deputy Governor Lawrence Schembri Speaks

22:45 New Zealand Trade Balance, mln May 123 -100

23:30 Japan Unemployment Rate May 3.3% 3.3%

23:30 Japan Household spending Y/Y May -1.3% 3.4%

23:30 Japan Tokyo Consumer Price Index, y/y June 0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June 0.2% 0.1%

23:30 Japan National Consumer Price Index, y/y May 0.6%

23:30 Japan National CPI Ex-Fresh Food, y/y May 0.3% 0.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.