- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the British pound traded higher against the U.S. dollar in the release of the labour market data from the U.K.

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar in the release of the labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May 0.0% Revised From 0.1% -0.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.3% Revised From 2.2% 2.5% 2.7%

08:30 United Kingdom Average Earnings, 3m/y April 2.3% Revised From 1.9% 2.1% 2.7%

08:30 United Kingdom ILO Unemployment Rate April 5.5% 5.5% 5.5%

08:30 United Kingdom Claimant count May -7.8 Revised From -12.6 -12.3 -6.5

08:30 United Kingdom Bank of England Minutes

09:00 Eurozone Harmonized CPI May 0.2% 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May 0.0% 0.3% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) May 0.6% 0.9% 0.9%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June -0.1 0.1

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Investors are awaiting signals when the Fed starts raising its interest rate.

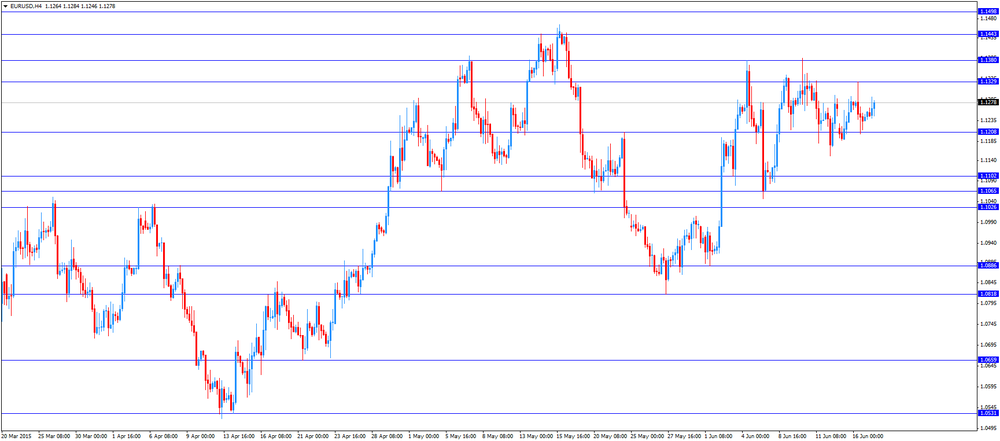

The euro traded lower against the U.S. dollar after the final consumer inflation data from the Eurozone. Eurozone's final consumer price index rose 0.2% in May, in line with the previous estimate.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.3% in May from 0.0% in April, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 0.9% in May from 0.6% in April, in line with the previous estimate.

Concerns over the Greek debt problem still weighed on the euro. The next round of the debt talks between Greece and its creditors is scheduled to at the finance ministers' meeting this Thursday in Luxembourg. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

The British pound traded higher against the U.S. dollar in the release of the labour market data from the U.K. The U.K. unemployment rate remained unchanged at 5.5% in the February to April quarter, in line with expectations. It was the lowest level since 2008.

The claimant count decreased by 6,500 people in May, missing expectations for a drop by 12,300, after a decrease of 7,800 people in April.

Average weekly earnings, excluding bonuses, climbed by 2.7% in the February to April quarter, exceeding expectations for a rise by 2.5%, after a 2.3% gain in the November to January quarter. It was the highest gain since December to February 2009.

Average weekly earnings, including bonuses, rose by 2.7% in the February to April quarter, exceeding expectations for a gain of 2.1%, after a 2.3% increase in the November to January quarter. It was the highest rise since June to August 2011.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

All MPC members noted that it was appropriate to keep the monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced" between voting to hold or hike interest rate repeating comments from the last minutes.

MPC members said that the monetary policy will depend on "the prospects for inflation in the United Kingdom and would not be determined by the actions of other central banks".

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian wholesale sales data. Canadian wholesale sales are expected to climbed 0.3% in April, after a 0.8% rise in March.

The Swiss franc traded higher against the U.S. dollar due to increasing demand in the safe-haven currency. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index rose to 0.1 points in June from -0.1 points in May.

EUR/USD: the currency pair increased to $1.1292

GBP/USD: the currency pair rose to $1.5754

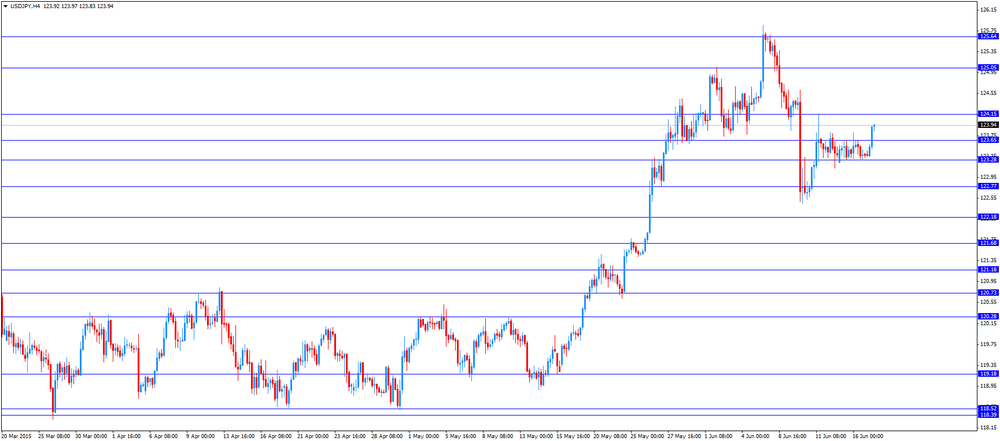

USD/JPY: the currency pair was up to Y123.97

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m April 0.8% 0.3%

14:30 U.S. Crude Oil Inventories June -6.812 -1.8

17:45 United Kingdom BOE Gov Mark Carney Speaks

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP y/y Quarter I 3.5% 3.1%

22:45 New Zealand GDP q/q Quarter I 0.8% 0.6%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.