- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar as the Greek debt crisis continues to weigh on the euro

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as the Greek debt crisis continues to weigh on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index (Preliminary) April 106.0 107.2

05:00 Japan Coincident Index (Preliminary) April 109.2 111.1

06:00 Germany Factory Orders s.a. (MoM) April 1.1% Revised From 0.9% 0.5% 1.4%

06:00 Germany Factory Orders n.s.a. (YoY) April 2.0% Revised From 1.9% 0.4%

06:45 France Trade Balance, bln April -4.41 Revised From -4.58 -3.0

08:30 United Kingdom Consumer Inflation Expectations Quarter II 1.9% 2.2%

09:00 OPEC OPEC Meetings

The U.S. dollar traded mixed against the most major currencies ahead of U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.4% in May. The U.S. economy is expected to add 227,000 jobs in May, after adding 223,000 jobs in April.

The euro traded lower against the U.S. dollar as the Greek debt crisis continues to weigh on the euro. According to the IMF and Greek officials, Athens plans to bundle its repayment of IMF loans. Greece have to repay of around $1.7 billion IMF loans. Greece had to repay its IMF loans on June 5, 12, 16 and 19.

Meanwhile, the economic data from the Eurozone was better than expected. German seasonal adjusted factory orders jumped 1.4% in April, exceeding expectations for a 0.5% increase, after a 1.1% rise in March. March's figure was revised up from a 0.9% gain.

The increase was driven by a rise in foreign orders. Foreign orders climbed by 5.5% in April, while domestic orders dropped by 3.8%.

New orders from the Eurozone rose 6.8% in April, while orders from other countries increased 4.7%.

The intermediate goods declined by 0.9% in April, capital goods orders were up 2.3%, while consumer goods orders increased 4.5%.

Bundesbank upgraded its growth forecasts for 2015 and 2016 for Germany. The growth is expected to be 1.7% in 2015, up from the previous estimate of 1.0%, and 1.8% in 2016, up from the previous estimate of 1.6%.

According to the French Customs, France's trade deficit narrowed to €3.0 billion in April from €4.41 billion in March. March's figure was revised down from a deficit of €4.58 billion.

The British pound traded slightly higher against the U.S. dollar after consumer inflation expectations from the U.K. The Bank of England (BoE) released its quarterly survey. Consumer inflation expectations for the coming year in the UK rose to 2.2% in May from 1.9% in February. February's reading was the lowest level since late 2001.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.8% in May.

Canada's economy is expected to add 10,000 jobs in May.

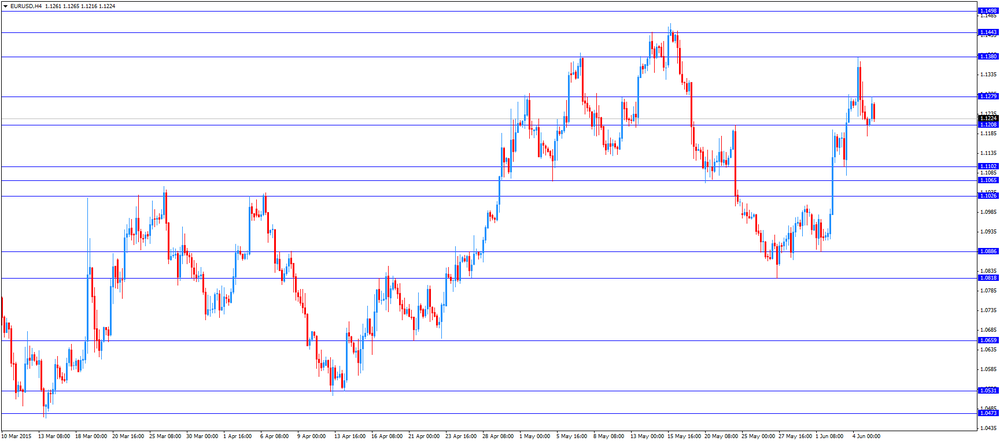

EUR/USD: the currency pair fell to $1.1216

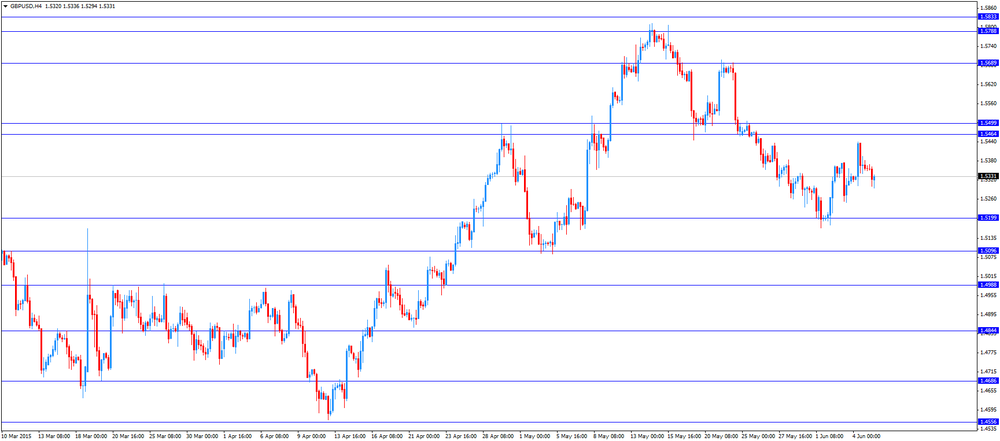

GBP/USD: the currency pair increased to $1.5356

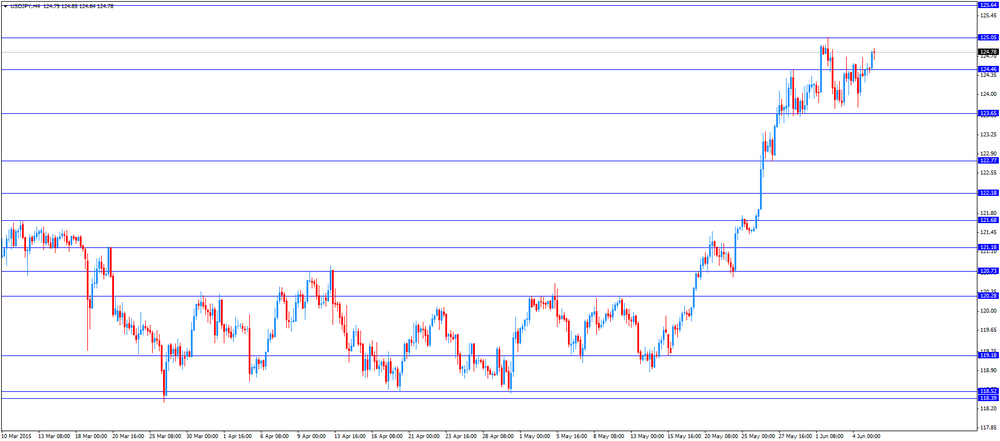

USD/JPY: the currency pair rose to Y124.85

The most important news that are expected (GMT0):

12:30 Canada Unemployment rate May 6.8% 6.8%

12:30 Canada Employment May -19.7 10

12:30 U.S. Average hourly earnings May 0.1% 0.2%

12:30 U.S. Nonfarm Payrolls May 223 225

12:30 U.S. Unemployment Rate May 5.4% 5.4%

16:30 U.S. FOMC Member Dudley Speak

19:00 U.S. Consumer Credit April 20.52 16.7

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.