- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the British pound climbed against the U.S. dollar after the better-than-expected U.K. manufacturing production data

Foreign exchange market. European session: the British pound climbed against the U.S. dollar after the better-than-expected U.K. manufacturing production data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans March 1.1% Revised From 1.2% 1.0% 1.6%

05:00 Japan Leading Economic Index (Preliminary) March 104.7 Revised From 104.8 105.5 105.5

05:00 Japan Coincident Index (Preliminary) March 110.7 109.5

08:00 China New Loans April 1180 903

08:30 United Kingdom Manufacturing Production (YoY) March 1.2% Revised From 1.1% 1.0% 1.1%

08:30 United Kingdom Manufacturing Production (MoM) March 0.5% Revised From 0.4% 0.3% 0.4%

08:30 United Kingdom Industrial Production (YoY) March 0.1% 0.2% 0.7%

08:30 United Kingdom Industrial Production (MoM) March 0.1% 0.0% 0.5%

The U.S. dollar traded lower against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to decline to 5.085 million in March from 5.133 million in February.

The euro traded higher against the U.S. dollar in the absence of any major economic data from the Eurozone. A government bonds selloff on the European markets supported the euro.

Greece yesterday began the transfer of €750 million in loans to the International Monetary Fund (IMF). A payment deadline is today.

According to Reuters, the Greek government used emergency reserves in its holding account with the IMF to repay loans.

Greece has averted a possible default, but there are no reasons for optimism yet. Eurogroup said after yesterday's meeting that it will not unlock the €7.2 billion tranche of loans until the Greek government begins reforms agreed with its creditors. Athens is struggling to meet its payment obligations.

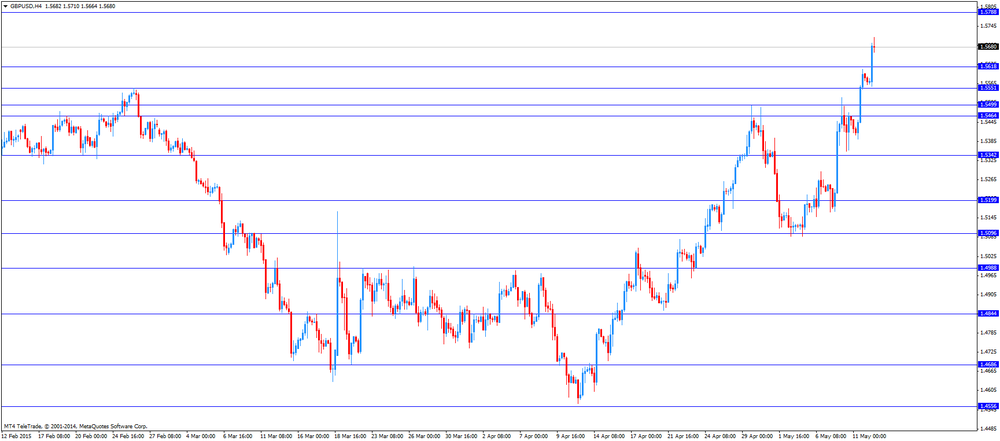

The British pound climbed against the U.S. dollar after the better-than-expected U.K. manufacturing production data. Manufacturing production in the U.K. rose 0.4% in March, exceeding expectations for a 0.3% gain, after a 0.5% increase in February. February's figure was revised up from a 0.4% rise.

Manufacturing output was driven by oil and gas extraction, which jumped 4.9% in March, the biggest rise since February 2014.

On a yearly basis, manufacturing production in the U.K. increased 1.1% in March, after a 1.2% rise in February. It was the largest increase since September 2014. February's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.5% in March, beating forecasts of a flat reading, after a 0.1% rise in February.

On a yearly basis, industrial production in the U.K. gained 0.7% in March, exceeding expectations for a 0.2% rise, after a 0.1% increase in February.

For the first quarter as a whole, industrial output was up 0.1%, driven by a 2.7% gain in the utilities sector, while manufacturing output rose 0.1%.

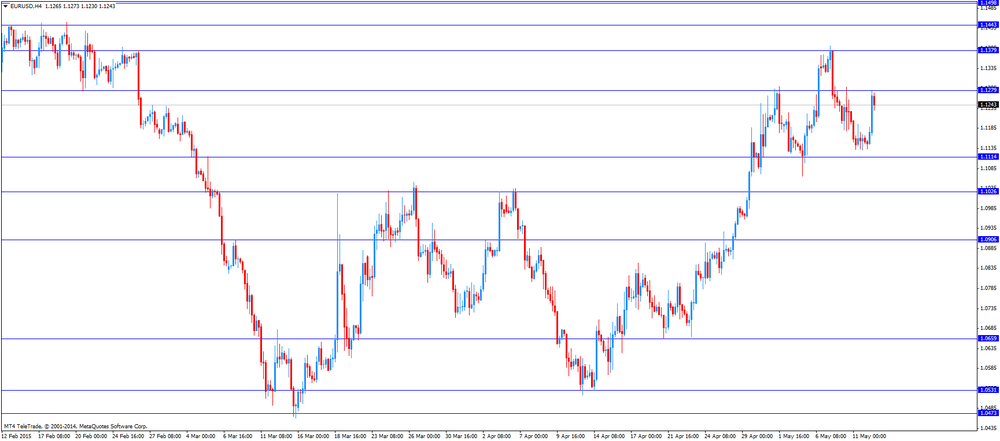

EUR/USD: the currency pair rose to $1.1278

GBP/USD: the currency pair increased to $1.5710

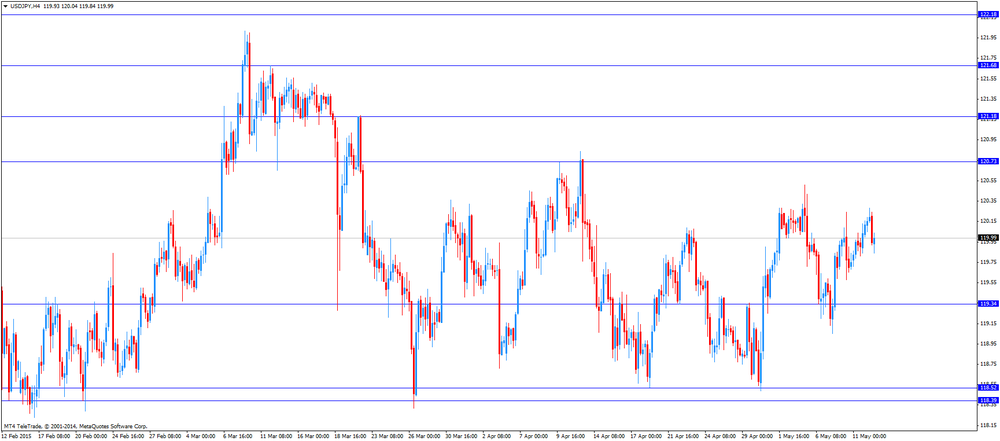

USD/JPY: the currency pair fell to Y119.84

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate April 0.6%

14:00 U.S. JOLTs Job Openings March 5.133 5.085

16:45 U.S. FOMC Member Williams Speaks

21:00 New Zealand RBNZ Financial Stability Report

21:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.