- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: The euro fell

Foreign exchange market. Asian session: The euro fell

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Australia RBA Meeting's Minutes

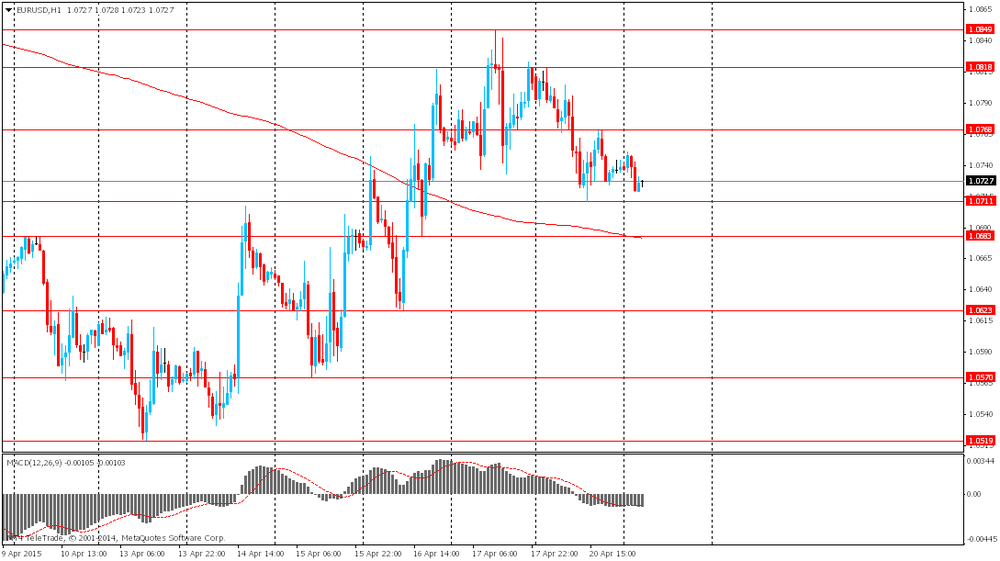

The euro fell at $1.0738, toward the lower end of a $1.0712 to $1.0825 range seen yesterday, weighed down by German bund yields touching fresh lows and Greek woes dominating the headlines. Ahead of key data in the form of German ZEW due for release later in the European session (0900 GMT).

The aussie fell at $0.7725, toward the low end of the $0.7707 to $0.7843 seen yesterday, as aussie strength attributed to China's rate stimulus was more than negated on news that China's Property developer, Kasia Group, had defaulted on its overseas debt. Broad-based

US dollar strength was also seen following upbeat US corporate earnings results and RBA Stevens' speech where he mentioned rates could be cut again if needed and the aussie was very likely to fall further over time.

EUR / USD: during the Asian session the pair fell to $ 1.0720

GBP / USD: during the Asian session the pair fell to $ 1.4880

USD / JPY: during the Asian session the pair rose to Y119.50

Another data lite day for the UK with attention on Germany ZEW at 0900GMT. Wednesday brings BOE Minutes and Thursday UK retail sales. Until then main market focus remains on Greece debt woes and linked comment. UK General Election remains a background factor with betting now favouring a minority Labour led government.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.