- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2% +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3 0

01:30 China PPI y/y February -4.3% -4.2% -4.8%

01:30 China CPI y/y February +0.8% +1.0% +1.4%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4% +28.9%

06:45 Switzerland Unemployment Rate February 3.2% Revised From 3.1% 3.2% 3.2%

07:45 France Industrial Production, m/m January +1.4% Revised From +1.5% +0.8% +0.4%

07:45 France Industrial Production, y/y January -1.3% +0.6%

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 5.030 million in January from 5.028 million in December.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro. European finance ministers piled pressure on Greece to examine its books in order to obtain more aid.

The European Central Bank President Mario Draghi asked on Monday Greece to allow new visits from technical experts. Greece agreed to allow experts to examine its books in Athens on Wednesday.

Industrial production in France climbed 0.4% in January, missing expectations for a 0.8% gain, after a 1.4% rise in December. December's figure was revised down from a 1.5% increase.

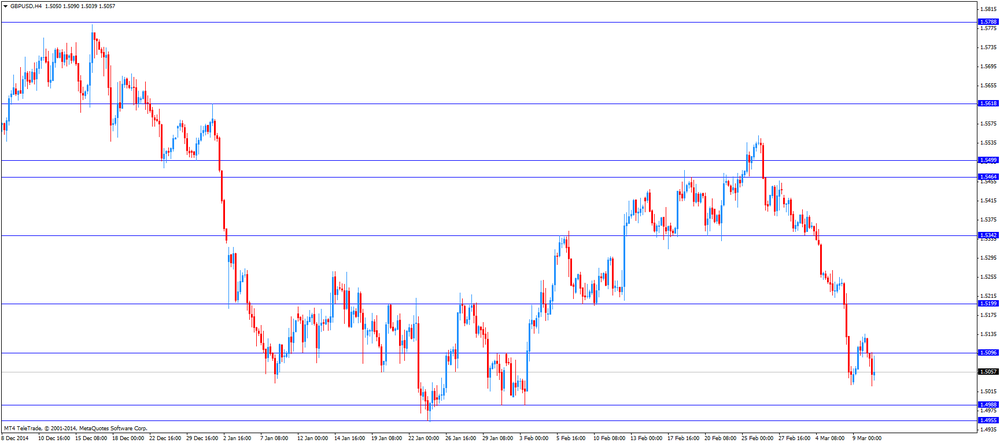

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after the unemployment rate data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

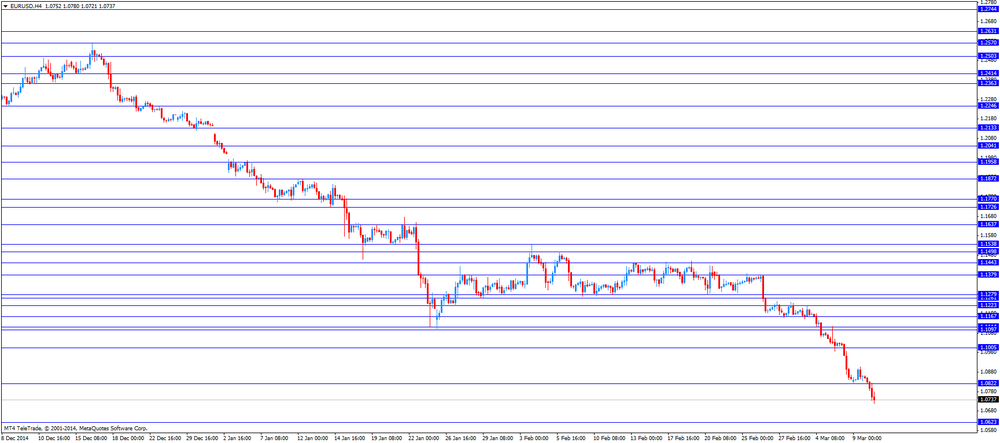

EUR/USD: the currency pair fell to $1.0721

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair declined to Y120.91

The most important news that are expected (GMT0):

14:00 U.S. JOLTs Job Openings January 5028 5030

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.