- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the British pound dropped against the U.S. dollar after the weaker-than-expected services data from the U.K.

Foreign exchange market. European session: the British pound dropped against the U.S. dollar after the weaker-than-expected services data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance November -0.88 Revised From -1.32 -1.59 -0.93

01:45 China HSBC Services PMI December 53.0 53.4

08:48 France Services PMI (Finally) December 49.8 49.8 50.6

08:53 Germany Services PMI (Finally) December 51.4 51.4 52.1

08:58 Eurozone Services PMI (Finally) December 51.9 51.9 51.6

09:30 United Kingdom Purchasing Manager Index Services December 58.6 58.9 55.8

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The ISM non-manufacturing purchasing managers' index is expected to decline to 58.2 in December from 59.3 in November.

Factory orders in the U.S. are expected to decline 0.3% in November, after a 0.7% drop in October.

The euro declined against the U.S. dollar after the mixed services purchasing managers' index (PMI) from the Eurozone. Eurozone' final services PMI fell to 51.6 in December from a preliminary reading of 51.9. Analysts had expected the final index to remain at 51.6.

Germany's final services PMI remained rose to 52.1 in December from a preliminary reading of 51.4. Analysts had expected the final index to remain at 51.4.

France's final services PMI increased to 50.6 in December from a preliminary reading of 49.8. Analysts had expected the final index to remain at 49.8.

Political uncertainty in Greece and speculation the European Central Bank will add further stimulus measures still weighed on the euro. There is speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month. If a left-wing government wins Greek parliament elections, it may cancel austerity measures and may renegotiate Greece's debt.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

The British pound dropped against the U.S. dollar after the weaker-than-expected services data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.8 in December from 58.6 in November, missing expectations for a rise to 58.9. That was the lowest level since May 2013.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian raw materials purchase price index. Canada's raw materials purchase price index is expected to decline 4.6% in November, after a 4.3% drop in October.

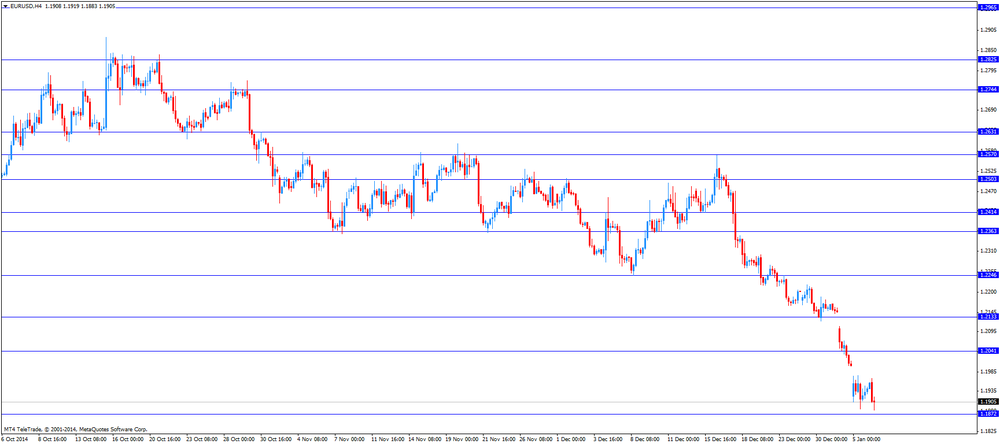

EUR/USD: the currency pair declined to $1.1883

GBP/USD: the currency pair fell to $1.5175

USD/JPY: the currency pair rose to Y119.38

The most important news that are expected (GMT0):

13:30 Canada Raw Material Price Index November -4.3% -4.6%

15:00 U.S. ISM Non-Manufacturing December 59.3 58.2

15:00 U.S. Factory Orders November -0.7% -0.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.