- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: U.S. dollar trades weaker against major peers

Foreign exchange market. Asian session: U.S. dollar trades weaker against major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

07:00 SwitzerlandUBS Consumption Indicator November 1.32 (Revised From 1.29) 1.29

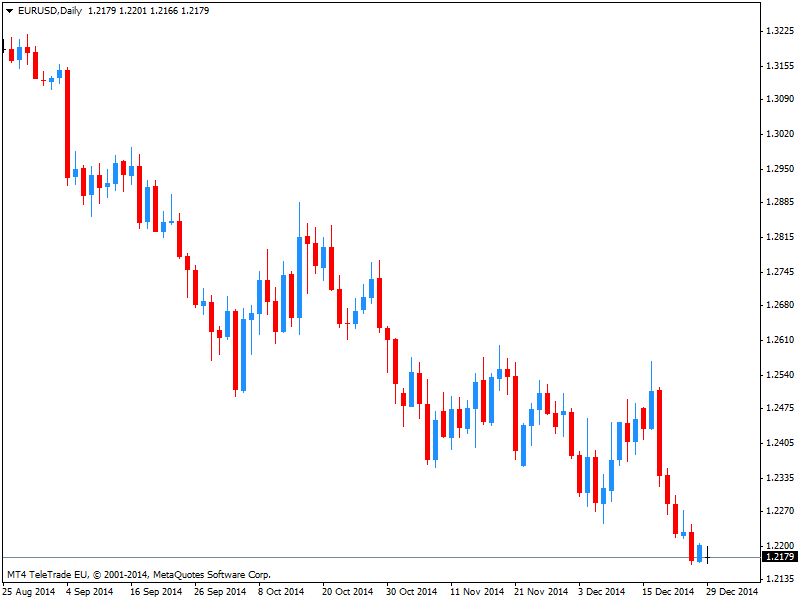

The greenback traded weaker against its major peers. The euro could recover from its two-year lows hit on December 23rd amid the third and final attempt of Greece's Prime Minister Antonio Samaras attempt to get his candidate approved by the parliament. If this third attempt is not successful general elections will be held in late January or early February where the anti-austerity party Syriza could become more powerful.

The Australian dollar further recovered from new lows at USD0.8086 hit on December 23rd currently trading at USD8134 amid signs that China is going to spur lending to strengthen economic growth. China is Australia's most important trading partner.

New Zealand's dollar rose against the greenback.

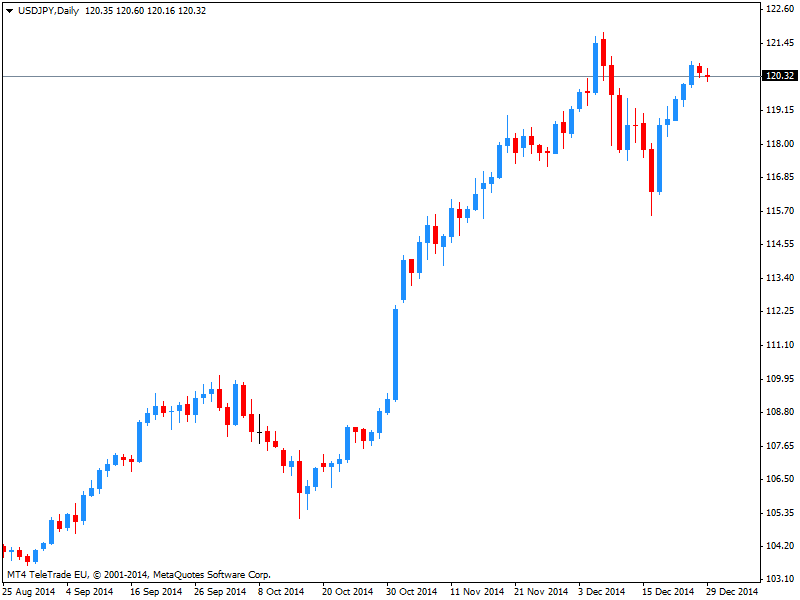

The Japanese yen traded slightly stronger during the Asian. This weekend the Japanese Government approved a 3.5 Trillion Yen fiscal stimulus to strengthen its economy and restore the country's public finances. Since the end of 2011 the Japanese currency slid more than 36%

EUR/USD: the euro added small gains against the greenback

USD/JPY: the U.S. dollar traded slightly weaker against the yen

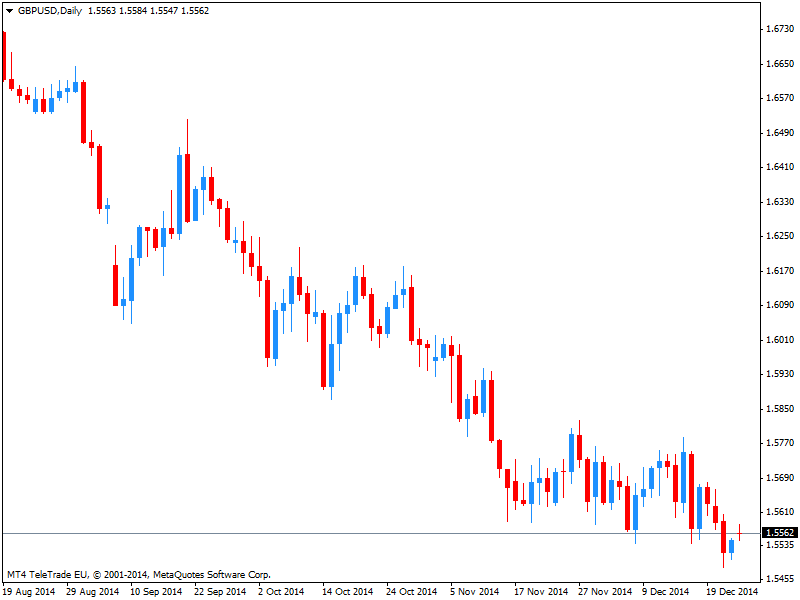

GPB/USD: The British pound gained against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

no news scheduled for today

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.