- Analytics

- News and Tools

- Market News

- Gold decline

Gold decline

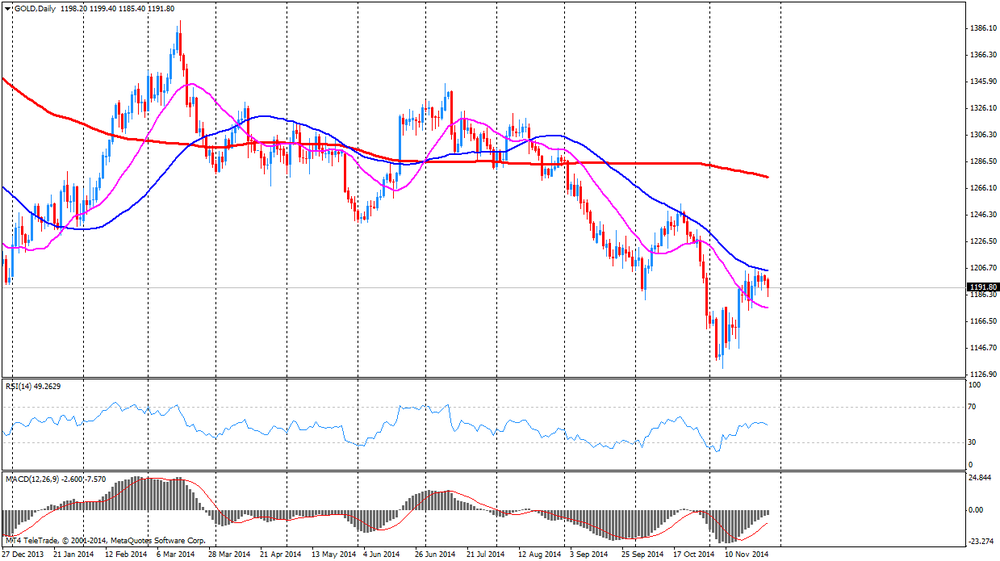

Gold prices decline due to outflows from secured gold ETF funds and on the eve of the referendum in Switzerland devoted to gold stocks.

"Gold is trading near $ 1,200, and for movement in any direction to overcome the mark of $ 1,180 or $ 1,205. The activity of the precious metals market will be weak on Thanksgiving Day and the day before the referendum in Switzerland, which will be held on the weekend," - said a dealer MKS Group Jason Cherizola.

The world's largest reserves of gold secured fund ETF SPDR Gold Trust on Wednesday fell by 0.29 percent to 718.82 tons, approaching the six-year low.

In Switzerland, on Sunday held a referendum on a proposal to ban the country's central bank to sell gold reserves and oblige him to keep at least 20 percent of assets in gold, compared with 8 percent in October. According to a recent survey, the proposal is 38 percent of the Swiss, but if the result of the vote will be positive, the central bank will need in the coming years to buy 1,500 tons of gold, which will cause a rise in prices, analysts said.

Trading volumes are likely to remain reduced on Thursday as US markets are closed today due to the Thanksgiving holiday.

The cost of the December gold futures on the COMEX today fell to 1184.70 dollars per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.