- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies ahead of the Chicago purchasing managers' index and final Reuters/Michigan Consumer Sentiment Index

Foreign exchange market. European session: the U.S. dollar traded mixed to higher against the most major currencies ahead of the Chicago purchasing managers' index and final Reuters/Michigan Consumer Sentiment Index

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence October -1 -2

00:30 Australia Producer price index, q / q Quarter III -0.1% +0.2%

00:30 Australia Producer price index, y/y Quarter III +2.3% +2.6% +1.2%

00:30 Australia Private Sector Credit, m/m September +0.4% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y September +5.1% +5.4%

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 275

03:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y September -12.5% -17.1% -14.3%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

07:00 Germany Retail sales, real adjusted September +1.5% Revised From +2.5% -1.0% -3.2%

07:00 Germany Retail sales, real unadjusted, y/y September -0.7% Revised From +0.1% +1.2% +2.3%

07:45 France Consumer spending September -0.9% Revised From +0.7% -0.5% -0.8%

07:45 France Consumer spending, y/y September +1.4% +0.2%

10:00 Eurozone Unemployment Rate September 11.5% 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) October +0.3% +0.4% 0.4%

12:30 Canada GDP (m/m) August 0.0% -0.1%

12:30 U.S. Employment Cost Index Quarter III +0.7% +0.5% +0.7%

12:30 U.S. Personal Income, m/m September +0.3% +0.3% +0.2%

12:30 U.S. Personal spending September +0.5% +0.1% -0.2%

12:30 U.S. PCE price index ex food, energy, m/m September +0.1% +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y September +1.5% +1.5%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the Chicago purchasing managers' index and final Reuters/Michigan Consumer Sentiment Index. The Chicago purchasing managers' index is expected to decline to 59.5 in October from 60.5 in September.

The final Reuters/Michigan Consumer Sentiment Index is expected to rise to 86.4 in October.

Personal income in the U.S. rose 0.2% in September, missing expectations for a 0.3% increase, after a 0.3% gain in August.

Personal spending in the U.S. declined 0.2% in September, missing expectations for a 0.1% rise, after a 0.5% gain in August.

The greenback remained supported by yesterday's U.S. gross domestic product. The U.S. preliminary gross domestic product increased at an annual rate of 3.5% in the third quarter, beating expectations for a 3.1% gain, after a 4.6% rise in the second quarter.

The euro traded lower against the U.S. dollar. Eurozone's consumer price index climbed at an annual rate of 0.4% in October, in line with expectations, up from a 0.3% rise in September.

Eurozone's unemployment rate remained unchanged at 11.5% in September, in line with expectations.

German adjusted retail sales fell 3.2% in September, missing expectations for a 1.0% decline, after a 1.5% gain in August. August's figure was revised down from a 2.5% increase.

Consumer spending in France dropped 0.8% in September, missing forecasts of a 0.5% decrease, after a 0.9% decline in August. August's figure was revised down from a 0.7% rise.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar dropped against the U.S. dollar after the weak Canadian gross domestic product. The Canadian gross domestic product fell 0.1% in August, after the flat reading in July.

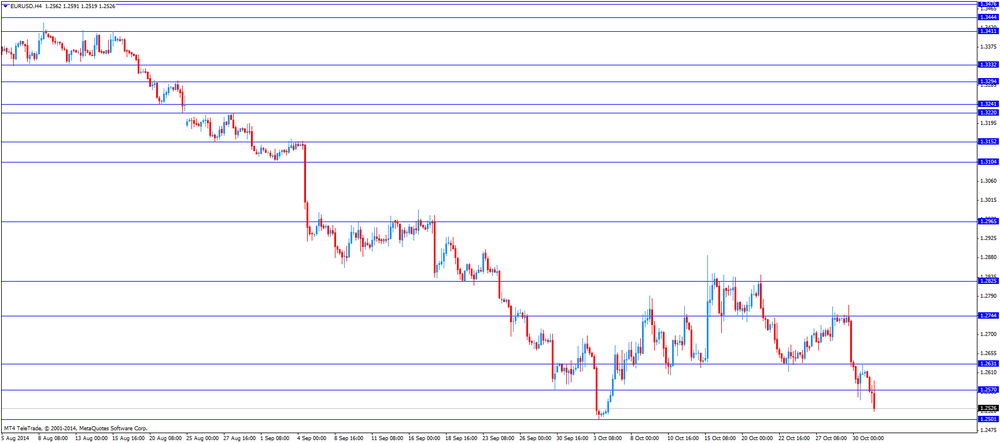

EUR/USD: the currency pair dropped to $1.2519

GBP/USD: the currency pair traded mixed

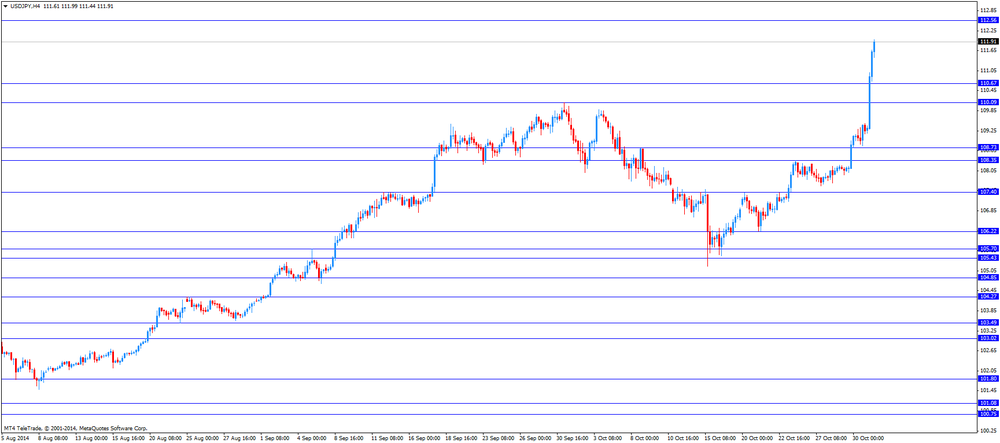

USD/JPY: the currency pair rose to Y111.99

The most important news that are expected (GMT0):

13:45 U.S. Chicago Purchasing Managers' Index October 60.5 59.5

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 84.6 86.4

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.