- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the release of the Reserve Bank of Australia’s interest rate decision

Foreign exchange market. Asian session: the Australian dollar traded mixed against the U.S. dollar after the release of the Reserve Bank of Australia’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

04:54 Japan Bank of Japan Monetary Base Target 270 270 270

04:54 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

05:00 Japan Leading Economic Index August 105.4 104.2 104.0

05:00 Japan Coincident Index August 109.9 108.5

06:00 Germany Industrial Production s.a. (MoM) August +1.6% Revised From +1.9% -1.4% -4.0%

06:00 Germany Industrial Production (YoY) August +2.5% -2.8%

07:00 Switzerland Foreign Currency Reserves September 453.8 462.2

07:15 Switzerland Retail Sales Y/Y August -0.6% +0.8% +1.9%

07:15 Switzerland Consumer Price Index (MoM) September 0.0% +0.2% +0.1%

07:15 Switzerland Consumer Price Index (YoY) September +0.1% 0.0% -0.1%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Industrial Production (MoM) August +0.5% 0.0% 0.0%

08:30 United Kingdom Industrial Production (YoY) August +1.7% +2.6% +2.5%

08:30 United Kingdom Manufacturing Production (MoM) August +0.3% +0.2% +0.1%

08:30 United Kingdom Manufacturing Production (YoY) August +2.2% +3.4% +3.9%

08:30 United Kingdom BOE Credit Conditions Survey

The U.S. dollar mixed to higher against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The New Zealand dollar traded mixed against the U.S. dollar after the disappointing NZIER business confidence data from New Zealand. The New Zealand Institute of Economic Research released its business confidence index. The index dropped to 19 in the third quarter from 32 in the second quarter.

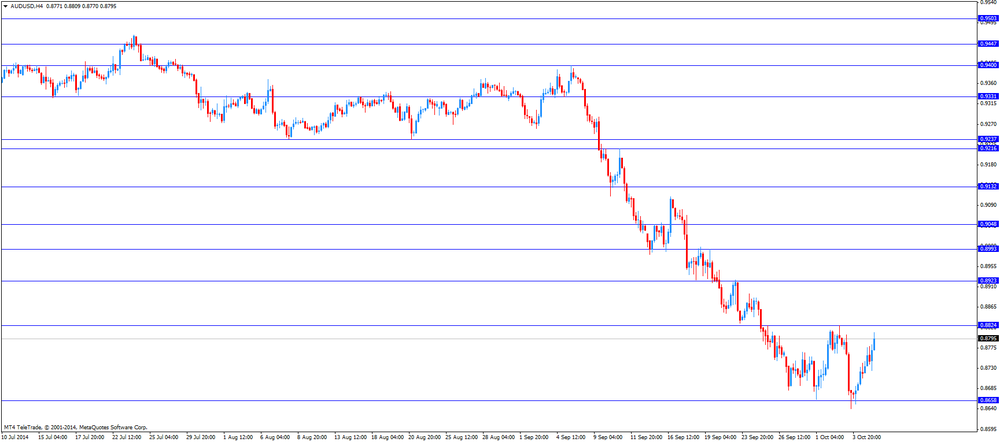

The Australian dollar traded mixed against the U.S. dollar after the release of the Reserve Bank of Australia's interest rate decision. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.50%. Analysts had expected this decision.

The RBA Governor Glenn Stevens said that the Aussie remained "high by historical standards" despite the recent decrease. He also said that Australia's economy grew moderately and "labour market data have been unusually volatile".

The AIG performance of construction index climbed to 59.1 in September from 55.0 in August.

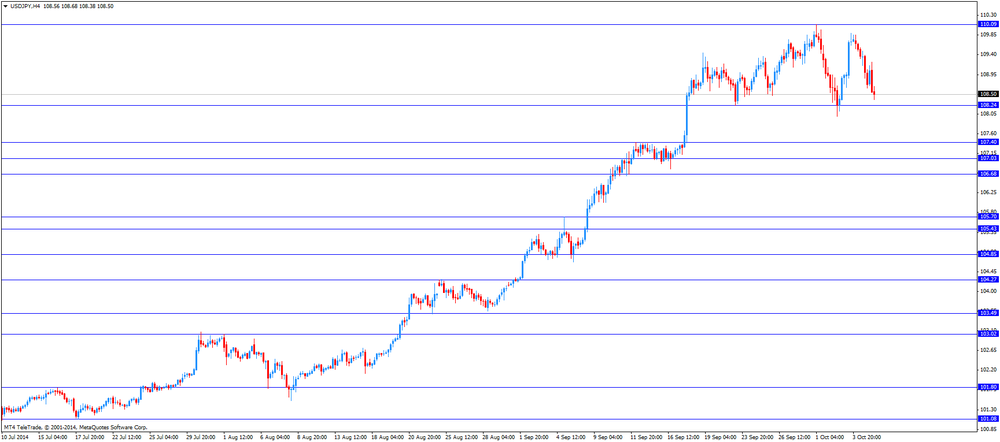

The Japanese yen rose against the U.S. dollar after comments by Japanese Prime Minister Shinzo Abe. He expressed concern about a weaker yen.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference today that the BoJ will closely monitor the exchange rate. He added that the central bank will maintain its quantitative and qualitative monetary easing program until the inflation target of 2% is achieved. Kuroda noted the BoJ will adjust its quantitative and qualitative monetary easing program if necessary.

Japan's preliminary leading index declined to 104 in August from 105.4 in July, missing expectations for a decrease to 104.2. That was the lowest level since January 2013.

Japan's coincident index fell to 108.5 in August from 109.9 in July.

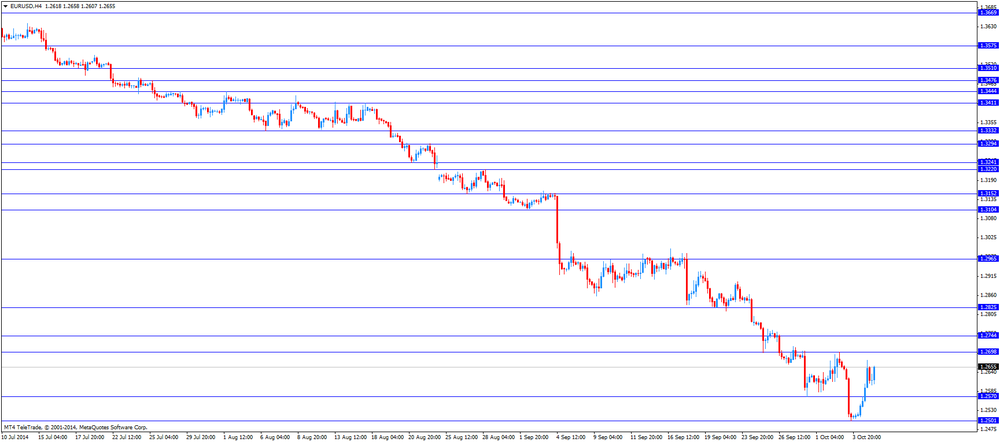

EUR/USD: the currency pair fell to $1.2604

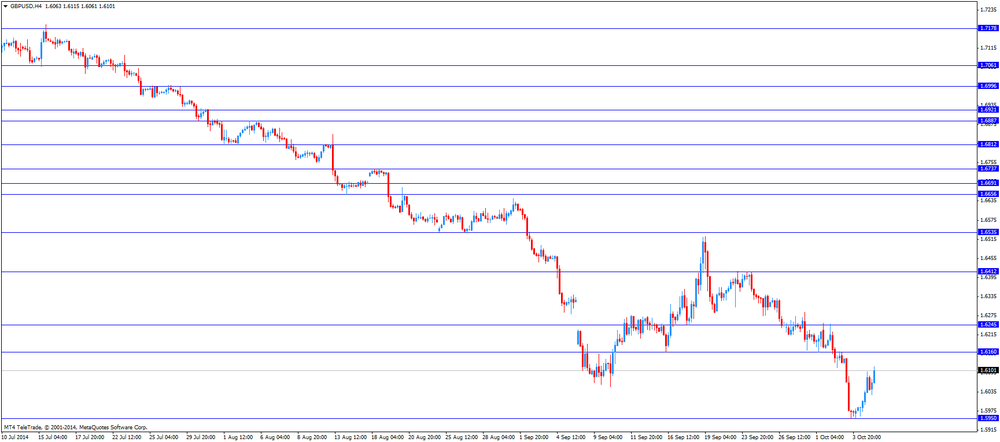

GBP/USD: the currency pair decreased to $1.6025

USD/JPY: the currency pair fell to Y108.53

AUD/USD: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) August +11.8%

14:00 United Kingdom NIESR GDP Estimate September +0.6%

14:00 U.S. JOLTs Job Openings August 4673 4710

17:20 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. FOMC Member Dudley Speak

23:50 Japan Current Account (adjusted), bln August 99.3 190

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.