- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the New Zealand dollar traded higher against the U.S dollar after the better-than-expected gross domestic product from New Zealand

Foreign exchange market. Asian session: the New Zealand dollar traded higher against the U.S dollar after the better-than-expected gross domestic product from New Zealand

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56 1.39

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.5% Revised From +2.6% +3.9%

The U.S. dollar traded lower against the most major currencies. In the yesterday's evening trading session, the greenback rose significantly against the most major currencies. The U.S. dollar was supported by the results of the Fed's monetary policy meeting. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The New Zealand dollar traded higher against the U.S dollar after the better-than-expected gross domestic product (GDP) from New Zealand. New Zealand's GDP rose 0.7% in the second quarter, exceeding expectations for a 0.6% increase, after a 1.0% gain in the first quarter.

On a yearly basis, New Zealand's GDP climbed by 3.9% in the second quarter, after a 3.8% rise in the first quarter.

The Australian dollar traded slightly higher against the U.S. dollar. The Fed's interest rate decision weighed on the Aussie.

The Reserve Bank of Australia (RBA) released its bulletin today. The RBA said spare capacity in the Australian labour market has risen over the past few years.

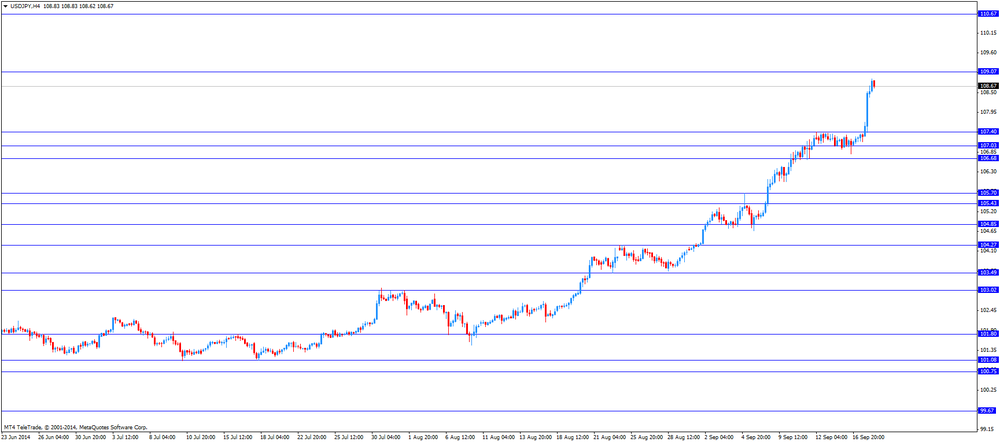

The Japanese yen declined against the U.S. dollar despite the better-than-expected data from Japan. Japan' trade deficit declined to ¥948.5 billion in August from ¥1,023.8 billion, beating expectations for a decline to a deficit of ¥990.0 billion.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

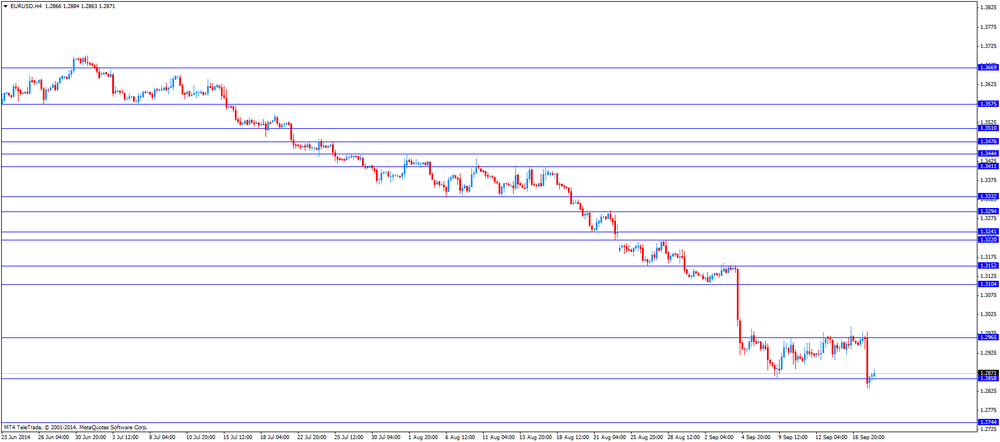

EUR/USD: the currency pair rose to $1.2873

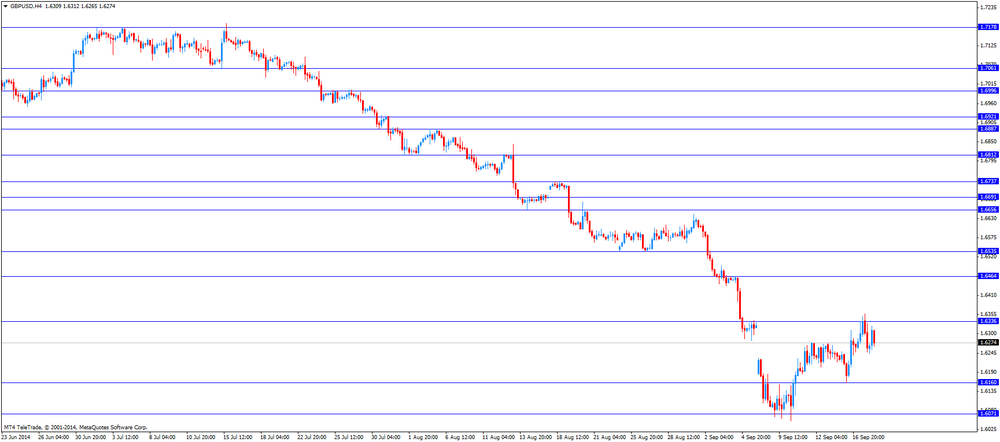

GBP/USD: the currency pair increased to $1.6322

USD/JPY: the currency pair climbed to Y108.87

The most important news that are expected (GMT0):

09:15 Eurozone Targeted LTRO 174

10:00 United Kingdom CBI industrial order books balance September 11 9

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.