- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

07:48 France Manufacturing PMI (Finally) July 47.6 47.6 47.8

07:53 Germany Manufacturing PMI (Finally) July 52.9 52.9 52.4

07:58 Eurozone Manufacturing PMI (Finally) July 51.9 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing July 57.5 57.2 55.4

During the European session, the Forex market the euro rose against the dollar on the final data on business activity in the manufacturing sector.

Eurozone manufacturing activity growth remained stable at seven-month low of June, final data showed Markit Economics, published on Friday.

On a seasonally adjusted final index of purchasing managers in manufacturing was 51.8 in July, unchanged from June. Pre-reading for July was at 51.9.

The continuing growth of activity in Germany was partly offset by a deep recession of the French manufacturers.

At the same time, the German industrial sector has shown steady growth in July. Manufacturing PMI Markit / BME rose to 52.4 in July from 52 eight-month low in June. But the value for July was lower than the preliminary assessment 52.9.

On the other hand, the French manufacturing sector weakened in July, but a little less than originally anticipated.

French PMI index fell to 47.8 from a revised 48.2 in June. It was its lowest value in 2014 till now. Value for July was revised from 47.6.

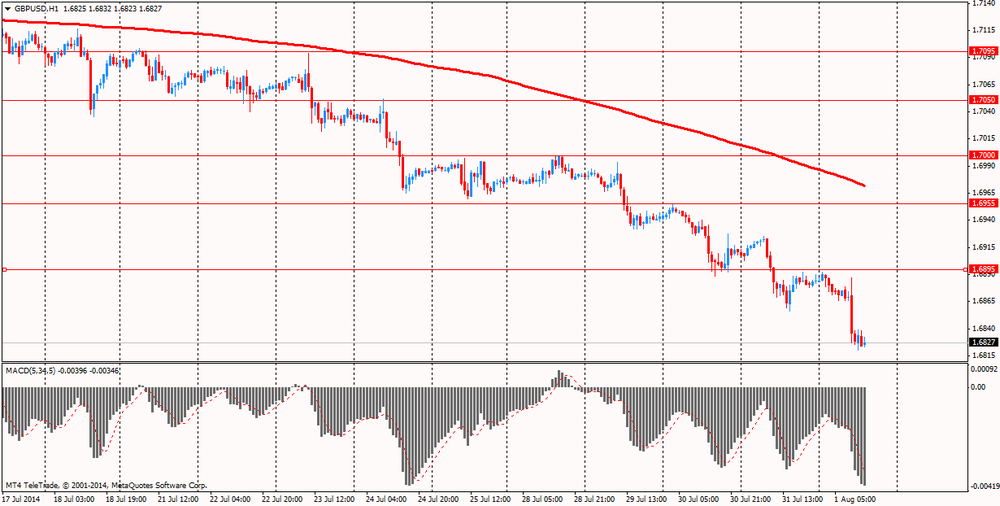

The British pound fell against the U.S. dollar, as data on manufacturing activity disappointed investors.

In the UK manufacturing activity grew at the slowest pace in a year in July, while a slowdown in new orders and output end of the first half of the "significant growth spurt," said Friday Markit Economics. Industrial activity index fell to 55.4 from a revised level of 57.2 in June. Economists had forecast a reading of 57.2 in July, from 57.5 previously voiced in June. The new orders index fell to 57.8 from 60.6 and the output index also fell.

Although the report refers to some loss of momentum in manufacturing, the sensor is higher than the average in the 51.5 series, and showed expansion of 17 consecutive months. Other indicators show continued strength - a report from the Confederation of British Industry showed that factory orders are at their highest level since 1995.

"Despite the cooling in July, growth in production and new orders remain well above their long-term trends, maintaining a constant job creation," said Rob Dobson, economist at Markit in London. "Growth rates remain historically very strong, to help promote another robust economic growth in the third quarter."

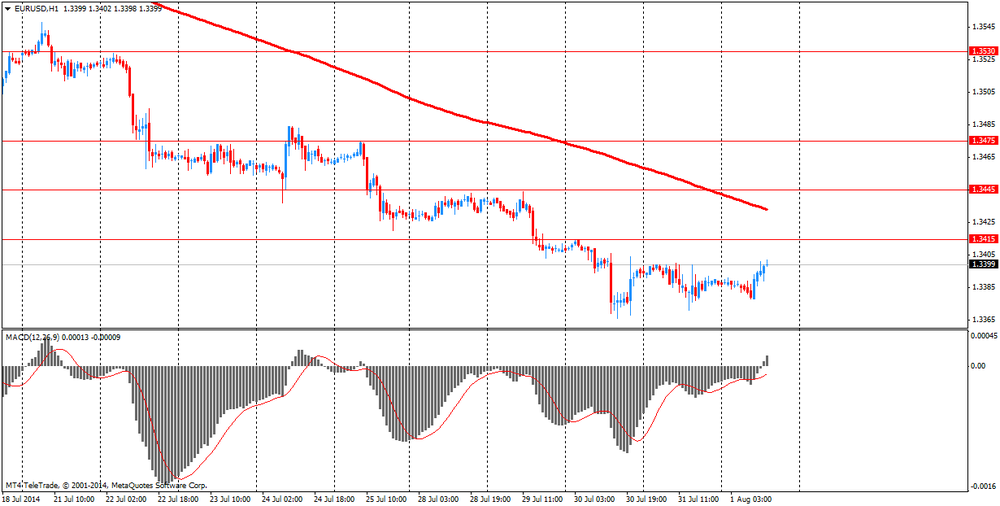

EUR / USD: during the European session, the pair rose to $ 1.3402

GBP / USD: during the European session, the pair fell to $ 1.6820

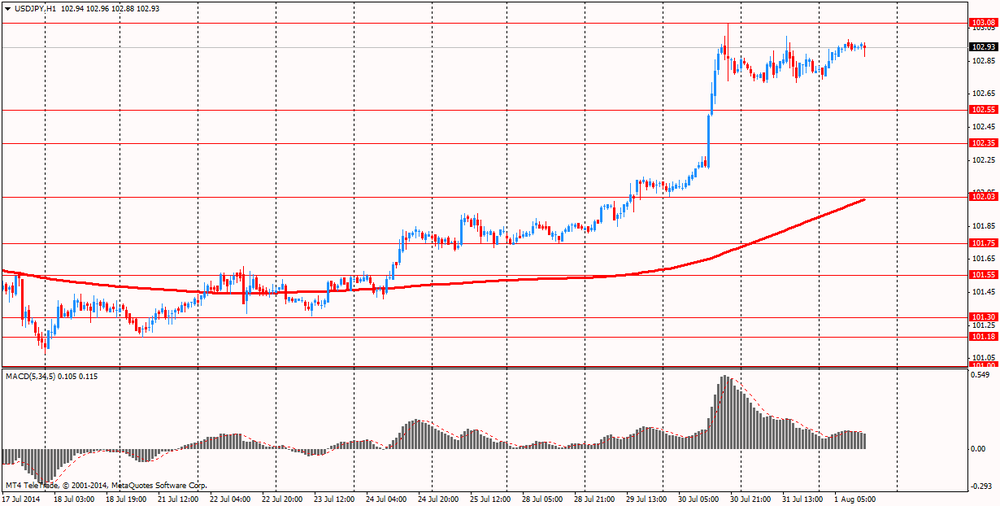

USD / JPY: during the European session, the pair rose to Y102.98

U.S. at 12:30 GMT publish unemployment, changes in the number of people employed in non-agricultural sector, the change in the number of employees in the private sector of the economy, changes in the number of people employed in the manufacturing sector of the economy, the change in average hourly wages, the share of the economically active population, the total revision of employment for 2 months in July, the main index for personal consumption expenditures, changes in spending, deflator for personal consumption expenditures for June, in 13:55 GMT - indicator of consumer confidence from the University of Michigan in July in 14:00 GMT - ISM manufacturing index for July .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.