- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

06:00 United Kingdom Nationwide house price index July +1.0% +0.6% +0.1%

06:00 United Kingdom Nationwide house price index, y/y July +6.0% Revised From +11.8% +10.6%

06:00 Germany Retail sales, real adjusted June -0.2% Revised From -0.6% +1.1% +1.3%

06:00 Germany Retail sales, real unadjusted, y/y June +2.4% Revised From +1.9% +0.4%

06:45 France Consumer spending June +1.0% +0.3% +0.9%

06:45 France Consumer spending, y/y June -0.6% +1.8%

07:55 Germany Unemployment Change July +7 Revised From +9 -5 -12

07:55 Germany Unemployment Rate s.a. July 6.7% 6.7%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July +0.5% +0.5% +0.4%

09:00 Eurozone Unemployment Rate June 11.6% 11.6% 11.5%

During the European session on Forex euro fell against the dollar on background data on inflation and unemployment in the eurozone. Eurozone inflation slowed in July to its lowest level in four and a half years, mainly due to falling energy prices, showed on Thursday, preliminary data from Eurostat.

Inflation slowed to 0.4 percent in July from 0.5 percent in June. Inflation is expected to remain unchanged at 0.5 percent. This is the lowest figure since the beginning of price growth since November 2009.

Core inflation, excluding energy, food, alcohol and tobacco remained unchanged at 0.8 percent in July.

Energy prices fell by 1 percent, and prices for food, alcohol and tobacco fell by 0.3 percent. At the same time, the prices of non-energy industrial goods remained in the flat, and the cost of services increased by 1.3 percent.

Eurozone unemployment rate unexpectedly fell in June, showed data released Thursday by Eurostat.

The unemployment rate fell slightly to 11.5 percent from 11.6 percent in May. Rate forecast was to remain unchanged at 11.6 percent.

In addition, the youth unemployment rate fell to 23.1 percent in June from 23.2 percent a month earlier.

The total number of unemployed persons decreased by 152,000 from May to 18.41 million in June.

The British pound fell against the dollar after data on house prices. In the UK house price growth slowed in July, lagging behind the expectations of economists, data showed on Thursday surveys mortgage lender Nationwide.

House prices rose by 10.6 percent compared with the previous year in July, an increase of the seventeenth consecutive month, and followed growth of 11.8 percent in June. This was less than the growth of 11.3 percent expected by economists.

On a monthly basis, prices rose at the slowest pace since April 2013, by 0.1 percent in July. It was slower than the increase of 1 percent in June and 0.5 percent growth expected by economists.

The average price of a house rose to 188,949 pounds from 188,903 pounds in June.

Robert Gardner, chief economist at Nationwide, said: "The slowdown should not be considered surprising, given the evidence of moderate activity in recent months."

"Approved Mortgage Applications fell by almost 20 percent in the period from January to May, and there has also been some easing in promising indicators - such as new customer demands."

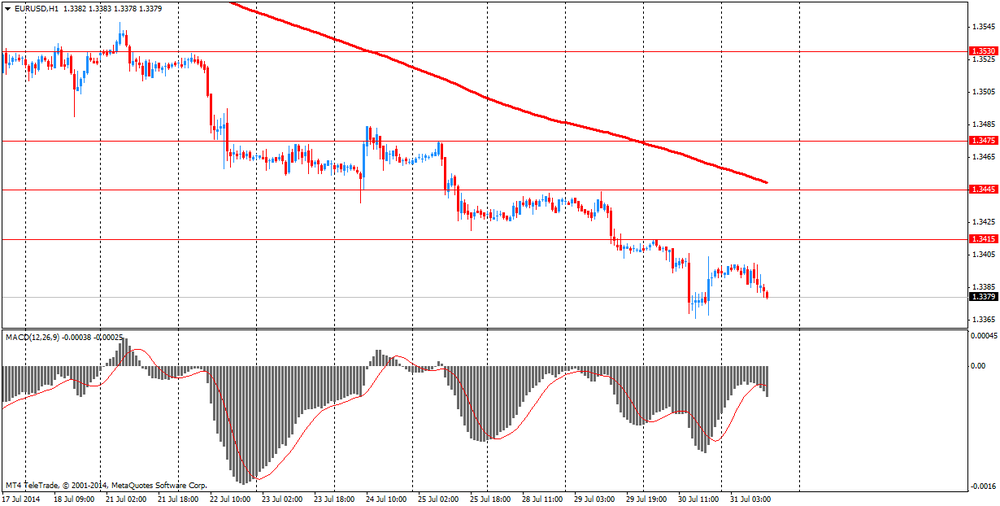

EUR / USD: during the European session, the pair fell to $ 1.3379

GBP / USD: during the European session, the pair fell to $ 1.6869

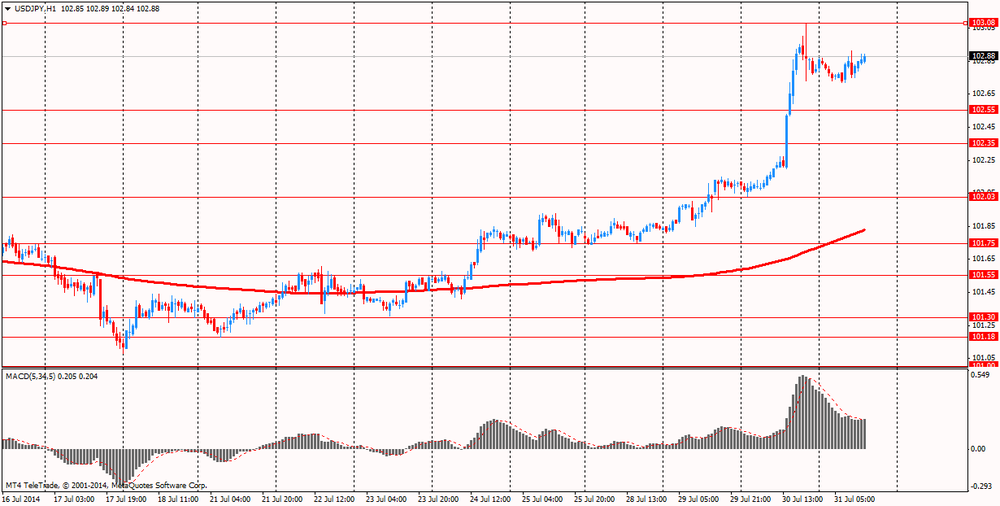

USD / JPY: during the European session, the pair rose to Y102.91

At 12:30 GMT, Canada will release the change in GDP in May. In the U.S. at 12:30 GMT will number of initial claims for unemployment insurance, the number of repeated applications for unemployment benefits, labor cost index for the 2nd quarter in 13:45 GMT - Chicago PMI index for July.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.