- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

06:00 Switzerland UBS Consumption Indicator June 1.77 2.06

07:00 Switzerland KOF Leading Indicator July 100.5 Revised From 100.4 101.1 98.1

09:00 Eurozone Business climate indicator July 0.22 0.17

09:00 Eurozone Industrial confidence July -4.3 -4.5 -3.8

09:00 Eurozone Economic sentiment index July 102.1 Revised From 102.0 102.2

12:00 Germany CPI, m/m (Preliminary) July +0.3% +0.2% +0.3%

12:00 Germany CPI, y/y (Preliminary) July +1.0% +0.9% +0.8%

During the European session, the Forex market the euro fell slightly against the dollar on the data by the mood in the economy.

In the eurozone, the level of economic confidence rose unexpectedly in July, which was due to the improvement of industrial sentiment data showed on Wednesday the European Commission survey.

Economic sentiment index rose to 102.2 in July from a revised 102.1 in June. Economists predicted that the figure will fall to 101.9 from June initial appraised value 102.

Industrial Confidence rose to -3.8 from -4.3 a month ago. Increased confidence in the industry was the result of more optimistic managers on expected production and the current level of total portfolio, and their assessment of stocks of finished products in general remained unchanged.

Meanwhile, confidence in the services sector fell to 3.6 from 4.4 months ago. Reduced confidence in the services sector was due to significantly lower expectations and managers demand more muted assessment of past business situation, which outweighed a more positive stance on past demand.

According to preliminary estimates consumer sentiment fell to -8.4 from -7.5 in June. The consumer confidence index fell due to the markedly more pessimistic estimates of future unemployment and future general economic situation, which were only partially offset by a moderate improvement in consumers' assessment of their readiness for future savings.

Sentiment in the construction sector improved to -28.2 from -31.7 in the previous month. Increased confidence in the building was part of the revision of the expressed expectations of employment and, to a lesser extent, improved assessment of the level of portfolio managers orders.

More data showed that business confidence dropped slightly to 0.17 in July from 0.21 in June.

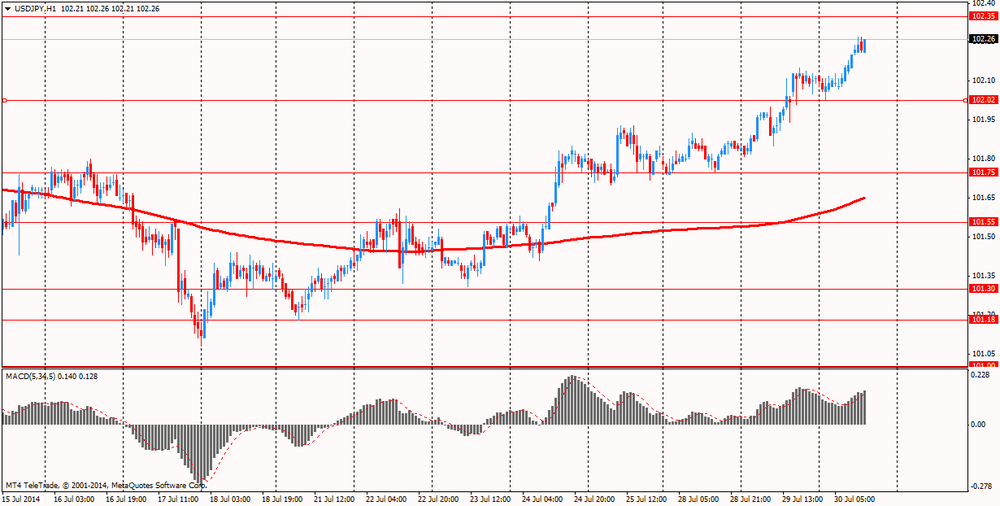

The U.S. dollar rose against the yen in anticipation of strong employment data in the U.S. that may prompt the Fed to further reduce the incentive programs. Remember, today completed a 2-day meeting of the Committee on the open market operations of the Federal Reserve System and the decision will be announced on the possible timing of rate increases the rate of the Central Bank and the further reduction of bond purchases.

In addition, will be held today publication of data on U.S. growth in the preceding quarter. According to the median forecast of economists, GDP world's largest economy will grow by 3.1%, after falling 2.9% previously. If this forecast is confirmed, then this figure will rise to the highest since September 2013.

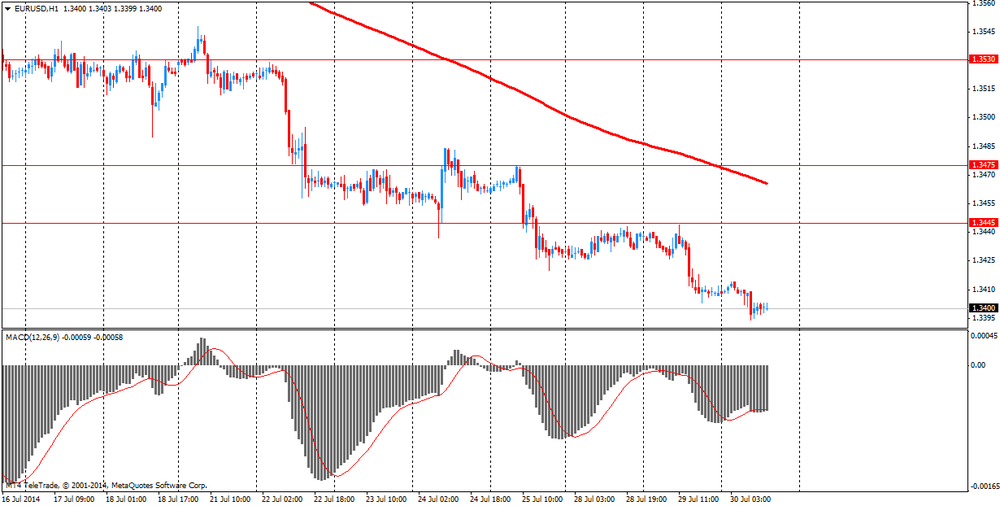

EUR / USD: during the European session, the pair fell to $ 1.3394

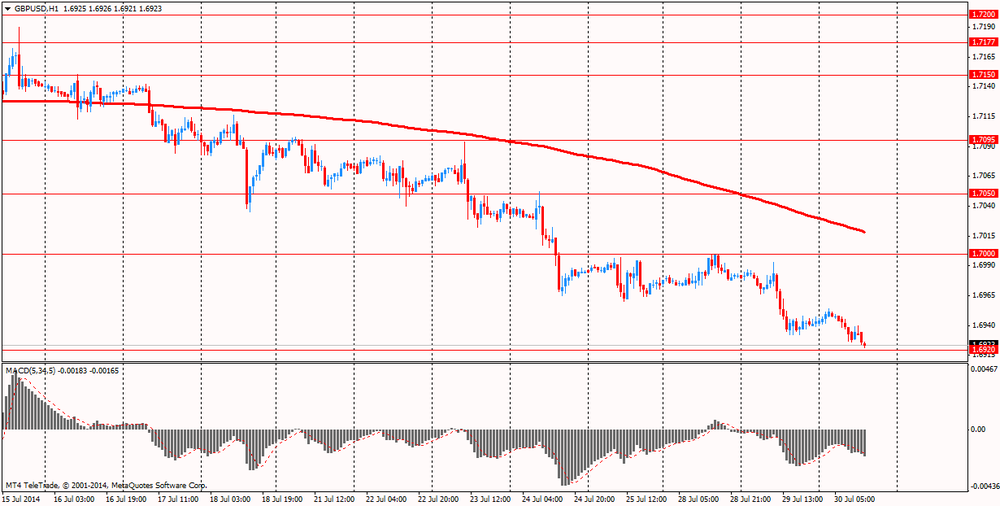

GBP / USD: during the European session, the pair fell to $ 1.6921

USD / JPY: during the European session, the pair rose to Y102.27

At 12:15 GMT the United States will change ADP Employment for July. At 12:30 GMT, Canada will present the raw material price index for June. U.S. at 12:30 GMT to publish preliminary data on changes in GDP, the GDP price index, the index of personal consumption expenditures, the main index of personal consumption expenditures for the 2nd quarter to 14:30 GMT - data on crude oil inventories from the Energy Department. At 18:00 GMT we will know the FOMC decision on the basic interest rate and the accompanying statement will be made FOMC. At 23:05 GMT UK release indicator of consumer confidence from the GfK July.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.