- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

During the European session, the Forex market the euro rose slightly against the dollar in the conditions of low-key activity of investors. Danske Bank analysts say that today we are calm before the storm, because on the eve of the eventful week calendar Monday is almost empty.

Interest is the only U.S. report on pending real estate transactions, which is a good leading indicator of existing home sales.

Recently, the report featured a good performance, demonstrating that the last two months, this sector is recovering, confirmed that the housing market index and NAHB.

Meanwhile, other indicators were not as optimistic, in particular - building permits and new home sales.

J. Yellen noted priority market dynamics properties for CB, stressing that the sector remains weak, and although he showed little progress, the overall results of this year so far has been disappointing.

The British pound is trading sideways against the U.S. dollar. Published secondary data on the housing market, according to which the confidence of British homebuyers worsened in the second quarter. These results showed a survey by mortgage lender Halifax on Monday.

Balance of people who believe that now the "good time to buy" fell from 34 to 5 in the previous quarter. It was the biggest drop since April 2011.

Meanwhile, about 57 percent believe that now is a good time to sell, and 32 percent think it's a bad time to form the balance of 25.

Craig McKinley, director of mortgages at Halifax, said: "It seems that we have reached a tipping point when the balance between buyers and sellers is much far from the synchronization."

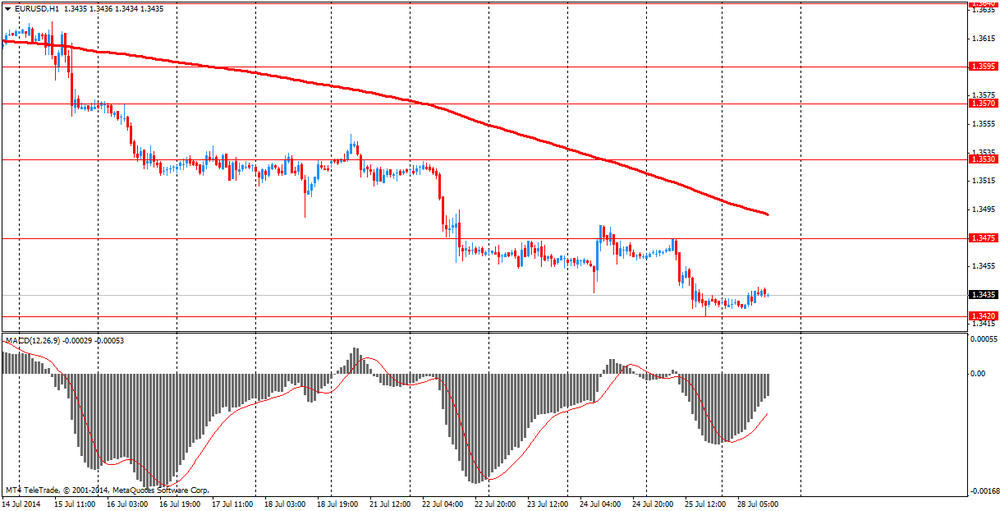

EUR / USD: during the European session, the pair rose to $ 1.3441

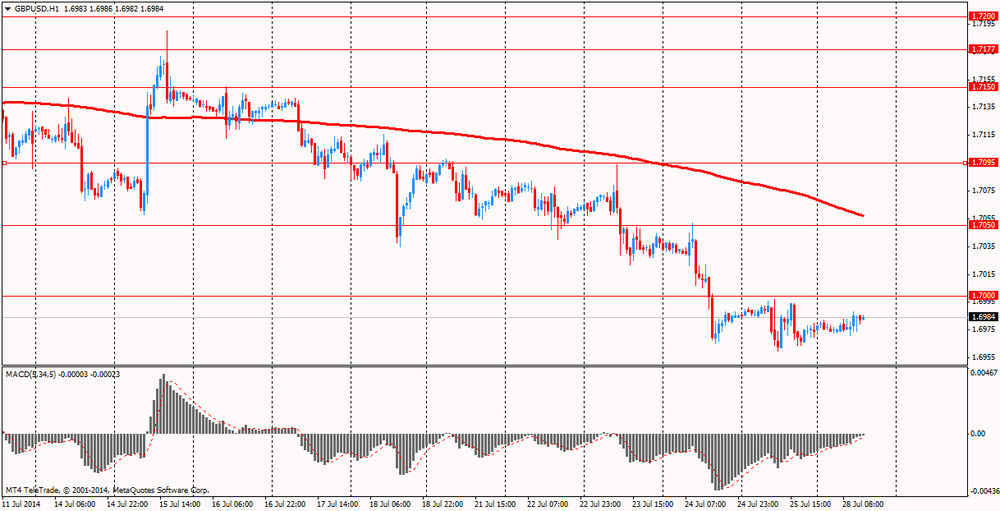

GBP / USD: during the European session, the pair traded in the range of $ 1.6971 - $ 1.6988

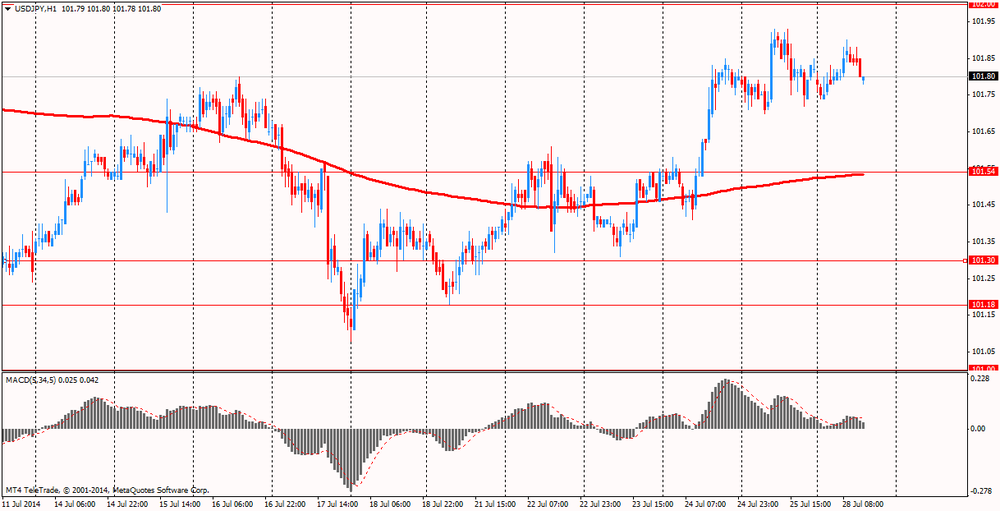

USD / JPY: during the European session, the pair rose to Y101.90 and stepped

At 14:00 GMT the United States will change in the volume of pending home sales for June. 23:30 GMT Japan will present the change in volume level of household expenditure in June in 23:50 GMT - the change in retail sales for June.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.